Rachel Reeves warned ISA reform 'wrong tool' to boost UK economy as £20k tax-free allowance at risk

Savers urged to be careful of tax on savings interest |

GB NEWS

ISAs are tax-free savings accounts with Britons being able to put away £20,000 in these products without losing money to HMRC

Don't Miss

Most Read

Latest

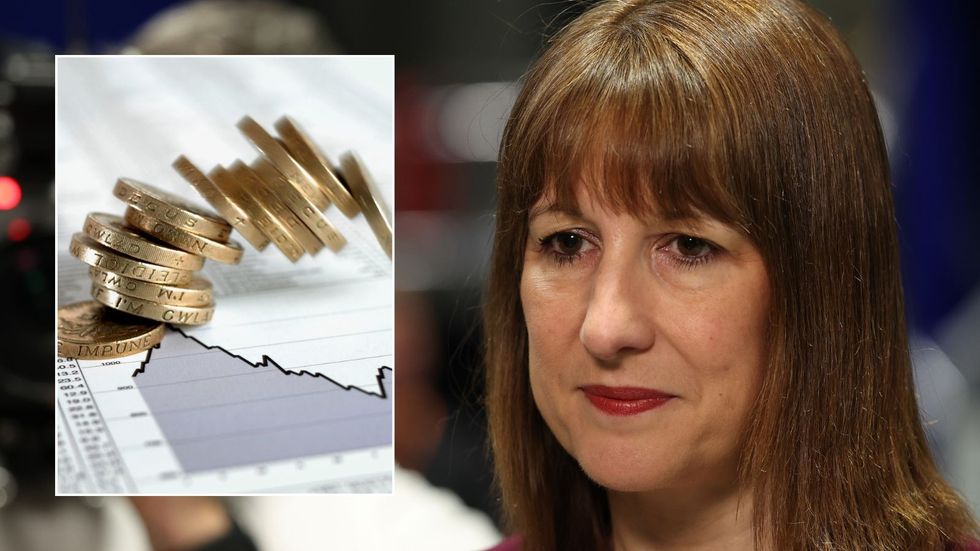

Finance chiefs have urged Rachel Reeves not to reform cash ISAs amid reports the Chancellor plans to slash the tax-free savings allowance.

The Treasury is reportedly considering lowering the annual cash Isa allowance from £20,000 to £4,000, to encourage more people to put their money into investments.

Last month, the Labour Government confirmed it is looking at options for reform, while Treasury costings documents released with the spring statement assume the overall ISA limit of £20,000 remains in place up to and including 2029/30.

The reported reduction would mean many with savings in tax-free Isas would have to choose between shifting their money into riskier stock investments or putting it into savings accounts subject to tax.

The Chancellor is considering a reduction to the £20,000 tax-free alllowance

|PA / GETTY

Reeves is looking for new sources of investment in the UK economy to boost gross domestic product (GDP) growth, according to reports.

Banks and building societies have challenged the Chancellor's stance during meetings with Treasury officials, expressing concerns about the potential impact on savers and the wider financial system.

Stuart Haire, chief executive of the Skipton Building Society, has met Treasury officials to push against the plans and told The Telegraph reducing the limit would not have the desired effect.

"We agree with the Government that people in the UK should increase, if they have the wherewithal and the risk appetite, the amount of money they have got in equities," he said.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Banks are using the Government to avoid drastic changes to ISAs

| GETTY"However, changing the cash ISA limit will not do that, so therefore it's the wrong tool to achieve the policy outcome."

David Postings, the chief executive of UK Finance, told The Telegraph: "Getting more people investing is the right thing to do, but we should do it in a positive way rather than restricting options such as the ability to invest in cash ISAs."

He emphasised the accessibility of cash ISAs, stating: "They are an easy-to-understand product that help individuals start saving and set aside money for the future.

"The money banks and building societies hold in cash ISAs is also lent out, supporting borrowers and the wider economy."

This comes after the Conservatives warned last month that reforms to cash ISAs risk causing "damage" to the residential mortgage market, with shadow Treasury minister Mark Garnier challenging the Government in the Commons.

Critics argue that discouraging cash savings could impact the funds available for mortgage lending, potentially affecting housing market stability.

LATEST DEVELOPMENTS:

Interest rate hikes from the Bank of England have been passed down to savings products | GETTY

Interest rate hikes from the Bank of England have been passed down to savings products | GETTY A Treasury spokesperson insisted "no decisions have been made" regarding the potential changes to cash ISAs.

"We want to support people to save and absolutely recognise the important role that cash savings play in building a buffer for a rainy day," they said.

"We also want to ensure that savers are getting the best returns possible, while boosting the economy to create jobs right across the UK."

More From GB News