Labour to tax pensions of Britons who die before retirement age

Inheritance tax: How charitable giving can cut your bill |

GBNEWS

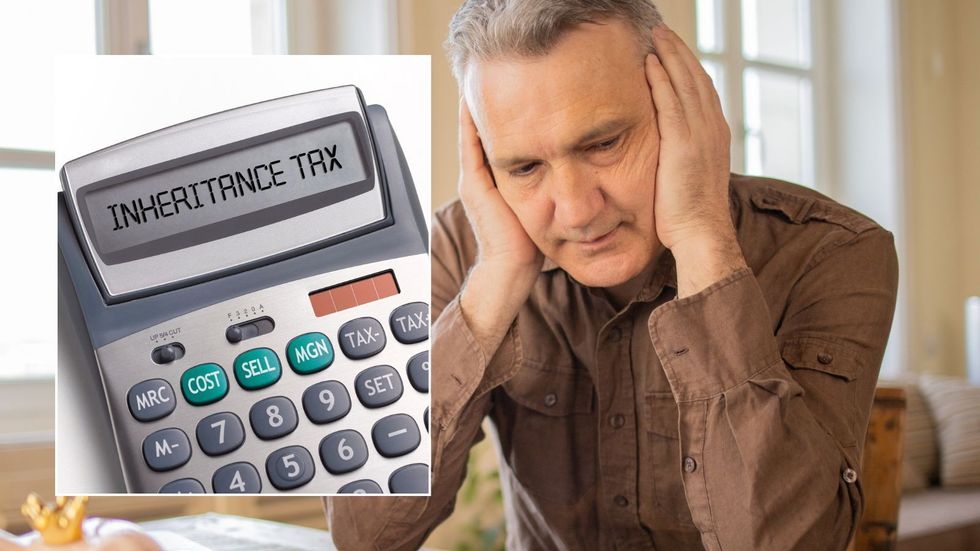

Pension pots will soon become liable for inheritance tax under the Chancellor's reforms

Don't Miss

Most Read

Families could soon face hefty death duties on pension savings, even if a loved one dies before ever touching the money.

HMRC has confirmed that inheritance tax of up to 40 per cent will apply to private pensions from April 2027, regardless of whether the saver dies before the current withdrawal age of 55

Rachel Reeves' plan to remove the existing exemption will bring pensions into line with other assets for tax purposes, potentially leaving bereaved families with a significant bill.

**ARE YOU READING THIS ON OUR APP? DOWNLOAD NOW FOR THE BEST GB NEWS EXPERIENCE**

With the minimum pension access age set to rise from 55 to 57 in 2028, more savers could find themselves unable to use their retirement funds before death.

Financial sector professionals have strongly criticised the policy, with wealth manager Ian Cook from Quilter Cheviot describing the measure as "abhorrent".

Cook warned the tax could be "particularly brutal" for families whose relatives had built up pension savings with tax relief over many years, only to see almost half wiped out if they died prematurely.

"It's a disincentive for people to save for the long term," Cook stated, adding that the public message was clear: "don't save into your pension."

Independent pensions specialist Tom McPhail characterised the policy as an "underhand raid" designed to address the Government's financial shortfalls.

Britons are being worried about the looming changes to inheritance tax | GETTY

Britons are being worried about the looming changes to inheritance tax | GETTY McPhail argued that "the UK's pension tax relief system is slowly collapsing under the weight of unfair and bureaucratic restrictions."

The reforms have faced resistance from the pensions sector, despite the Government's determination to implement them as planned.

The inheritance tax changes will take effect from April 2027, ending the current system where pensions pass to beneficiaries free from death duties.

Under existing rules, retirement savings are inherited without any tax liability if the deceased was younger than 75, subject to a £1.07million cap. For those dying at 75 or older, beneficiaries must pay income tax on the inherited funds.

The new regime will impose inheritance tax on all pension assets exceeding the standard £325,000 threshold

| GETTYThe new regime will impose inheritance tax on all pension assets exceeding the standard £325,000 threshold, known as the nil-rate band. This allowance rises by £175,000 when leaving a main residence to direct descendants.

The Government anticipates the pension tax changes will generate approximately £1.5billion annually by 2029-30.

Death in service benefits from registered pension schemes will remain exempt from inheritance tax, addressing concerns about taxation of lump sum payments to families when employees die whilst working.

Labour to tax pensions of Britons who die before retirement age |

Labour to tax pensions of Britons who die before retirement age | Getty

McPhail criticised the Government's approach, stating it was becoming "increasingly incoherent" and suggested the Government should task its newly launched pensions commission with examining both tax relief and public sector pension costs.

The Investing and Saving Alliance, representing numerous financial services firms, has called on the Chancellor to exempt pension pots below £90,000 from the death duty changes.

A Treasury spokesperson defended the policy, stating: "We continue to incentivise pensions savings for their intended purpose of funding retirement instead of them being openly used as a vehicle to transfer wealth and more than 90 per cent of estates each year will continue to pay no inheritance tax after these and other changes."

More From GB News