Inflation drops to 3% with Bank of England interest rate cut on the cards

The move down in inflation will come as a relief to mortgage holders and borrowers in particular

Don't Miss

Most Read

Latest

The consumer price index (CPI) rate of inflation fell sharply to three per cent in the 12 months to January.

The fall is in line with the predictions of many economists, with easing pressures across airfares, food, and energy being cited as key factors.

The fall is a 10-month low reading for inflation, and will be seen as a positive step towards the Bank of England's two per cent inflation target.

December's reading sat at 3.4 per cent, an increase on the months prior - and a sign that inflation had been moving in the wrong direction prior to today.

Responding to the figures, Chancellor Rachel Reeves said: "Cutting the cost of living is my number one priority.

"Thanks to the choices we made at the Budget we are bringing inflation down, with £150 off energy bills, a freeze in rail fares for the first time in 30 years and prescription fees frozen again.

"Our economic plan is the right one, to cut the cost of living, cut the national debt, and create the conditions for growth and investment in every part of the country."

Rachel Reeves has aimed to cut inflation

|GETTY/ONS

Shadow chancellor Mel Stride has responded to the fall in inflation by arguing that it “remains above target thanks to Labour’s choices”.

He said “families are still feeling the pinch because of Labour’s economic mismanagement”, pointing to yesterday’s unemployment figures, which showed the jobless rate at a near five‑year high.

“Britain is not being governed,” he said.

“The economy is weaker and working people are paying the price. Only the Conservatives have a plan for a stronger economy, and a leader with the backbone to deliver that plan and get Britain working again.”

Harriet Guevara, Chief Savings Officer at Nottingham Building Society, said the fall in CPI “reinforces the view that price pressures are continuing to ease, and strengthens the case for the Bank of England to cut rates.”

She added that “a sustained move down in inflation is an important signal for borrowers, as it increases the likelihood of those rate cuts,” noting that “markets are already factoring in cuts over the coming months, and further evidence that inflation is cooling would add to that momentum.”

“For savers, it’s a more nuanced picture,” she said.

“Lower inflation helps protect the real value of cash, but it’s often the point at which savings rates begin to soften as lenders anticipate base rate cuts.”

The Bank of England kept interest rates at 3.75 per cent in its first decision of the year, following six cuts in the past 18 months.

The expected hold was decided by a narrow 5–4 vote, signalling that rate cuts could follow if the economic outlook improves.

Minutes show inflation, wage growth and unemployment were central to the committee’s thinking.

Following Wednesday's Office for National Statistics' (ONS) CPI figures, optimism for further cuts will grow.

The Bank of England are now more likely to cut rates, economists say

|GETTY

Chancellor Rachel Reeves has attempted to boost the UK economy and address the issue of inflation since taking office, and these figures will come as a relief to Labour.

Charlie Ambler, Co-Chief Investment Officer at wealth management firm Saltus, said: “While a drop will reassure markets that inflation will follow a downward trajectory over the course of the year, the risk of renewed pressure later in 2026 remains front of mind.

“Markets are likely to interpret a three per cent reading as supportive of the current expectation for gradual rate cuts this year, rather than an acceleration of easing."

Other measures of inflation also fell.

Core inflation, which excludes volatile items such as food and fuel, dropped to 3.1 per cent.

Services inflation, which reflects price rises in the largest part of the economy, eased to 4.4 per cent from 4.5 per cent in December.

Both indicators are watched closely by the Bank of England when it sets interest rates.

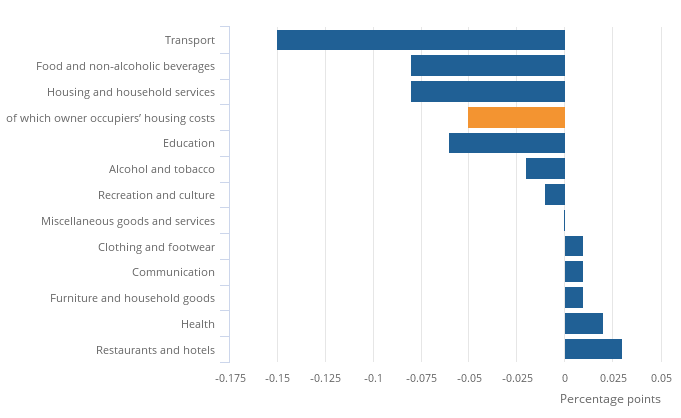

Contributions to change in the annual inflation rate

|ONS

Grant Fitzner, chief economist at the Office for National Statistics (ONS), says the fall in the inflation rate to three per cent in the year to January was partly due to lower petrol prices.

He said: "Airfares were another downward driver this month with prices dropping back following the increase in December.

"Lower food prices also helped push the rate down, particularly for bread and cereals and meat. These were partially offset by the cost of hotel stays and takeaways."

More From GB News