Inflation warning: CPI could hit 3.7 per cent as pressure builds on Bank of England

‘It’s alright for them!’ MPs blasted as they brace for inflation-busting pay rise while farmers suffer: ‘Worst two years this century’ |

GBNEWS

With inflation expected to remain stubbornly high, economists say interest rate relief could be delayed further

Don't Miss

Most Read

Latest

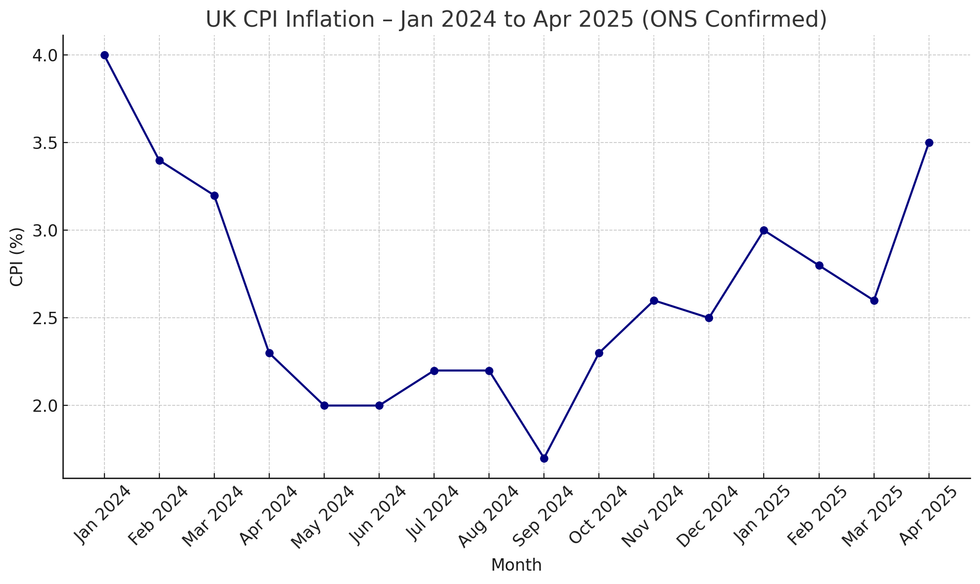

The Office for National Statistics will release May's consumer prices index figure on Wednesday, with inflation expected to remain significantly above three per cent.

April's figure stood at 3.4 per cent, after the ONS corrected an initial error that had stated 3.5 per cent.

Economists are divided on their predictions for May's inflation rate. Forecasts range from 3.2 per cent to 3.6 per cent, though all agree the figure will stay well above the three per cent mark.

The persistently high inflation comes as households await Thursday's Bank of England meeting, where interest rate decisions could affect mortgage holders hoping for relief from current rates.

UK inflation is expected to stay above the Bank of England’s target | GETTY

UK inflation is expected to stay above the Bank of England’s target | GETTYRaj Badiani, of S&P Global Market Intelligence, expects the May inflation figure to reach 3.6 per cent, with a further rise to 3.7 per cent in June.

He said: "Higher headline inflation in May and June reflects the impact of some firms passing on higher payroll costs to consumers."

Paul Dales of Capital Economics takes a more optimistic view, predicting May's figure could be as low as 3.2 per cent.

He attributes April's high inflation partly to Easter timing, which inflated airfare and holiday costs.

"This Easter timing effect will reverse in May, subtracting 0.2 percentage points from CPI inflation," Dales explained.

Pantheon Macroeconomics forecasts a middle ground at 3.4 per cent, noting that "a correction to Vehicle Excise Duty and airfare falls will be partly offset by strong food and clothes prices."

The Bank of England cut interest rates to 4.25 per cent in May, but experts believe Thursday's meeting is unlikely to bring another reduction given the persistent inflation levels.

Inflation jumped to 3.5% last month

| ONS figures/GBNEWSMortgage holders awaiting rate relief may face disappointment as high inflation constrains the Bank's options.

The mortgage market remains volatile, with some major banks reducing rates whilst others increase them during these uncertain times.

Lower interest rates could eventually lead to reduced mortgage rates, though this appears increasingly distant.

Some experts now predict there may be only one additional interest rate cut throughout 2025, suggesting a prolonged period of elevated borrowing costs for households.

Ofgem has confirmed a seven per cent reduction in household energy costs beginning next month.

| GETTYDespite the inflation pressures, households will receive some respite when energy bills fall from July. Ofgem has confirmed a seven per cent reduction in household energy costs beginning next month.

Badiani acknowledged this positive development, stating: "There is some positive inflation news, which will help to lower inflation in the second half of this year.

Dales expects inflation to remain between 3 and 3.5 per cent for the remainder of the year, suggesting the energy bill reduction may help prevent further increases but won't dramatically lower overall inflation.

More From GB News