House prices drop £1,789 as Halifax says affordability improves: 'Green light for many first-time buyers!'

Halifax data shows monthly prices fall as affordability improves

Don't Miss

Most Read

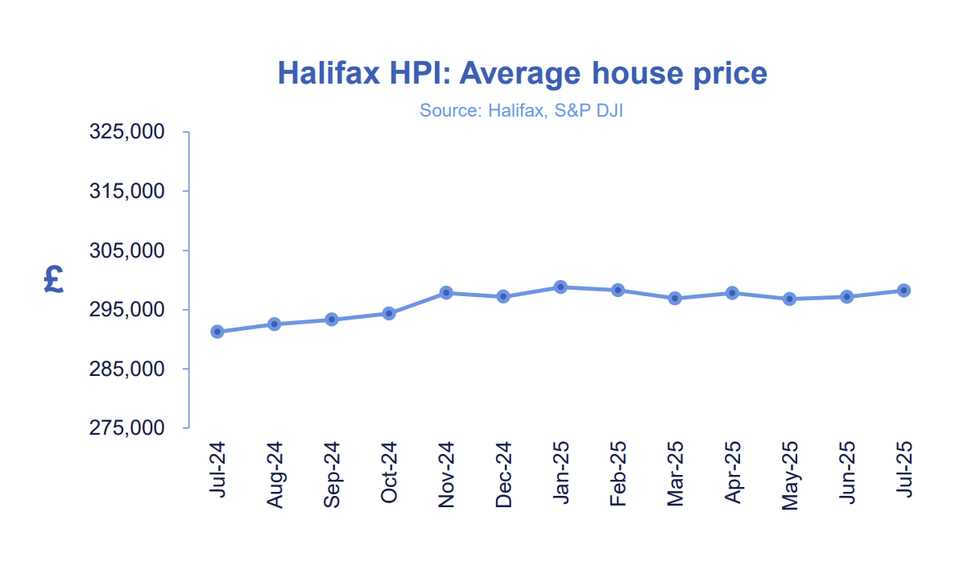

Average UK house prices fell last month with an improvement in affordability for first-time buyers, the latest figures from Halifax show.

Average property values declined by 0.6 per cent over the month, according to the lender’s December house price index.

This brought the typical UK home price to £297,755.

That figure is £1,789 lower than in November and represents the lowest average price recorded since June 2025.

TRENDING

Stories

Videos

Your Say

Halifax also reported that the house price to income ratio fell to its lowest level in more than ten years.

The lender said this measure, which compares average house prices with average earnings, is a key indicator of affordability for prospective buyers.

On an annual basis, house price growth slowed further in December.

Annual growth eased to 0.3 per cent, down from 0.6 per cent in the previous month.

Halifax said the slowdown reflects a combination of subdued demand and easing pressures seen across the housing market in recent months.

Despite the improvement, the lender noted that affordability challenges have not been fully resolved for all buyers.

Amanda Bryden, head of mortgages at Halifax, told Newspage that the latest data showed a shift in favour of first-time buyers.

"While affordability pressures persist, the house price to income ratio was at its lowest in over a decade in December, striking a positive note for those looking to purchase their first home."

Halifax data shows monthly prices fall as affordability improves

|GETTY

She said the change reflected a period of slower house price growth relative to incomes.

Looking ahead, Halifax said it expects property values to increase modestly over the coming year.

The lender forecast house price growth of between one and three per cent during 2026.

Ms Bryden said there remain several factors that could influence affordability in the months ahead.

She pointed to slower wage growth and a flattening employment rate as potential headwinds for buyers.

However, Halifax said the combination of easing house price growth and stabilising mortgage conditions could support demand among first-time buyers.

Mortgage brokers have also highlighted the significance of the lower house price to income ratio.

Craig Fish, director at London-based Lodestone Mortgages, said the data could influence buyer confidence.

"It’s the green light many first-time buyers have been waiting for."

LATEST DEVELOPMENTS

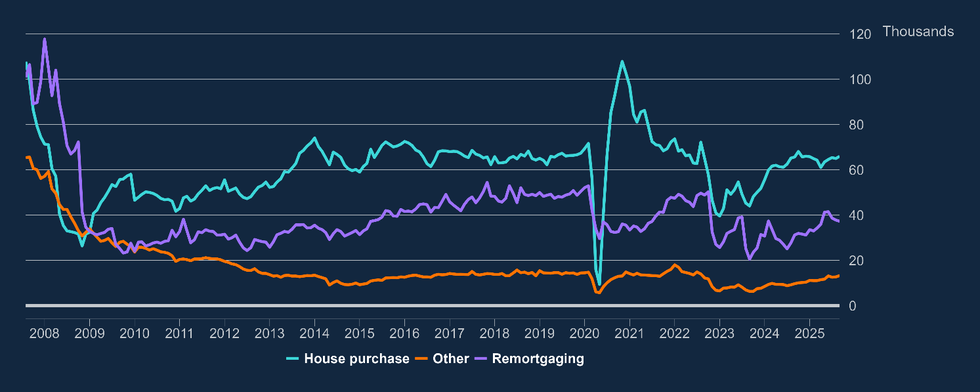

Net mortgage approvals increased by 1,000, to 65,900 in September | BANK OF ENGLAND

Net mortgage approvals increased by 1,000, to 65,900 in September | BANK OF ENGLANDHe said easing mortgage rates and demand that had built up over recent years could play a role in market activity during 2026.

Emma Jones, managing director at Runcorn-based Whenthebanksaysno.co.uk, said lending conditions had shifted over the past year.

"Lenders initiated an assault on affordability on multiple fronts during 2025 and, with rates expected to continue to edge down in the weeks ahead and house price growth subdued, 2026 could be the year of the first-time buyer."

She said lender policy changes had helped widen access to mortgages for some buyers.

Industry figures have also pointed to product innovation by lenders as a contributing factor.

Katy Eatenton, mortgage and protection specialist at St Albans-based Lifetime Wealth Management, said banks and building societies focused heavily on affordability during 2025.

House prices were high in the first half of 2025

| Halifax"Lenders innovated aggressively last year on the affordability front as they know that cracking the affordability enigma code is essential to helping more first-time buyers onto the ladder and for the wider health of the property market."

She said changes to lending criteria and product design had supported buyer access.

David Stirling, independent financial adviser at Belfast-based Mint Wealth, said affordability assessments had become more flexible.

He said some first-time buyers could benefit as lenders adjust their models in response to market conditions.

Ranald Mitchell, director at Norwich-based Charwin Mortgages, said the current environment reflects a period of cooling price growth alongside improved affordability metrics.

He said 2026 could represent a period where conditions are more balanced for first-time buyers compared with recent years.

More From GB News