HMRC tax code rules explained as thousands of pensioners owed £3,000 refund - check if you can claim

Brits spent 800 years on HOLD to HMRC as Nigel Farage FUMES at 'INCOMPREHENSIBLE' wait times |

GBNEWS

New rules will speed up tax refunds for regular pension withdrawals

Don't Miss

Most Read

Thousands of pensioners could be owed tax refunds of nearly £3,000.

But many savers still face delays and paperwork to get back what they are rightfully owed.

Between January and March this year, more than 15,000 people reclaimed an average of £2,881 after being overtaxed when dipping into their pensions. A total of £44 million were refunded in just three months, according to HMRC figures.

In response to long-standing criticism, HMRC has updated its real-time PAYE tax code system to help ensure that people taking multiple withdrawals from their pension pot will be taxed more accurately.

From April 2025, these savers will be moved off emergency tax codes more quickly. Instead of facing a steep overtaxation on their first withdrawal, the system will recognise that further payments are likely and apply a more appropriate tax code earlier in the year.

The aim is to reduce the number of people caught out by the ‘Month 1’ emergency tax rule where HMRC divides a person’s allowances by 12 and taxes a withdrawal as if it will happen every month, often creating unexpectedly high tax bills.

HMRC tax code rules explained as thousands of pensioners owed £3,000 refund

| GETTYHowever, the change will not benefit everyone. Those taking a single lump sum from their pension - often for a large purchase, home repairs or to pay off debt — will still be overtaxed unless they actively claim the money back.

Tom Selby, director of public policy at AJ Bell, welcomed the technical improvement but warned it doesn’t go far enough.

He said: "HMRC has offered a glimmer of hope to those who take a regular drawdown income.

"From April 2025, the Government improved its tax code process so these people will be moved from an emergency code to paying the right amount of tax more quickly. But that doesn’t help those taking a one-off withdrawal who will continue to be overtaxed."

Under the current system, HMRC taxes the first flexible pension withdrawal in a tax year using an emergency code, even though most people only take out what they need.

These can be filled out online via the HMRC website, and refunds are typically paid within 30 days

| GETTYSelby added: "HMRC’s outdated approach to the taxation of flexible pension withdrawals continues to hit hard-working savers in the pocket, with the latest official figures revealing over £1.4 billion has now been repaid to people who were overtaxed on their first withdrawal and filled out the relevant HMRC form to claim their money back.

“These figures are likely to be only the tip of the iceberg, however, as they only capture those who fill in the relevant HMRC reclaim form. In reality, many more people will use the quicker process of reclaiming the money they are owed.

"As a result, they will be reliant on HMRC putting their affairs in order at the end of the tax year."

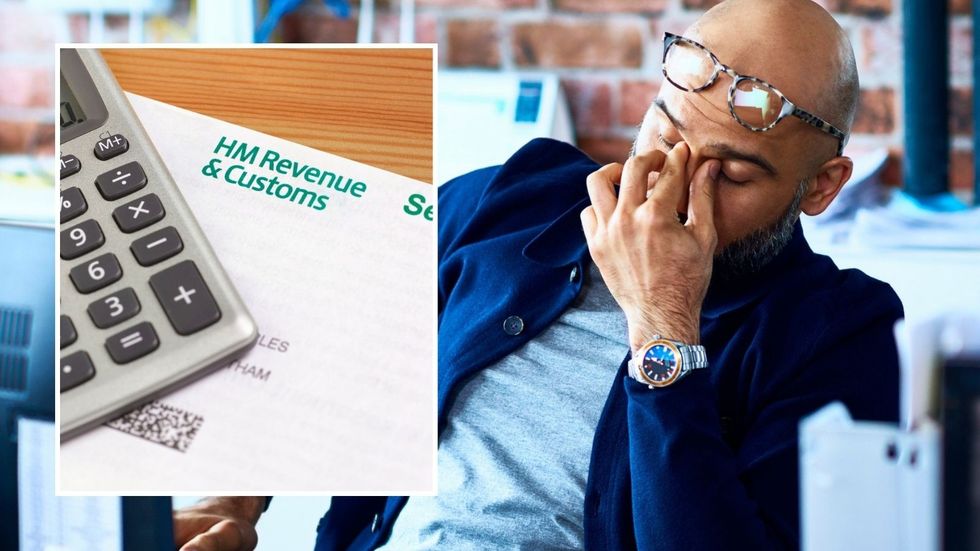

Taxpayers are waiting months for refunds from HMRC | GETTY

Taxpayers are waiting months for refunds from HMRC | GETTY To get a refund quickly, savers must use one of three HMRC forms depending on their situation:

- Form P55 – if only part of the pension pot has been withdrawn

- Form P53Z – if the entire pot has been taken and the person is working or on benefits

- Form P50Z – if the entire pot has been taken and the person is not working or receiving benefits

These can be filled out online via the HMRC website, and refunds are typically paid within 30 days.

Selby concluded: "It is simply unacceptable that after all this time the government has still not managed to adapt the tax system to cope with the fact Brits are able to access their pensions flexibly from age 55, instead persisting with an arcane approach which hits people with an unfair tax bill."