HMRC alert: Thousands of Britons at risk of £2m social media tax penalty - are you?

Thousands may owe tax after earning above £1,000 allowance

Don't Miss

Most Read

Thousands across Britain could face unexpected tax bills after HMRC launched its "Help For Hustles" campaign targeting people earning money or gifts through online content.

New research from business platform Tide shows 42 per cent of social media users now receive cash or freebies for posts on platforms including TikTok, Instagram and YouTube.

Tide found the typical earner brings in about £1,223 a year from online activity.

This figure sits above HMRC’s £1,000 trading allowance threshold.

TRENDING

Stories

Videos

Your Say

It means many creators may be required to complete a self-assessment tax return without realising they fall within the rules.

The campaign comes as the Christmas and New Year period often leads to increased online promotional activity.

Tide’s research shows only 44 per cent of people earning money from their content have registered for self-assessment with HMRC. The data indicates younger users are most active in generating online income.

The UK’s leading business management platform said 55 per cent of 18 to 24-year-olds earn money from platforms such as TikTok and Instagram. Only 36 per cent of young earners in that age group have filed a tax return.

Millions across Britain could face surprise tax bills after HMRC launched its ‘Help for Hustles’ campaign targeting people earning money or gifts from online content

|GETTY

Tide said this gap could lead to issues for those who do not understand their obligations. More than half of social media earners do not realise they may need to pay tax on supplementary income or on gifted items received in exchange for posts.

Tide calculated that missed self-assessment filings across the UK could result in more than £2million in fines over a single year.

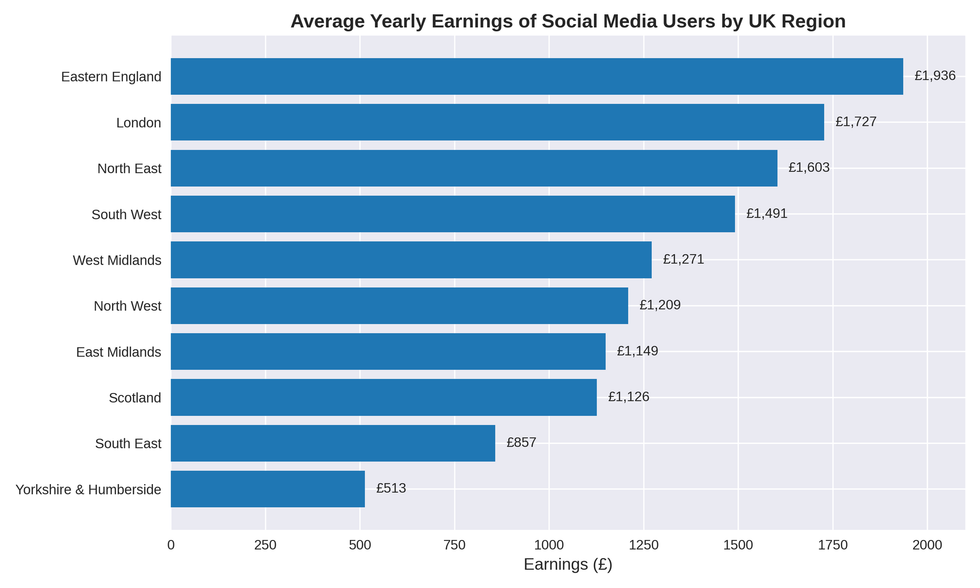

The research identified regional differences in the earnings of social media users.

Eastern England reported the highest average earnings at £1,936 per person. London ranked second with average earnings of £1,727.

LATEST DEVELOPMENTS

Average yearly earning of social media users by UK region

|Tide/CoPilot

Heather Cobb, UK managing director at Tide, said creators must monitor their income closely.

She said: "It's great that TikTok, Instagram and other social platforms have opened up new ways for people to add to their income, and what might start as a bit of extra pocket money can quickly spiral into a serious side hustle."

She said many people do not treat their online activity as a business when they start earning, making it difficult to keep track of income.

She added: "Especially for those who receive gifted items in return for social media promotion, as the value of these items also counts towards the yearly £1,000 allowance. Unknowingly going over this can result in a costly penalty."

Social media influencers could find themselves paying substantial tax penalties

|GETTY

Megan Paul, a content creator and Tide member who founded Gel by Megan in Warwickshire, said her social media activity expanded rapidly.

She said: "What started out as me posting photos of my nails on Instagram as a creative outlet alongside my 'day job' in the civil service, quickly grew to thousands of followers, brand partnerships, sponsored posts and now my own training academy."

Ms Paul moved into self-employment four years ago, and her online income played a significant role in that decision.

"Taxes and self-assessments may feel scary, but most areas have thriving small business communities that you can lean on for advice."

She encouraged creators to recognise that online work can develop beyond a hobby. Ms Paul also said individuals should ensure they understand tax requirements as their online presence grows.

More From GB News