France’s debt crisis offers stark warning for Britain as political chaos fuels market turmoil

GB News

Britain and France are wrestling with 'very similar' fiscal problems, economists warn

Don't Miss

Most Read

France’s national debt has surged to €3.35trillion, equal to 114 per cent of GDP, while its budget deficit stands at 5.8 per cent, almost double Brussels’ ceiling.

Markets have reacted savagely, pushing yields on 30-year bonds to their highest level in sixteen years.

Prime Minister Francois Bayrou has attempted to impose a €44billion austerity package that includes sweeping spending freezes and even the elimination of two public holidays, but opposition parties remain united against his minority administration and he is almost certain to lose a confidence vote.

His downfall would mark the sixth prime minister since 2020, underlining the depth of France’s political deadlock.

Could the French economic crisis be a sign of what's to come?

|GETTY

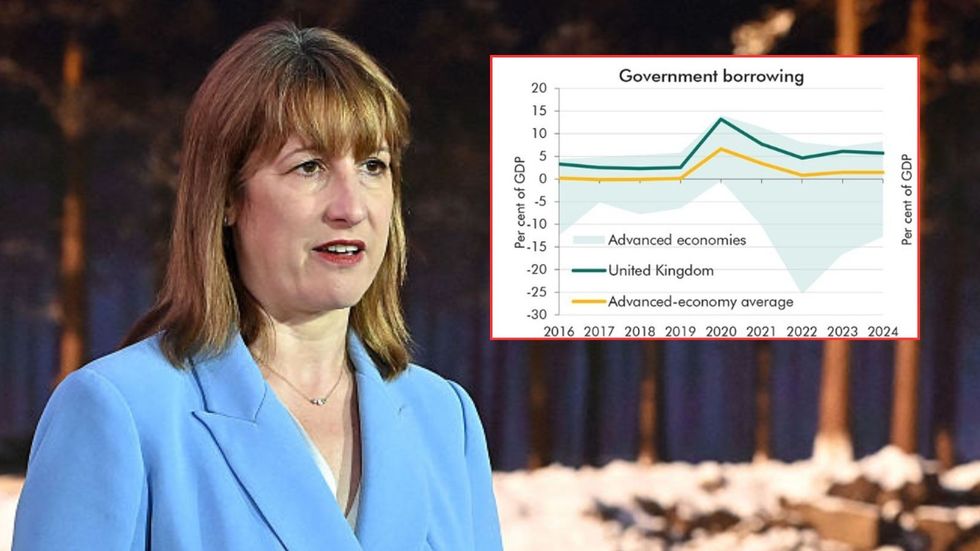

Britain’s fiscal position is uncomfortably close to France’s, with debt and deficit levels on a similar trajectory, but investors remain more anxious about the UK’s outlook.

Maxime Darmet, Senior Economist at Allianz Trade, told GB News: “The UK and France are grappling with very similar fiscal pressures, with debt and deficits at roughly the same levels. Markets are becoming more nervous, but they appear tougher on the UK, given its weaker external fundamentals such as a large current account deficit and high external debt, which make it more exposed to capital flight.”

Mr Darmet added that “the Bank of England has lost some credibility by tolerating higher inflation compared to the ECB, which unsettles investors,” and pointed to Labour’s reversal of spending cuts in the Spring Budget as a further source of market scepticism.

“The UK does enjoy the advantage of political stability, meaning the Government can react quickly to market pressures,” Mr Darmet said.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

“But the upcoming budget is expected to rely heavily on tax rises as a means of fiscal consolidation, and there is scepticism about whether this will be sufficient to bring debt down.”

He noted that France is pursuing a more balanced mix of spending cuts alongside tax hikes, adding: “In its Autumn budget, the UK Government may look at windfall taxes on corporate super-profits and closing inefficient tax loopholes—tools the French are already deploying.”

Unions in France have already called for national strikes from September 10 in response to austerity proposals, and economists warn that political paralysis combined with financial stress risks reigniting unrest on the scale of the gilets jaunes protests.

Observers say this offers a warning to Britain: France shows how quickly market confidence can erode when Governments fail to deliver credible fiscal plans, and if Westminster does not act decisively in the Autumn Budget, investors could soon turn on Britain with the same severity now facing Paris.

Analysts say the Government’s room for manoeuvre is limited

| GETTYUnions in France have already called for national strikes from September 10 in response to austerity proposals.

Economists warn that political paralysis combined with financial stress risks reigniting unrest on the scale of the gilets jaunes protests.

Observers say this offers a warning to Britain. France shows how quickly market confidence can erode when Governments fail to deliver credible fiscal plans.

If Westminster does not act decisively in the Autumn Budget, investors could soon turn on Britain with the same severity now facing Paris.

Mr Darmet said that France’s struggles “highlight the risks of leaving fiscal consolidation too late,” and argued that the credibility of the UK Government will be judged by the scale and clarity of measures announced in November.

The UK’s Office for Budget Responsibility has already warned that debt is on an “unsustainable trajectory” without further action.

The Institute for Fiscal Studies has also cautioned that difficult decisions on spending will be unavoidable.

LATEST DEVELOPMENTS:

Rachel Reeves has previously called for the OBR to be scrapped

| GETTY / OBR graphAnalysts say the Government’s room for manoeuvre is limited, given Labour’s fiscal rules that cap borrowing and require debt to fall as a share of GDP.

Sir Keir Starmer’s administration has promised economic stability after years of turbulence.

Economists note that delivering that pledge will depend on persuading investors that Britain’s books are firmly under control.