Economy on the brink: UK heading towards recession 'by end of the year' as alarm bells sound over joblessness

'Rinsing every drop from the British economy!' Rachel Reeves skewered by GB News guest as Chancellor branded 'desperate' |

GBNEWS

Job losses and falling vacancies push the UK closer to recession, according to leading analysts

Don't Miss

Most Read

Britain is edging closer to a potential recession after a sharp rise in unemployment set off a key economic alarm bell, economists warn.

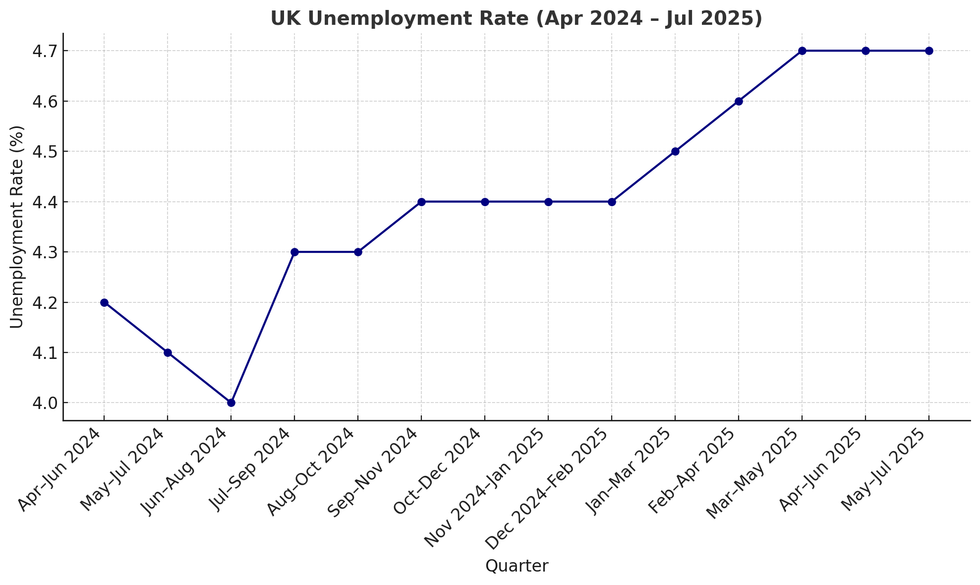

The latest figures show joblessness has climbed to 4.7 per cent, up from 4.1 per cent a year earlier, enough to trigger the so-called Sahm rule, a measure economists watch closely as a warning sign of downturns.

This breach marks the fifth time in two decades that Britain has crossed this threshold.

Simon French, chief economist at City stockbroker Panmure Liberum, explained: "This rule has been breached four times in the last two decades and on each occasion this coincided with a technical UK recession."

TRENDING

Stories

Videos

Your Say

Professor Joe Nelis, economic adviser from accountancy firm MHA has cautioned that whilst the Sahm rule serves as a dependable recession predictor in America, its effectiveness in Britain proves less consistent.

He told GB News: "While it may be a helpful signal of economic stress, its predictive power in the UK is more mixed, as shifts in unemployment here tend to be slower and more muted."

Despite these caveats, he acknowledged that the half percentage point surge in joblessness over twelve months indicates economic pressure.

He continued: "However, the 0.5 percentage-point increase in unemployment over the past year does suggest that the economy is under strain and raises the likelihood of a short, mild recession in late 2025 or early 2026"

UK economy faces threat of ‘stagflation’ after bumpy year | GETTY

UK economy faces threat of ‘stagflation’ after bumpy year | GETTYThe warning comes as Britain's labour market shows signs of strain. Official data reveals job vacancies dropped by 10,000 to 728,000 in the three months to August, underlining concerns about slowing demand for workers.

Mr French emphasised that this fifth activation of the rule serves as "a clear warning signal for UK policymakers."

He pointed out that whilst the 2011 trigger and subsequent 2012 double-dip recession were later revised away by ONS growth adjustments, the current breach demands attention.

The Sahm Rule signals a recession when the three-month moving average of the national unemployment rate increases by 0.5 percentage points or more above its lowest point in the previous 12 months

|GBNEWS/ONS

Mr French observed that both fiscal and monetary authorities recognise the data reveals "a softening UK labour market and the heightened risk of damaging passthrough to the economic cycle."

Economic experts have proposed measures to mitigate the looming downturn.

Professor Nelis suggested that "the Bank of England could look at bringing interest rates down sooner to support spending, while the Government might use targeted infrastructure projects or short-term job programmes to steady the labour market without reigniting inflationary pressure."

These recommendations aim to cushion the economy against the predicted contraction whilst avoiding renewed price pressures.

Cutting interest rates while launching targeted job schemes has been suggested as a twin-track approach to ease pressure on the labour market and head off a deeper downturn.

But policymakers face a difficult balancing act, as stubbornly high prices continue to limit their room for manoeuvre.

Inflation stood at 3.8 per cent in August - the highest level since January 2024 - and remains well above the Bank of England’s two per cent target.

Unemployment sits a 4.7% high

| PAFood and beverage costs accelerated for a fifth consecutive month to 5.1 per cent, propelled by increases in vegetables, dairy products, eggs and fish.

Monica George Michail from the National Institute of Economic Research stated the data "confirm inflation remains entrenched," whilst Capital Economics analyst Paul Dales described the figures as "troubling."

These stubborn price increases have solidified market expectations that interest rate reductions cannot occur before year-end, complicating efforts to address the weakening jobs market.

More From GB News