Taxpayers to fork out an extra £700 each a year by 2030 after Labour scraps DWP benefit cuts

WATCH: Lee Anderson announces Reform’s benefits crackdown on 'anxiety generation' |

Research from the Centre for Social Justice is shining a light on how much Britons will need to pay for the UK's ballooning benefits bill

Don't Miss

Most Read

Latest

A prominent think tank has calculated that each taxpayer will face an additional £700 annual burden by 2030 following the Labour Government's U-turn on certain reforms to the Department for Work and Pensions (DWP).

Following a backbench rebellion, ministers dropped changes impacting Personal Independence Payments (PIP) and the health-related component to Universal Credit.

The Centre for Social Justice (CSJ) revealed that expenditure on disability-related benefits will surge from £49.6billion currently to £72.3billion within six years.

Based on the organisation's analysis, the Government's choice to avoid identifying cost reductions through the Timms Review will result in dramatically increased welfare expenditure whilst leaving millions dependent on state support indefinitely.

Britons will have to pay hundreds of pounds extra after DWP reforms were scrapped

|GETTY

With 39.1 million individuals paying income tax, the projected £22.7billion spending increase represents a substantial financial impact on working households across Britain.

PIP claims have expanded by 1.3 million individuals following the pandemic, with projections indicating an additional 800,000 claimants will join the system before 2030.

Applications citing anxiety and depression have more than tripled compared to 2019 figures, contributing to a caseload that will grow from 3.8 million currently to beyond 4.6 million.

Research from the Institute for Fiscal Studies (IFS) indicates Britain stands alone amongst similar nations experiencing this surge, while other countries have maintained stable or declining disability claim numbers.

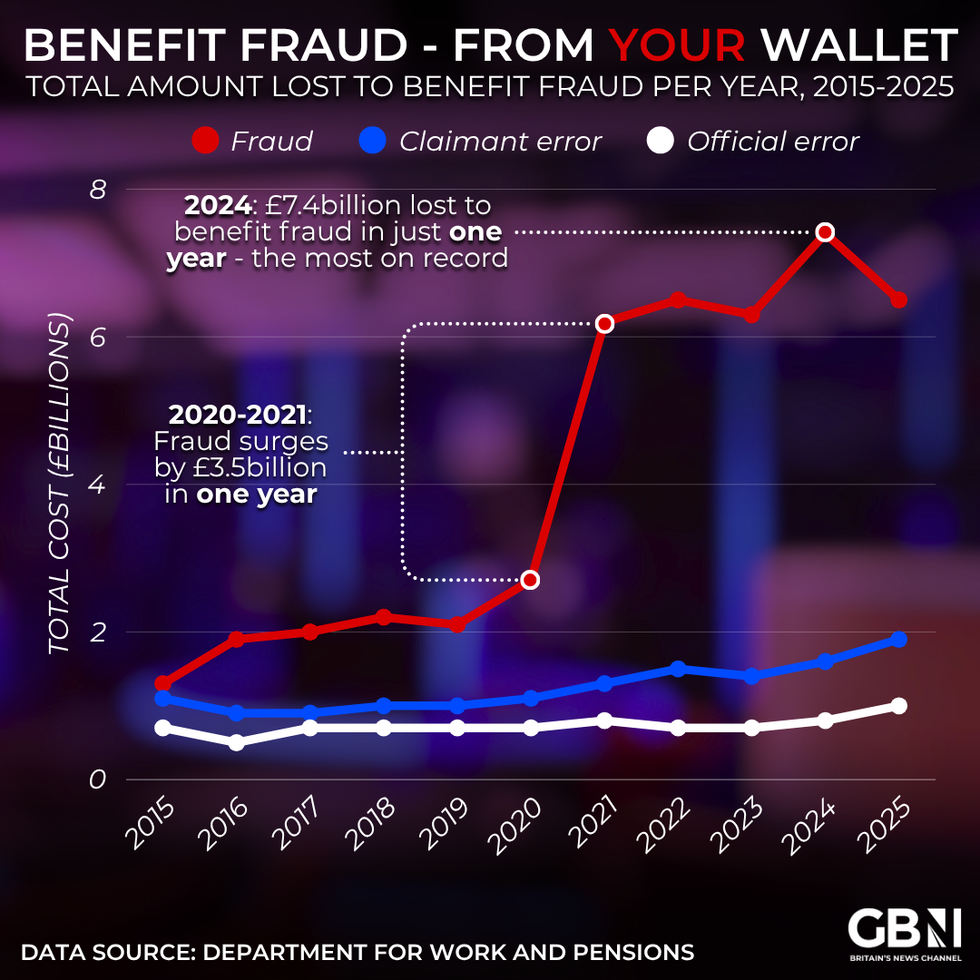

Benefit fraud - from your wallet: Total amount lost to benefit fraud per year | GB NEWS

Benefit fraud - from your wallet: Total amount lost to benefit fraud per year | GB NEWSPublished terms for the Timms Review acknowledge it must function within existing Office for Budget Responsibility forecasts for future PIP costs, effectively ruling out spending reductions.

The think tank has outlined several interventions to address the crisis, including removing Universal Credit Health and PIP from approximately 1.1 million individuals experiencing less severe anxiety, depression or ADHD, whilst adjusting remaining payments to £103 weekly.

These measures would generate £7.4billion in savings by 2029-30, with at least £1billion earmarked for dramatically expanding NHS Talking Therapies, social prescribing services and employment assistance programmes.

Additional proposals include establishing a Future Workforce Credit offering tax reductions to businesses recruiting young people not in education, employment or training, potentially bringing 120,000 into employment whilst generating £765million through tax receipts and benefit reductions.

Joe Shalam, the policy director at the CSJ, said: "Everyone can see the system is failing.

"Abandoning proper welfare reform while costs surge is a political choice with a £20 billion bill attached."

He added: "That bill lands on every taxpayer, and even worse, a lost generation will be stuck on benefits with no route back to work or independence. It is time for change this Budget."

The CSJ also advocates creating a Work and Health Service using £300 million in savings to expand WorkWell pilot schemes, helping individuals with workplace accommodations whilst transferring fit note responsibilities from overburdened GPs.

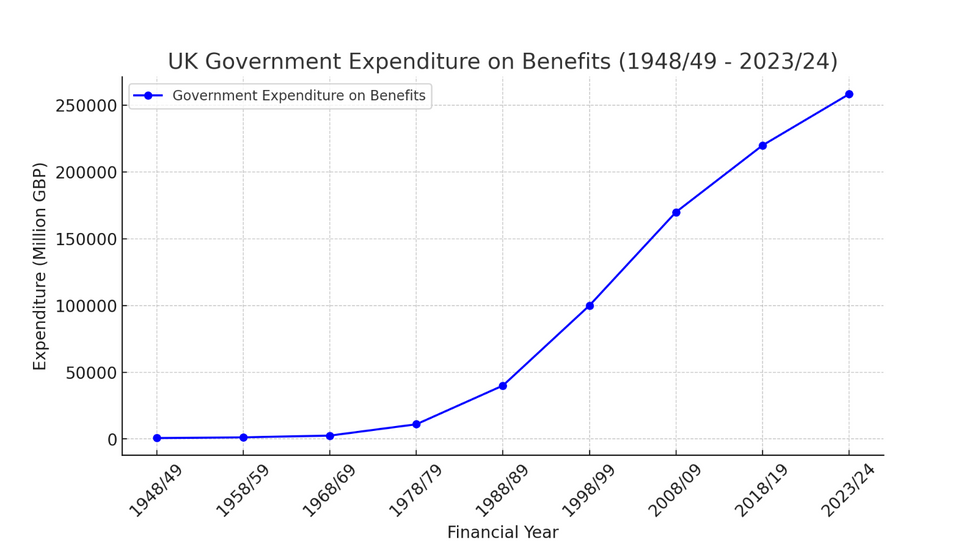

The UK government's expenditure on benefits has also increased over time, with the largest increase in 2020/21 due to the COVID-19 pandemic | ChatGPT

The UK government's expenditure on benefits has also increased over time, with the largest increase in 2020/21 due to the COVID-19 pandemic | ChatGPT Last month, Chancellor Rachel Reeves Rachel Reeves warned the public that she "can’t leave welfare untouched" during this parliament.

It is widely expected that the Treasury will scrap up to £1billion in tax breaks for a scheme providing cars for disabled people.

Speaking to Channel 4, the Chancellor shared: "We can’t leave welfare untouched.

"We can’t get to the end of this parliamentary session and I’ve basically done nothing … We have to do reform in the right way and take people with us."

More From GB News