Coventry Building Society warning: Pensioners risk losing Winter Fuel Payments over 'modest savings'

Savers urged to be careful of tax on savings interest |

GB NEWS

Pensioners are being reminded to check if they will be eligible for Winter Fuel Payments under new eligibility rules

Don't Miss

Most Read

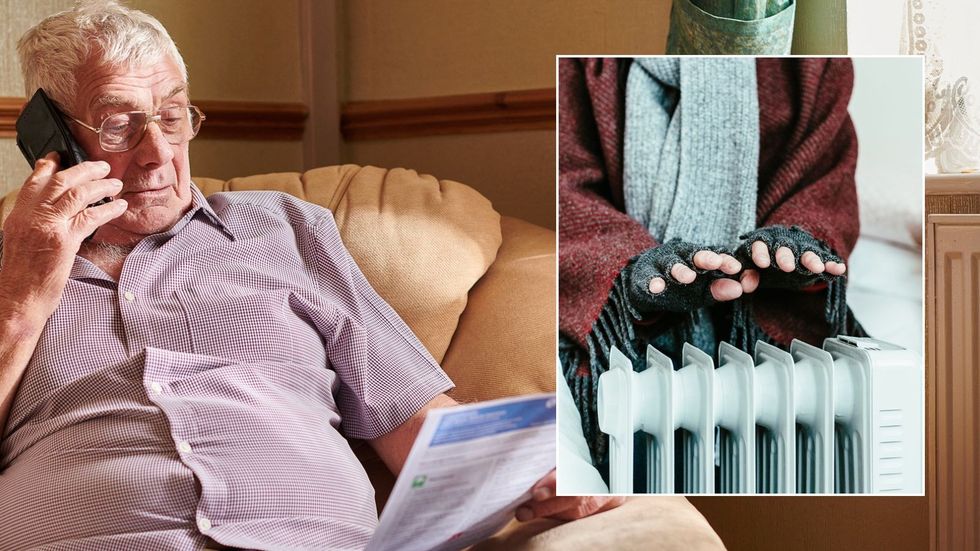

Pensioners across England and Wales could lose their Winter Fuel Payment eligibility without realising it, Coventry Building Society has warned.

This is due to interest from savings which are held outside of ISAs counting towards the £35,000 income threshold introduced this week by the Labour Government.

The Department for Work and Pensions (DWP) confirmed that pensioners earning below £35,000 annually will automatically receive payments of £200 or £300 this winter.

However, Coventry Building Society is warning that many may unknowingly exceed this limit and lose access to the up to £300 in energy bill support.

Coventry Building Society has issued a Winter Fuel Payment warning

|GETTY

Interest earned on standard savings accounts is considered taxable income and counts towards the threshold, even when it falls within the Personal Savings Allowance and remains untaxed.

A pensioner with £20,000 in a standard savings account earning 4.5 per cent interest would generate £900 annually.

While this amount falls within the £1,000 Personal Savings Allowance for basic rate taxpayers and isn't taxed, it still counts as taxable income.

This £900 would be added to other income sources when calculating eligibility for the Winter Fuel Payment.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Savings could impact your eligibility for the Winter Fuel Payment, according to the building society

| COVENTRY BUILDING SOCIETYFor someone already earning close to the £35,000 threshold, this additional income from savings could push them over the limit

The result would be losing access to the £200 or £300 payment, despite the interest itself being tax-free.

Jeremy Cox, the head of Strategy at Coventry Building Society, warned that "thousands could still unknowingly be left out in the cold - not because they're earning more, but because their savings are".

He explained that "many pensioners may not realise that interest earned on savings held outside of ISAs count towards their total taxable income".

"With interest rates still relatively high, even modest savings can generate income that pushes someone over the threshold."

LATEST DEVELOPMENTS:

ISAs are useful tools for those looking to save more than the personal savings allowance threshold without having to pay tax | GETTY

ISAs are useful tools for those looking to save more than the personal savings allowance threshold without having to pay tax | GETTYCox emphasised that "ISAs offer a tax-free way to keep savings interest out of the income equation.

"Interest earned within an ISA is never taxed and does not count toward income calculations".

The Winter Fuel Payment changes follow last year's means-testing that reduced the income threshold to £11,600, limiting payments to those on certain benefits.

Under the new system announced on June 11, pensioners earning above £35,000 will have payments reclaimed through PAYE or self-assessment.

More From GB News