Council tax warning as outdated rules leave thousands in £2,000 debt facing prison

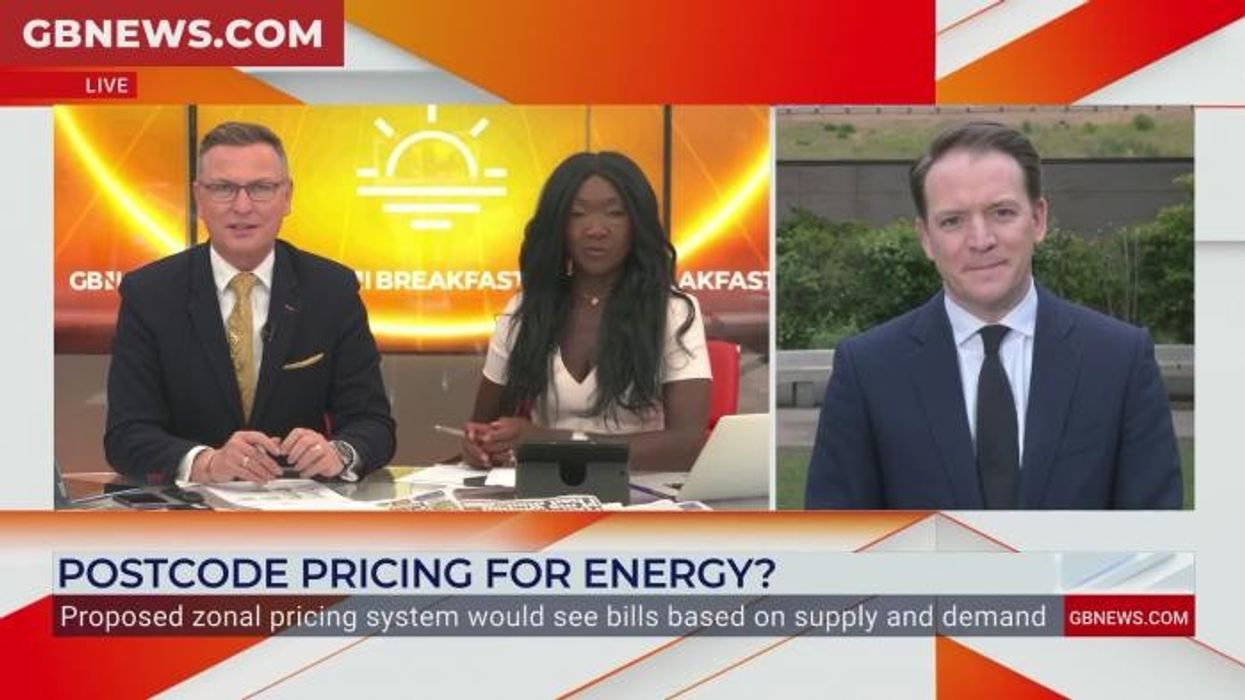

Ed Miliband risks ‘disproportionately burdening’ families with energy bills shake-up |

GB News

Resolution Foundation warns poorest families face mounting arrears and outdated enforcement threats

Don't Miss

Most Read

Latest

A new report warns that average council tax debts now top £2,000, with many households still facing the outdated threat of imprisonment if they fall behind.

Debt charity StepChange warned that such pressures are leaving families increasingly vulnerable, as the risk of arrears spiralling out of control grows.

Simon Trevethick, head of communications at debt charity StepChange, said: “This research speaks to what our advisers see on a daily basis – that the sheer weight of everyday costs is pushing households to the brink.

“For council tax, we see increased levels of harm as the risk of debt escalation and outdated threat of imprisonment loom large over those in difficulty – with average debts topping £2,000.”

He added: “We need to see a debt relief scheme to address historic energy arrears, a fundamental overhaul of council tax regulations – including the end to imprisonment rules – and immediate action from government to build household financial resilience.”

The findings come against a backdrop of mounting financial strain, with energy arrears also weighing heavily on struggling households.

More than one million British households have fallen behind on electricity payments while gas arrears have climbed to nearly 900,000.

The Resolution Foundation said energy arrears have tripled over the past decade, pushing families to unprecedented levels of financial pressure.

More than one million British households have fallen behind on electricity payments

|GETTY

The strain is showing most clearly in the lowest-income households, where nearly one in five families is now behind on at least one essential bill.

Debts themselves have also ballooned, with average electricity arrears rising from about £500 a decade ago to £1,600 today, while gas arrears are now close to £1,400.

StepChange says the typical client it supports is struggling with more than £2,300 in overdue household bills.

The rising balances reflect steep price increases rather than overspending, with gas alone costing around 50 per cent more per unit than before the energy crisis – leaving many families unable to keep up.

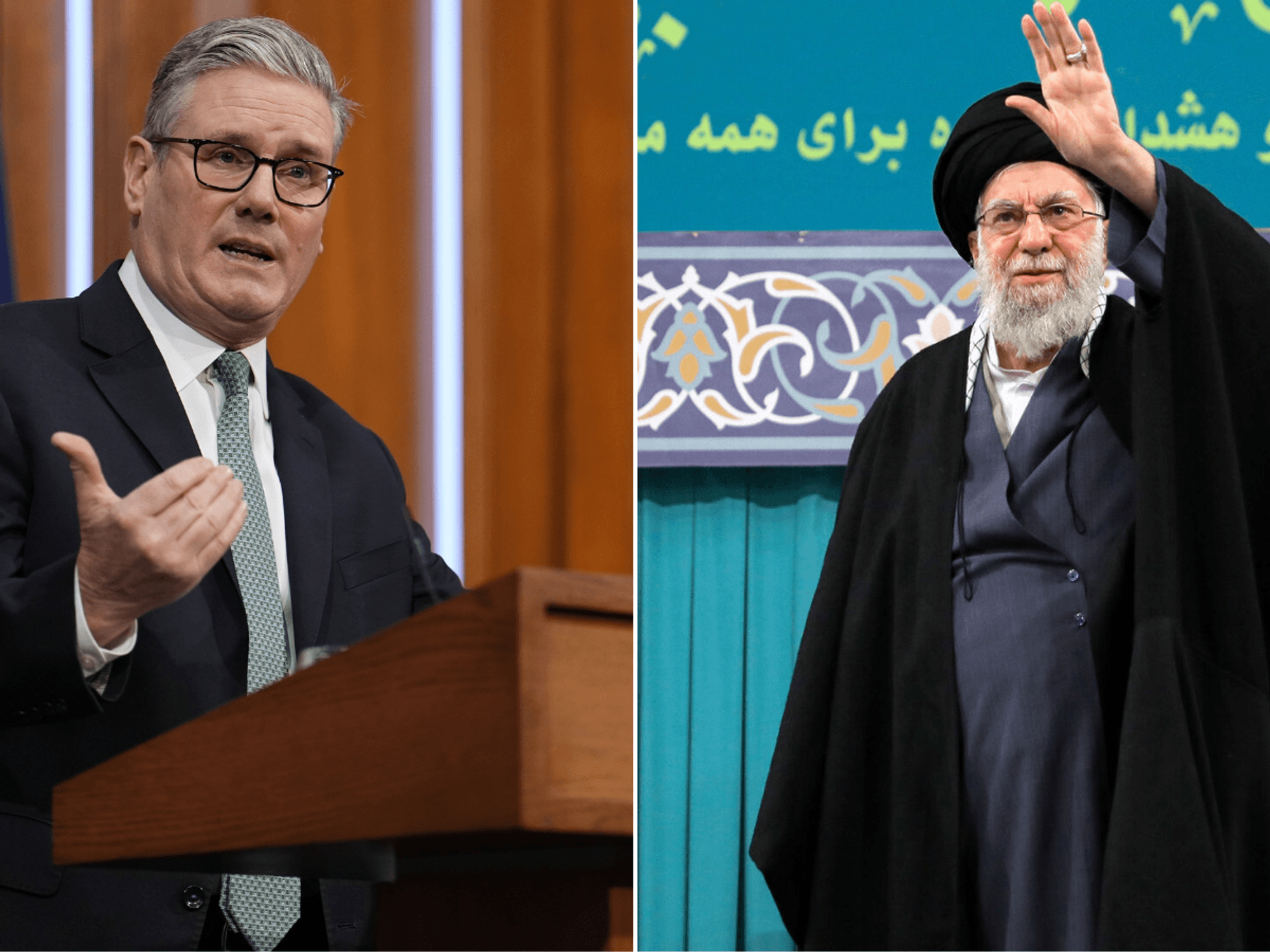

Energy Secretary Ed Miliband's net-zero plans have drawn much criticism.

| Getty ImagesResolution Foundation economist Felicia Odamtten said: “Tackling these problems will require additional help with priority bills, such as improved council tax support and a social tariff on energy bills.”

Ms Odamtten added: “All too often, lack of financial resilience is simply a consequence of lack of income.”

The Foundation found over two-fifths of lower-income households have savings below £1,000.

StepChange called for reforms to scrap imprisonment for council tax debt and restructure collection rules.

The charity also advocated for a debt relief programme to address historic energy arrears.

The Resolution Foundation said weakened council tax support schemes had intensified hardship in the most disadvantaged communities.

It warned that without Westminster action on energy pricing and council tax reform, millions face worsening financial distress.

Local authorities have defended collection practices, citing rising arrears and pressure on council budgets.

The energy price cap will rise in October | PA

The energy price cap will rise in October | PAEnergy suppliers have also warned that sustained non-payment risks destabilising the wider system.

Consumer groups argue that reforms must balance financial responsibility with protections for vulnerable households.

The research concludes that Britain’s poorest families are bearing the heaviest burden of essential service costs.

This comes as Britain's energy ranks as the most expensive in the G7.

More From GB News