Cash ISA savers urged to take urgent action or risk 'losing money' ahead of Rachel Reeves shake-up

Clare Muldoon blasts Rachel Reeves for targeting tax-free cash ISAs - 'Abhorrent!' |

GBNEWS

Calls to ditch low-interest Cash ISAs grow louder as ministers weigh plans to steer savers toward stock market investments

Don't Miss

Most Read

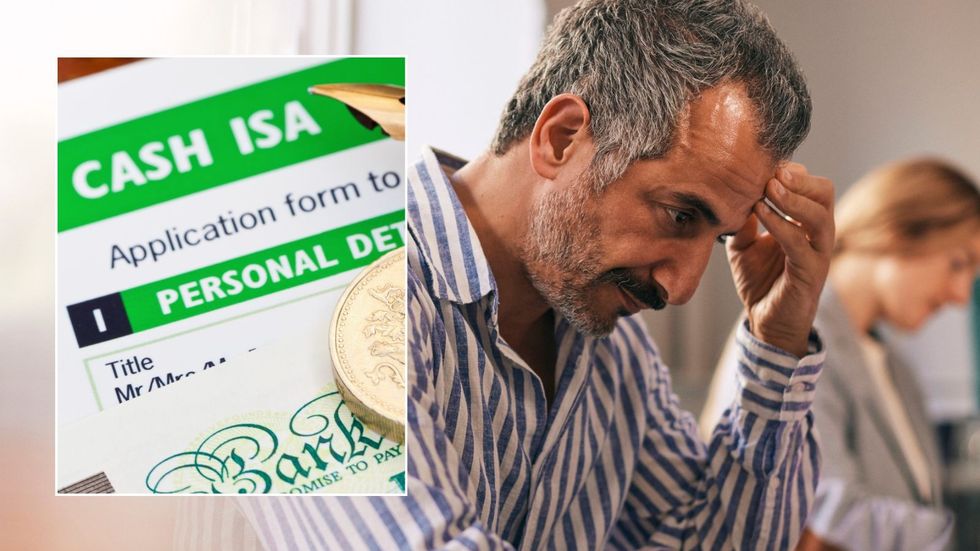

Although the Government has delayed changes to ISA rules, experts say failing to act now could leave savers worse off in the long run.

Savers could be sitting on a ticking time bomb as the value of their money erodes due to inflation.

A leading financial adviser has sounded the alarm for those relying on traditional Cash ISAs to protect their savings.

**ARE YOU READING THIS ON OUR APP? DOWNLOAD NOW FOR THE BEST GB NEWS EXPERIENCE**

Samuel Mather-Holgate, independent financial adviser at Mather and Murray Financial, warned: "If you've got bags of cash in ISAs, you're losing money.

"Inflation has been at record levels and your cash will not have kept up with this, so the buying power of that money has reduced.

"Shift some of the cash into an investment ISA and over the long term you should see better growth, and higher-than-inflation returns. Rachel Reeves is looking at how to get more people to do that, so you'll be giving her a helping hand too!"

The warning comes as inflation continues to outpace interest rates on many savings accounts.

Official figures show UK inflation rose to 3.6 per cent in June, up from 3.4 per cent in May, and still well above the Bank of England’s two per cent target.

New research from savings app Spring reveals that the total balance of adult savings accounts failing to beat inflation has soared by nearly £200billion since January, now totalling £660billion.

Billions of pounds are quietly being eroded as savers' money sits in underperforming accounts.

Rachel Reeves's cash ISA reforms could 'force' them into stock market investing | GETTY

Rachel Reeves's cash ISA reforms could 'force' them into stock market investing | GETTY Derek Sprawling, head of money at Spring, said the analysis "should be a wake-up call for savers", adding: "It’s time to review where your money is held and ensure it’s working harder for you."

He also stressed the importance of seeking out competitive interest rates, warning: "Anything less means your savings are losing value in real terms."

To encourage people to move their money out of languishing accounts, Chancellor Rachel Reeves had reportedly been considering reducing the cash ISA allowance from the current £20,000 to as little as £5,000.

The aim was to funnel more savings into stocks and shares to boost long-term investment in the UK economy.

Although no changes were announced in her Mansion House speech, Reeves made clear that reforms could still be on the horizon

| GETTYAlthough no changes were announced in her Mansion House speech, Reeves made clear that reforms could still be on the horizon.

She said: "I have confirmed that long-term asset funds can be included in stocks and shares Isas, allowing long-term Isa investors to benefit from this innovative product.

"And I will continue to consider further changes to Isas, engaging widely over the coming months and recognising that despite the differing views on the right approach, we are united in wanting better outcomes for both savers and for the UK economy."

ISAs are useful tools for those looking to save more than the personal savings allowance threshold without having to pay tax | GETTY

ISAs are useful tools for those looking to save more than the personal savings allowance threshold without having to pay tax | GETTYThe Building Societies Association welcomed the Government’s decision to hold back, with a spokesperson stating: "Our ambition is to ensure people's hard-earned savings are delivering the best returns and driving more investment into the UK economy."

For now, while no immediate cuts to the cash ISA allowance have been made, the message from financial experts is clear, sitting still could cost people.

More From GB News