Rachel Reeves will 'push savers into paying tax' as cash ISA allowance set to PLUMMET to £12k in Budget

What is a cash ISA? |

GB NEWS

The Chancellor is preparing to make changes to the tax-free cash ISA allowance in tomorrow's Budget statement

Don't Miss

Most Read

Chancellor Rachel Reeves is preparing to "push savers into paying tax" through looming changes to the ISA regime which will be announced in tomorrow's Budget, analysts warn.

It is understood the Chancellor will slash the cash ISA tax-free contribution limit from £20,000 to £12,000 as part of reforms to address the £20billion "black hole" in the public finances.

Victor Trokoudes, the founder and CEO of Plum, stated: "It's been reported that Rachel Reeves's plan to reform cash ISAs, slashing the £20,000 allowance to just £12,000 will go ahead."

He cautioned that "many savers will be pushed into paying tax on their savings as a result of this change."

Savers are preparing for the Chancellor's changes to ISA products

|GETTY

The proposed reduction represents a 40 per cent cut to the current tax-free savings allowance, raising concerns across the financial sector.

New data indicates that savers would overwhelmingly avoid investment options if the allowance reduction proceeds.

According to Plum's research, 37 per cent would place their money in standard cash savings accounts, while 20 per cent would opt for current accounts.

Mr Trokoudes revealed that "less than one in five (18 per cent) said they would invest in UK stocks and shares".

The ISA limit is currently £20,000 each tax year

| PAThe findings suggest the Treasury's apparent aim of encouraging investment through restricting cash savings options may prove counterproductive.

Rather than channelling funds towards productive investments, the policy appears set to simply shift savings into taxable accounts where interest earnings face potential taxation.

Building societies face particular threats from the proposed changes, with industry experts highlighting risks to mortgage lending capabilities.

Adam Craggs, a partner and head of Tax at Investigations and Financial Crime, gave a stark warning ahead of November 26's fiscal statement.

He shared: "Financial institutions, especially building societies, are also likely to raise concerns that a reduced cash ISA allowance would weaken their deposit base and limit their ability to fund mortgages, with potential knock-on effects for the housing market."

The reduction in tax-efficient deposits could constrain lending capacity at precisely the moment when housing market stability remains crucial.

Building societies rely heavily on retail deposits to fund their mortgage operations, making any significant outflow potentially damaging to their business models.

The measure faces likely political backlash, with critics viewing it as poorly conceived fiscal policy.

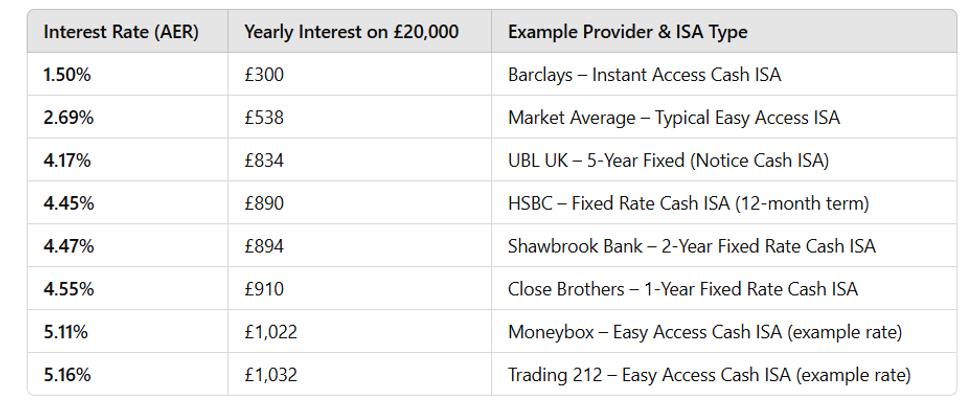

Examples of tax free Isa earnings in the UK if you had £20,000 in the Isa | GBN

Examples of tax free Isa earnings in the UK if you had £20,000 in the Isa | GBNMr Craggs noted that "politically, the cut risks being viewed as unfair or poorly targeted—more akin to a stealth tax than a measure to encourage investment".

He added that "MPs and consumer advocates have questioned whether reducing the allowance would achieve its intended outcome, suggesting it could do more harm than good."

The policy particularly affects cautious savers, with Craggs observing that "savers—particularly older, risk-averse households—may feel penalised, as cash ISAs remain one of the few safe, tax-efficient products available to them."

The Chancellor's Budget statement will take place in the House of Commons at 12:30pm tomorrow (November 26).

More From GB News