Reeves admits plans to bend rules as Labour plots £50bn borrowing spree in tax-hiking Budget

Ahead of October 30's Budget, the Chancellor is giving insight into how Labour is planning to implement its spending plans

Don't Miss

Most Read

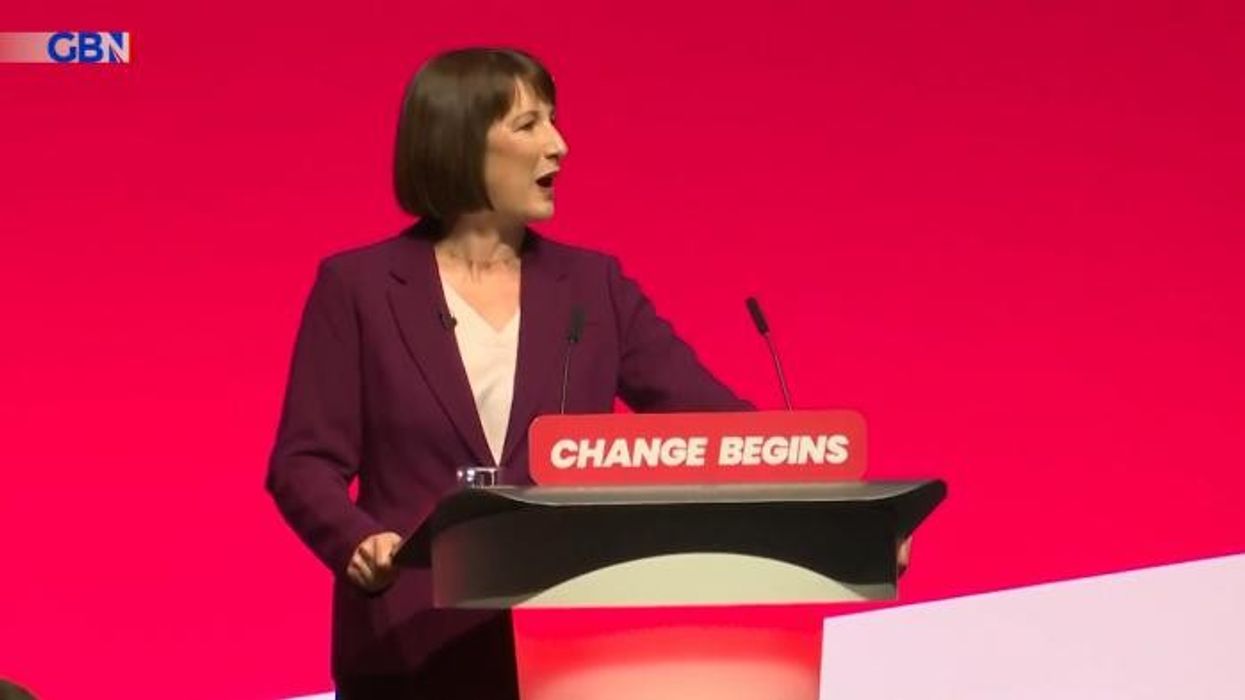

Chancellor Rachel Reeves has announced plans to overhaul spending and debt rules, with the intention to pave the way for increased investment in the UK economy.

Writing in the Financial Times, Reeves stated that her investment rule would "get debt falling as a proportion of our economy" whilst making "space for increased investment".

The changes are expected to alter how Government debt is measured, taking into account a wider range of state assets and liabilities.

This new approach, set to be unveiled in the upcoming Autumn Budget on October 30, aims to provide more flexibility for borrowing and investment.

However, said changes have sparked debate among policymakers including from Reeve's predecessor.

Shadow chancellor Jeremy Hunt warned that Reeves's actions could lead to higher mortgage costs.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Rachel Reeves has confirmed debt rules will be overhauled

|PA

He stated: "The consistent advice I received from Treasury officials was always that increasing borrowing meant interest rates would be higher for longer and punish families with mortgages."

Hunt also criticised the lack of parliamentary announcement, adding: "What's even more remarkable is that the Chancellor hasn't seen fit to announce this major change to the fiscal rules to Parliament. The markets are watching."

In response to these concerns, Reeves assured that safeguards would be implemented.

Speaking to Sky News, she said: "We will measure debt differently but of course we'll put guardrails in place to ensure that every pound of taxpayers' money spent is spent wisely."

Reeves further elaborated on the implementation of these changes, emphasising the involvement of key financial institutions.

"We'll involve the National Audit Office and the Office for Budget Responsibility in ensuring responsible spending," she added.

However, the Chancellor remained tight-lipped about specific Budget details with rumours circulating on a potential tax raid on businesses and pensions.

When questioned about potential changes to employer national insurance on pension contributions, she stated: "I was clear in the statement I made to the House of Commons in July that there will be difficult decisions in this Budget around spending, welfare and taxation."

LATEST DEVELOPMENTS:

Britons are anxious about the state of the economy

| GETTYReeves stressed the importance of fiscal responsibility, adding: "The worst thing that a Chancellor could do in the Budget next week is not put Britain's public finances and Britain's public services on a sustainable path. I'm determined to do that."

The Chancellor's plans for fiscal reform come amid widespread expectations of changes to debt measurement. These alterations are anticipated to include a broader range of state assets and liabilities, potentially giving Reeves more flexibility in the upcoming Budget.

Speaking to ITV, Reeves confirmed: "Our second rule, our investment rule, will change the way in which we measure government debt so we take into account our assets not just the costs of investment."

This approach aims to create space for increased investment in the economy, addressing concerns about potential falls in public sector investment under the previous government.