'It's killing me!' Grieving sister living in 'squalor' pleads for bedroom tax to be scrapped

Bedroom tax has been linked to increased levels of anxiety, social isolation, and poor health outcomes

Don't Miss

Most Read

A grieving Hull woman is pleading for bedroom tax to be scrapped as she claims the benefit cap is "killing her".

Sarah Duffin, 40, of Bransholme, is mourning the loss of her brother, who she cared for and lived with, after he tragically died of a heart attack in May.

Now his room in the two bedroom council house lies empty and Duffin says she cannot afford the extra cost of bedroom tax to live there alone.

The policy, also known as removal of the spare room subsidy, was brought in 12 years ago through the Welfare Reform Act in 2013 and it affects more than half a million people.

A grieving Hull woman is pleading for bedroom tax to be scrapped as she claims the benefit cap is 'killing her'

|GB News

It means council house tenants have their benefits reduced if their rented property is deemed to have more bedrooms than necessary, reducing Universal Credit by 14 per cent for having one extra bedroom and by 25 per cent if they are deemed to have two or more ‘spare’ rooms.

While intended to free up larger homes by encouraging those with a spare room to downsize, a study found its effects have disproportionately impacted communities across the UK, especially those in the North.

Bedroom tax has also been linked to increased levels of anxiety, social isolation, and poor health outcomes with some residents experiencing significant hardship and relying on loans to pay bills, while cutting back on essential items such as food.

This has been keenly felt by benefits claimant Sarah Duffin who says she is now paying an extra £50 a month in bedroom tax, which has left her feeling "lost, angry, frustrated, hurt and emotional."

Speaking to GB News in her rented two-bedroom Hull home, which has no carpets and few furnishings, she said: "On May, 2, 2025, my brother died. I cared for him as he had cancer and I saw him die in front of me in his bedroom - it's left me with flashbacks and PTSD.

"I asked the council straight away to get a direct let sorted to move me to a one bedroom flat [so she is exempt from bedroom tax] - they don't give a monkeys and I'm left in limbo.

"The benefits cap is killing me. The bedroom tax is a tax on the poor and it's killing a lot of people and it's not helping me with my mental health issues.

"I get Universal Credit - I get £90 a fortnight, and by the time I pay bedroom tax, council tax, [and energy and household bills] I have maybe £3 or £5 left to live on.

"I want the bedroom tax scrapping, it's a tax that people can't afford."

Duffin has been unemployed for most of her life. She left school early without qualifications due to being bullied, but has taken opportunities from the Job Centre to gain equivalent certificates and work experience.

Her dream role would be to work in the food industry, making and selling jam and curds, but the desperate job seeker says she has struggled to find employment in any role and she wants the benefits system reformed.

"The asylum seekers are coming here, they're getting everything hand over fist. I can't get a grant for furniture or carpets [from the council]. They didn't care. They still don't care. I've been left living in squalor," she said.

"I'm left in limbo to live on nothing. The system is broken, the country is broken because they [the government] don't care.

"I've got the qualifications to get a job, but there is no jobs because of the national insurance hike.

"The tax hike is killing shops, it's killing businesses. It's not worth working when you've got nothing to live for."

Hull City Council is currently housing Duffin in Bransholme.

A spokesman for the authority said: “Whilst it wouldn’t be appropriate to talk about the details of individual cases, residents who sadly suffer a bereavement which leads to a change in their benefits status as administered by the Department for Work and Pensions can access help from Hull City Council, including assistance in applying for a discretionary housing payment.

"In certain cases where a resident has requested to move to a different property in a different area of the city, the process can take some time, due to necessary partnership work and to ensure the placement of that resident is satisfactory.

Bedroom tax has also been linked to increased levels of anxiety, social isolation, and poor health outcomes

|GB News

"Delays may occur, especially if the tenant wants to be housed in specific location or street, where there is no available housing.”

The Department of Work and Pensions added: "The removal of the spare room subsidy applies to working age households living in the social rented sector in a home considered to have more bedrooms than their entitlement.

“Easements are available to support people who have suffered a bereavement, and Discretionary Housing Payments are available from local authorities for people entitled to Housing Benefit or Universal Credit who cannot meet their housing costs.”

There have been wider calls for a complete overhaul of the council tax system, including from Fairer Share.

The organisation proposes the abolition of council tax, bedroom tax and stamp duty and put forward the introduction of a proportional property tax.

This would be a flat rate of 0.48 per cent on the value of a property, the tax would be paid by the property owner and not the tenant, and payment of the tax would be deferred for those unable to pay.

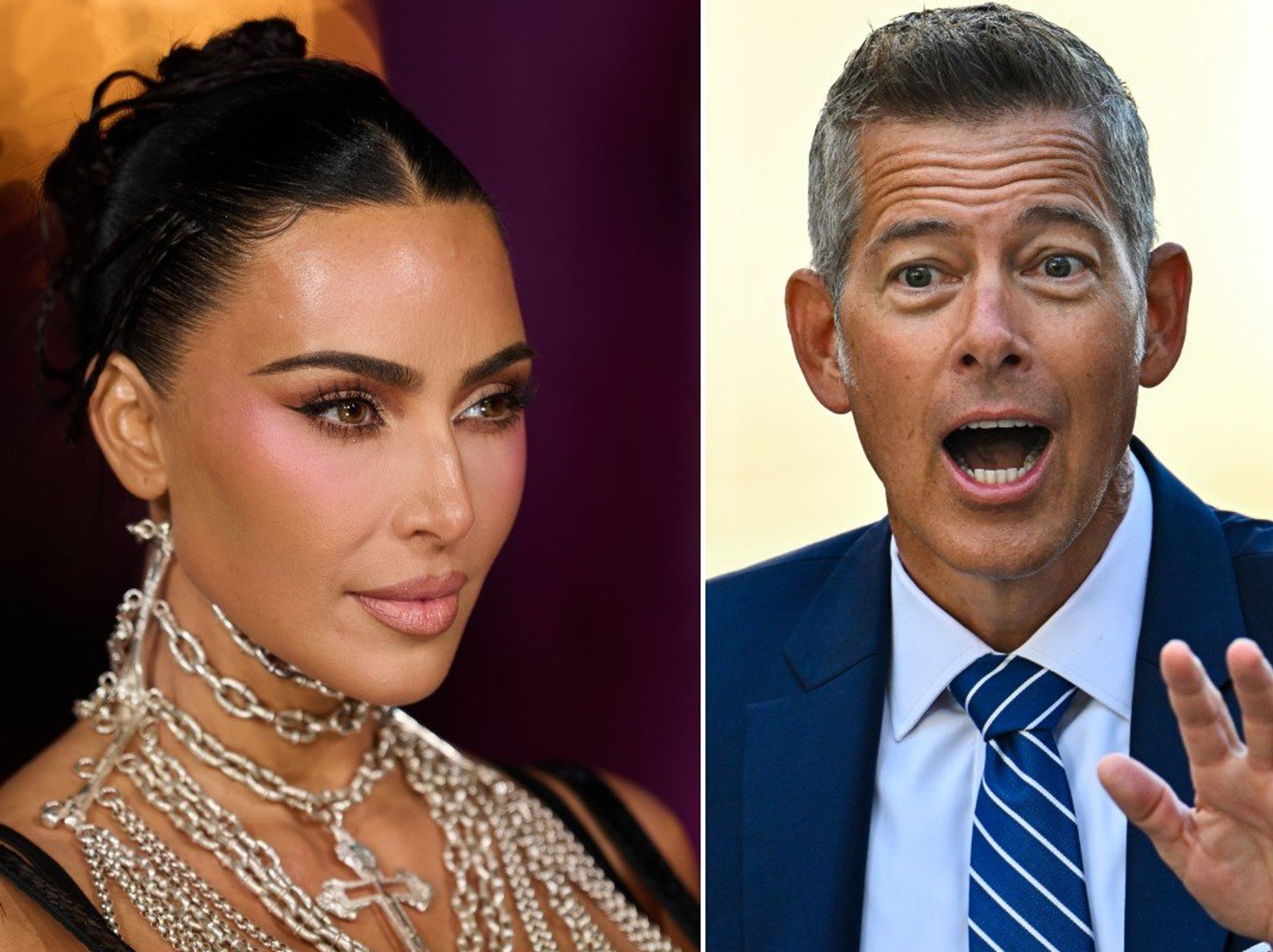

Commenting on Sarah Duffin's struggle with bedroom tax, Andrew Dixon, Chairman of Fairer Share, told GB News: "Sarah’s situation highlights the deep unfairness at the heart of our property tax system.

"While she’s paying council tax on a modest, poorly maintained rental home in Hull, a wealthy homeowner in a £3 million townhouse in Westminster may be paying just a little more, despite the home being worth over 40 times as much.

"This is the legacy of a broken Council Tax system based on 1991 property values, and it hits renters and low-income households hardest. The so-called 'Bedroom Tax' adds insult to injury by penalising those with no power to move or improve their housing.

"Fairer Share is calling for the abolition of Council Tax and Stamp Duty, replacing both with a proportional property tax based on up-to-date values. That would cut bills for millions like Sarah, while asking more from those with the broadest shoulders. The time for property tax reform is long overdue."

Bedroom tax was brought in under the Conservative and Liberal Democrat coalition in 2013, and it has remained in place under successive governments, including Labour who were against the scheme whilst in opposition.

Jonathan Brash, Labour MP for Hartlepool, is the chairman of the All-Party Parliamentary Group on Council Tax Reform, and said bedroom tax is a "deeply unfair system" that should be "scrapped".

He told GB News: "The bedroom tax is an unjust policy that punishes people for circumstances they cannot always control. No one should be penalised for having an empty room because of personal tragedy or a lack of alternative housing options. It is a deeply unfair system, and I believe it should be scrapped.

"We need a housing system built on compassion and common sense, not bureaucracy and box ticking. That is also why I am leading efforts in Parliament to reform council tax, which is equally regressive.

"As the Conservative/Lib Dem Government under David Cameron introduced the Bedroom Tax, they also changed rules on Council Tax support which slashed help available to vulnerable people as the burden of costs get higher and higher, year on year. They did this on the same day in 2013.

"Only people in social housing pay the Bedroom Tax and the same people, often in areas of high deprivation, are hammered by Council Tax while other areas of the country keep theirs low because the demand on services happens to be lower. It has been unbelievably one-sided.

"I'm pleased that the Labour Government is getting to grips with some of these issues, especially around the difference between Council Tax rates in different regions. But we need to go further and faster to get the support to those who need it right now.

"These are basic matters of fairness, and it is time the system worked for people, not against them."

Further information on bedroom tax can be found here.

If you are on benefits and struggling with rent or housing costs, the application for Discretionary Housing Payments is here.

More From GB News