Bank of England issues urgent update for anyone with a mortgage after interest rate cut

Interest rates cut: Recession warning as top economist says Bank of England move falls short - ‘I would have welcomed more’ |

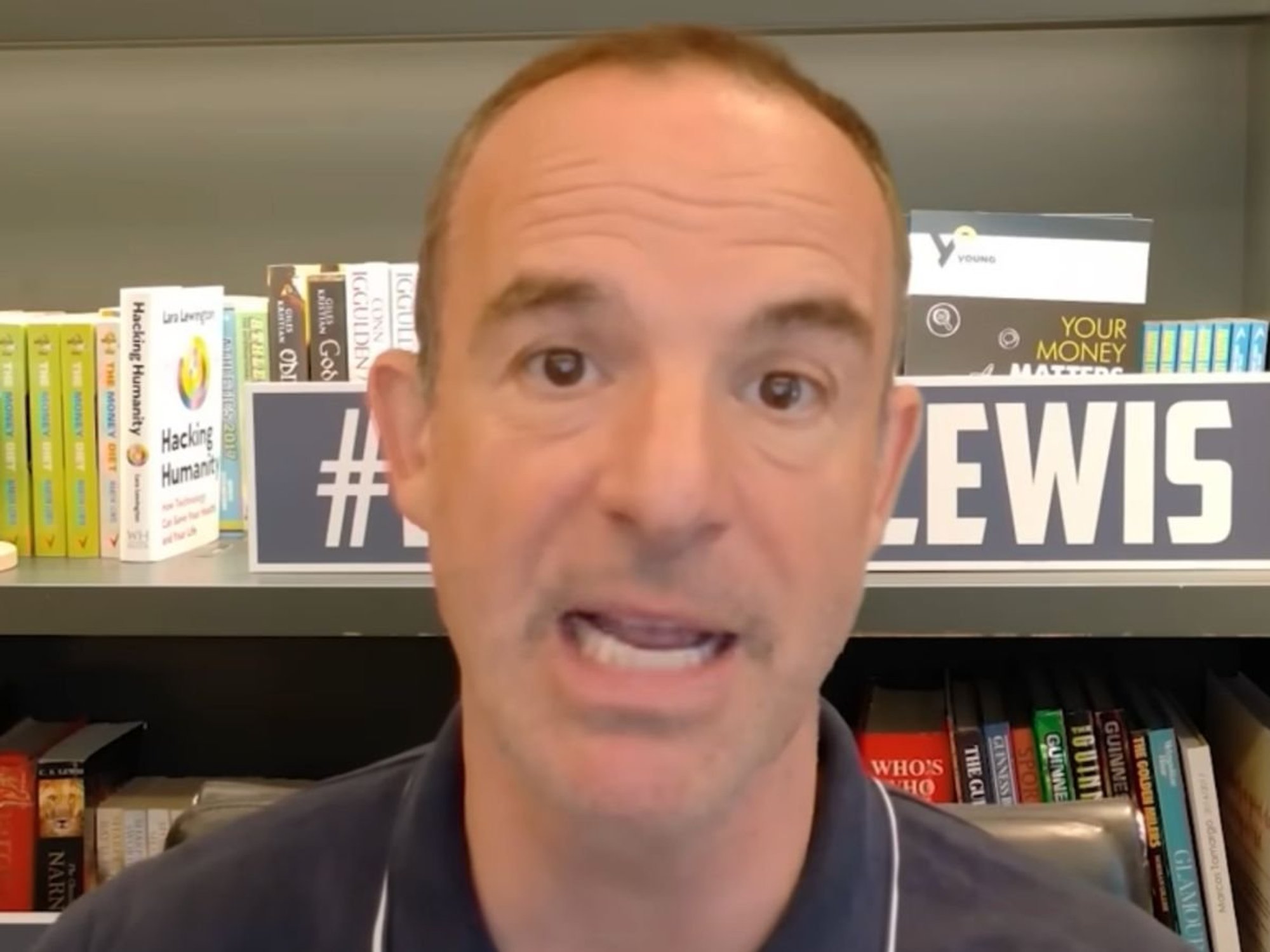

GBNEWS

Millions face higher repayments despite signs of easing rates

Don't Miss

Most Read

The Bank of England has issued an update for mortgage holders in its latest Monetary Policy Report.

It warns that while some mortgage rates have started to ease, many households refinancing this year are still likely to face higher monthly payments than before.

In its last Monetary Policy Committee meeting, the Bank of England voted to cut the interest rate to 4.25 per cent, a move that signals the potential for lower mortgage rates.

Although cheaper deals are starting to appear, the Bank's May 2025 Monetary Policy Report warned that many borrowers will still face high monthly payments when they remortgage.

The report stated: "Effective rates on new mortgages with a fixed-rate period of between two and five years, which represent around 60 per cent of the mortgage stock, remain around 130 basis points higher than the corresponding rates on outstanding mortgages."

This means most people coming off existing deals will still face a significant increase in borrowing costs.

Mortgage rates have dipped in recent weeks

| GETTYMortgage rates surged following a series of interest rate rises between late 2021 and 2023. And although the base rate was reduced in May, the full impact on borrowing costs will take time.

The report added: "The effective interest rate on the outstanding stock of fixed-rate mortgages is expected to increase further over the next few years."

Some households may start to benefit from slightly lower new mortgage rates. The report notes that "the effective interest rate on new fixed-rate mortgages has started to fall recently and is now slightly below the effective rate on the stock of fixed-rate mortgages."

This reflects a recent drop in swap rates, the market rates that underpin the pricing of fixed-term mortgage deals.

In particular, the Bank highlighted that "quoted rates on two and five-year fixed-rate mortgages at 75 per cent and 90 per cent loan-to-value fell by 20–35 basis points between January and April, consistent with falls in OIS rates at those maturities".

Although this is a modest change, it suggests some easing in conditions for new borrowers or those looking to refinance.

LATEST DEVELOPMENTS:

There are many mortgage deals on the market | GETTY

There are many mortgage deals on the market | GETTYDespite recent shifts, the overall burden on households remains high. The Bank’s report confirms that "mortgage costs for those refinancing remain higher than in the past".

Around 1.5 million fixed-rate mortgage deals are due to expire in 2025, with most borrowers expected to move onto higher rates.

However, new research by Compare the Market suggests that 937,433 homeowners who took out mortgages in 2023 could benefit from lower monthly payments if they act quickly when their two-year deals end.

Those who don’t secure a new deal risk being moved onto their lender’s standard variable rate (SVR), which could mean an average £2,861 rise in annual payments.

The Bank also pointed to behavioural shifts in response to affordability pressures.

Although fixed rates have edged lower, households refinancing are still likely to face higher payments than they did previously

| GETTYIt stated that "over half of new mortgages now have a term of 30 years or more, compared to around 30 per cent in 2015".

Extending the term of a mortgage can lower monthly repayments, but it increases the total cost over the life of the loan.

Demand for mortgage borrowing has been relatively stable in recent months. The Bank reported that "lenders expect the availability of secured credit to households to remain unchanged in 2025 Q2."

However, overall activity is expected to be tempered by higher costs and the reduced affordability of new housing.

Although fixed rates have edged lower, the broader message from the Bank remains clear that households refinancing this year are still likely to face higher payments than they did previously.

More From GB News