Rachel Reeves accused of 'fuelling a wave of fraud' with launch of new pay-per-mile car taxes

WATCH: Chancellor Rachel Reeves confirms electric vehicles will pay 3p per mile in new road tax

|GB NEWS

Pay-per-mile car taxes could see drivers charged around £240 every year

Don't Miss

Most Read

Latest

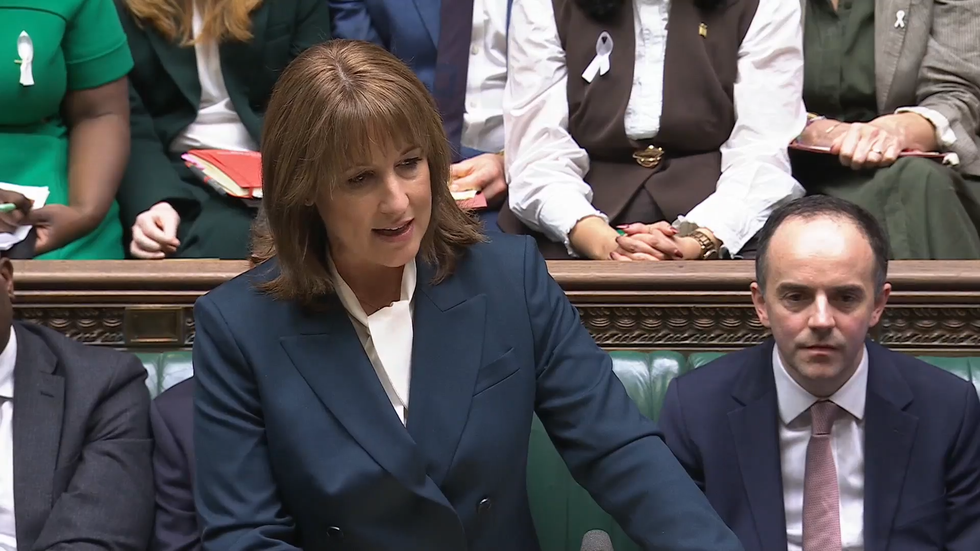

The Chancellor has been warned that new car tax measures announced last week could lead to an increase in mileage fraud as motorists look to cut their costs.

Rachel Reeves confirmed that a pay-per-mile scheme would be introduced in 2028, with electric car owners being charged 3p per mile, while plug-in hybrid drivers are expected to pay 1.5p.

The controversial road pricing scheme will be rolled out following a consultation where the industry is expected to provide feedback on the plans and identify any instances where issues could arise.

When the new taxes are introduced, motorists will be expected to take mileage readings from their in-car odometers to determine how much Electric Vehicle Excise Duty (eVED) they will need to pay.

TRENDING

Stories

Videos

Your Say

Experts have highlighted that the new taxes could lead to higher rates of mileage fraud as motorists tamper with their odometers to pay a lesser amount.

The Government's consultation into eVED states that drivers must ensure that they take "reasonable steps to ensure that the odometer is functioning correctly and that the data provided is accurate".

It outlines that motorists must rectify any issues, including if the odometer is not recording or showing the mileage properly.

Manufacturers will "retain responsibility" to ensure that odometers cannot be tampered with, as well as help the Government to identify where tampering may have taken place.

Chancellor Rachel Reeves has been warned that new car tax changes may lead to a spike in fraud

|GETTY/PA

The report also acknowledges data which shows that around 2.3 per cent of UK vehicles may show signs of "clocking", when the odometer is deliberately changed to show a lower mileage.

It added: "The Government recognises that the introduction of eVED may increase the likelihood of motorists choosing to clock their vehicles, or allowing the odometer to be inoperative."

Toby Poston, chief executive of the British Vehicle Rental and Leasing Association (BVRLA), warned that the pay-per-mile plan was the "wrong policy at the wrong time".

He outlined that the taxes would put off drivers from investing in electric vehicles, given that the eVED costs run alongside typical road tax payments.

LATEST DEVELOPMENTS

The expert warned: "In addition to the massive administrative and operational headaches for EV fleets, it creates an incentive for people to tamper with their mileages.

"Delivering this regime in its current form risks fuelling a wave of fraudulent activity that would see the Treasury recoup less, while simultaneously eroding confidence in the fragile used EV market."

The pay-per-mile charges are being introduced to combat the declining revenue from fuel duty, as more drivers transition away from petrol and diesel vehicles.

Around £25billion is raised from fuel duty every year, with estimates warning that this could fall by more than £20billion over the next few decades.

Chancellor Rachel Reeves unveiled the Budget on Wednesday, November 26

|GB NEWS

The Autumn Budget saw Chancellor Rachel Reeves continue the 5p per litre fuel duty freeze until September 2026 in a bid to protect petrol and diesel drivers from price rises.

While fuel duty has remained frozen since 2011, the Government has extended the 5p cut since 2022, when the Conservative administration introduced the rules in response to the Russian invasion of Ukraine.

Receipts from fuel duty will naturally decline over the coming years as Labour maintains its pledge to outlaw the sale of new petrol and diesel cars from 2030.

Although hybrid cars will remain on the market until 2035, only new zero emission vehicles will be on sale after that deadline.