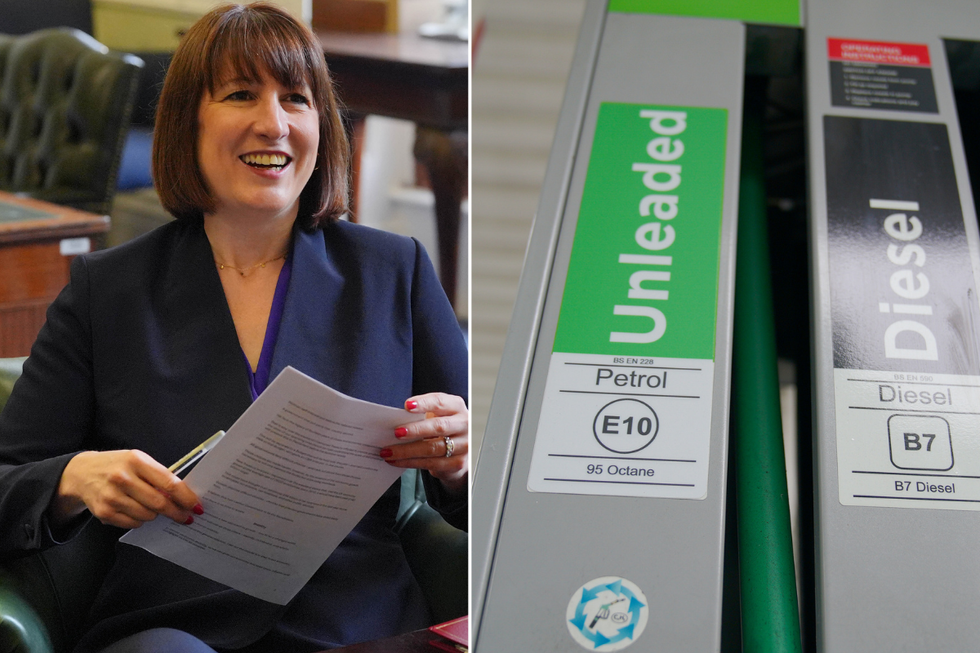

Rachel Reeves could introduce new car taxes for electric vehicles to combat fuel duty losses

Tax experts have warned that falling fuel duty due to uptake in electric vehicles will impact the economy

Don't Miss

Most Read

Latest

Labour's net zero ambitions could be hit with significant delays unless Rachel Reeves introduces a new tax option, experts have warned.

The proposed tax would replace fuel duty, which is currently declining as more people buy electric vehicles over petrol and diesel models.

As the Government pushes forward with electric cars, the impact on the economy has been dire, research has revealed.

The latest HMRC tax receipts data found that while fuel duty receipts for April to May 2025 reached £4.1billion, marginally higher than the previous year, the annual trend shows a continued decline.

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

The fuel duty freeze will expire in March next year, with experts calling on the Chancellor to find an alternative tax

| PAThis downward trajectory has been primarily driven by motorists abandoning diesel and petrol vehicles in favour of electric and hybrid alternatives.

The shift, while aligned with environmental goals, has created a funding gap that undermines the Government's ability to finance its ambitious renewable energy infrastructure projects.

Energy sector expert Sheena McGuinness from RSM UK has issued a stark warning about the state of Britain's green transition.

She said: "Despite the Government's claims that the UK is on the brink of a 'green industrial revolution', the annual fall in fuel duty revenues continues to cast doubt on the Government's energy strategy and its commitment to achieving net zero."

Drivers could see fuel duty rates rise in the October Budget | PA

Drivers could see fuel duty rates rise in the October Budget | PAThe temporary 5p per litre fuel duty cut, which has contributed to the declining revenues, is set to expire in March 2026, with experts calling on Reeves not to extend it for another year.

A Treasury spokesperson told GB News: "The 5p cut is set to expire in March 2026. The Chancellor makes decisions on tax policy at fiscal events in the context of public finances."

The current fuel duty rate is the lowest in cash terms since March 2009, following an 11-year freeze before the cut was introduced in 2022.

LATEST DEVELOPMENTS:

Experts have suggested that the "temporary easement" for motorists through the freeze has cost the Treasury £2billion per annum, with it only saving drivers £50.

Robert Salter, a director at Blick Rothenberg, has suggested even more drastic measures to help Labour reach its net zero targets, such as increasing the fuel duty rate to 10p.

He said: "The Government could go further and raise it by say 10p per litre, which would potentially raise £4billion.

"But practically, the Government needs to look at alternative options for raising revenue from motorists, as fuel duty will be coming down over the next few years, as more and more people move to electric vehicles or at least hybrids."

Fuel duty has been frozen at 5p per litre since 2022 | PA

Fuel duty has been frozen at 5p per litre since 2022 | PASalter explained that if the Government were to raise fuel duty, "it could accelerate the move to electric vehicles before the Government can put in alternative, practical plans to raise equivalent revenues from things like road tolls".

The April 2023 to March 2024 period saw fuel duty receipts fall by £300million compared to the previous year, with experts warning that this reduction in fuel duty income directly impacts the Treasury's ability to fund renewable energy infrastructure projects.

The transition to cleaner vehicles, whilst environmentally beneficial, is creating an unintended consequence for green energy financing.

As more motorists switch to electric and hybrid vehicles, the traditional fuel duty revenue stream that could support renewable investments continues to shrink.