HMRC car tax overhaul 'triggers' warning of job losses as thousands face cost hikes next year

Employee Car Ownership Schemes will change on October 6, 2026

Don't Miss

Most Read

Latest

HMRC has been warned that proposals to change the tax treatment of certain vehicles risk hammering the UK's automotive sector and reducing Government revenues.

It comes after the National Franchised Dealers Association argued that the Treasury's car tax changes simply don't add up.

Officials expect the move to boost revenues by hundreds of millions, but the NFDA explained that the policy would drive down new car registrations by around 150,000, wiping out the supposed tax windfall and threatening thousands of jobs in dealerships up and down the country.

The warning was heightened during a meeting at Group 1 Toyota's Nottingham dealership this week, attended by Alex Norris, Labour MP for Nottingham North and Kimberley, and Group 1 Automotive UK's chief executive, Mark Raban.

TRENDING

Stories

Videos

Your Say

NFDA chief executive Sue Robinson said the figures showed a completely different picture to HMRC's optimistic forecasts.

"We are grateful to Alex Norris MP for engaging with us directly, and to Mark Raban for outlining both the challenges and opportunities our sector faces," she said.

The NFDA has now stepped up lobbying ahead of the party conference season, vowing to keep pressure on MPs to stop what it calls a damaging and misguided tax raid.

From October 6, 2026, Employee Car Ownership Schemes arrangements will be dragged into company car Benefit-in-Kind rules if certain conditions are met.

The car tax changes will impact roughly 76,000 drivers | GETTY/PA

The car tax changes will impact roughly 76,000 drivers | GETTY/PAUnder the new rules, cars will be taxed if private use is restricted, if the registered keeper is not the employee, or if the deal includes a guaranteed buyback or resale clause.

HMRC claimed the changes will raise £275million in 2026–27, tapering down to £175million a year by 2029/30.

The policy has also been designed to amend the Income Tax (Earnings & Pensions) Act 2003, with officials explaining that it will ensure "fair taxation" of company car perks while keeping pressure on motorists to go electric.

But the changes come at a dire cost, with roughly 76,000 workers currently using ECOS schemes set to be impacted next year.

The new car tax changes are set to launch on October 6, 2026

LATEST DEVELOPMENTS:

Around 1,900 medium and large companies, mainly in car manufacturing and dealerships, will also be caught, though HMRC insists the administrative burden will be "minimal."

According to the NFDA, the collapse in car registrations will shrink the tax base, dent VAT receipts, and choke revenues from Vehicle Excise Duty – all while hitting employment in the sector.

Tax specialists back up parts of this warning with KPMG pointing out that most existing schemes already include all three of HMRC's "trigger conditions," meaning they will all fall under the new tax net.

Caroline Laffey, Partner at KPMG's Employer Reward Services, advised employers to start reviewing whether ECOS will even be viable beyond 2026, as many firms will be forced to rethink how they attract and retain staff.

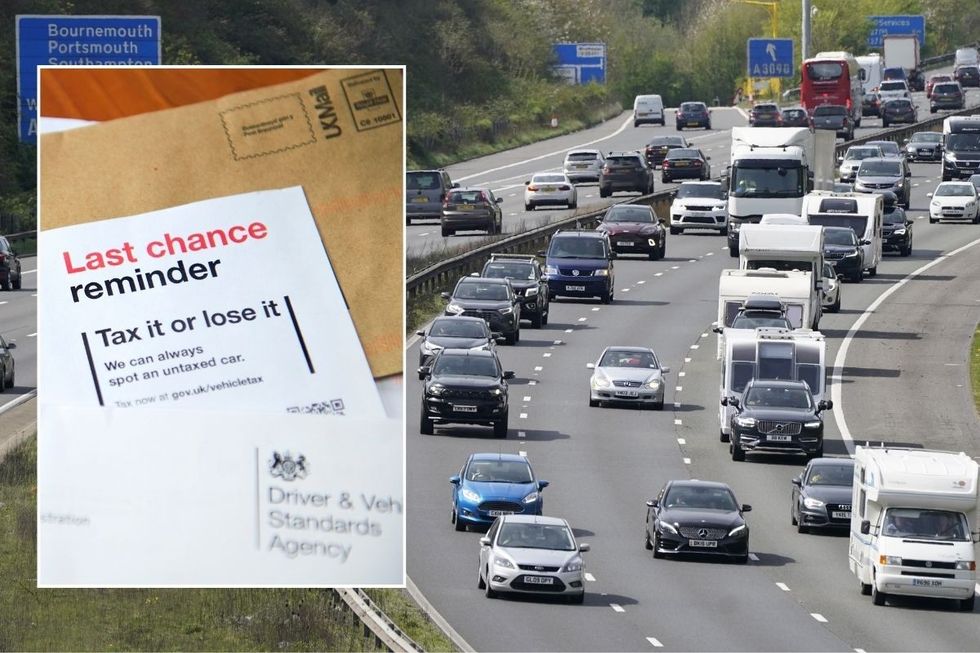

BiK taxes are paid by employees in exchange for using a company car | GETTY

BiK taxes are paid by employees in exchange for using a company car | GETTYMeanwhile, voices from the EV sector detailed how ministers are sending mixed signals. Thom Groot, chief executive of The Electric Car Scheme, said salary sacrifice deals have been a major driver of electric vehicle adoption. Workers with access to such schemes are three to four times more likely to go electric.

Mr Groot argued that instead of closing down ECOS schemes in search of extra cash, the Government should be doubling down on salary sacrifice incentives and even extending them to heat pumps and solar panels. If pension tax perks are reduced, he stated that the money should be diverted to "accelerate green initiatives."

He added: "It is no secret that the UK needs to balance its books, and if this is reduced or removed, the Government would do well to invest the money to accelerate the green transition, and look to transition salary sacrifice benefits to focus on other technology such as Heat Pumps and Solar Panels instead.

"The impact of salary sacrifice on the EV transition has been incredible since its introduction in 2020, and we know there would be a similar impact with other green technology, such as home solar, battery storage or heat pumps, that would also create jobs and spur economic growth."