UK financial regulator calls on drivers to avoid handing over £300 in fresh car finance scandal update

The Financial Conduct Authority has urged drivers to avoid using compensation firms which charge 30 per cent in fees

Don't Miss

Most Read

Latest

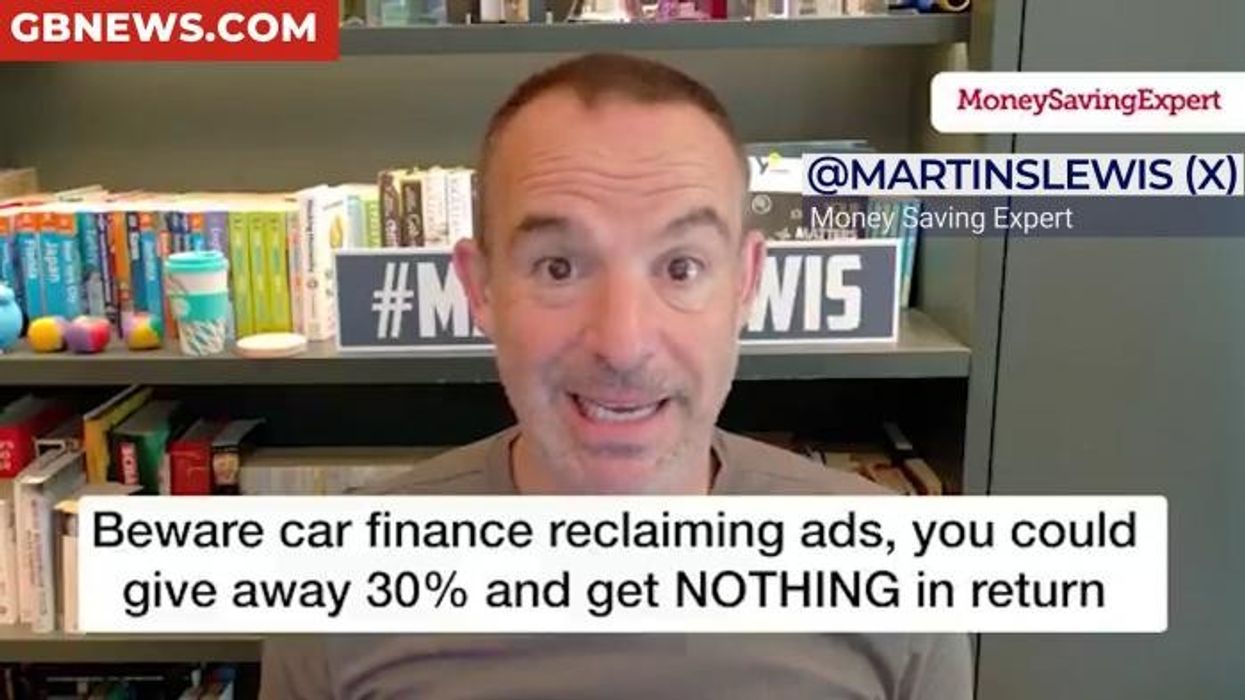

The UK’s financial watchdog has unveiled a £1million campaign warning motorists not to hand over large chunks of compensation to claims management firms (CMCs).

The Financial Conduct Authority (FCA) said many drivers entitled to redress for mis-sold motor finance are at risk of needlessly losing up to 30 per cent of their payout if they use middlemen instead of applying directly.

The regulator’s campaign, launched today, uses social media influencers, radio and online ads to hammer home a simple message: "you don’t need a CMC or solicitor to get your money back".

Fresh research for the FCA revealed a striking lack of awareness, which found that while nearly four in five car finance customers (79 per cent) know they could be owed compensation, two in five remain unaware that they could claim without intermediaries.

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

The FCA has launched a £1million campaign to help stop drivers unnecessarily losing 30% of their compensation

| GETTYAmong those who do know about potential redress, a quarter have already submitted claims. But almost half of those claimants went through a CMC or law firm, which surrenders around 30 per cent of their compensation in fees.

With average payouts expected to be under £950 per finance agreement, losing nearly a third represents a major hit for households.

Sheree Howard, the FCA’s executive director, said: "We’re worried too many people don’t realise they can claim directly. Using a CMC or solicitor could see you lose hundreds of pounds for no good reason."

To get the message out, the FCA has recruited Instagram and TikTok influencer Cameron Smith to front the campaign, with more online personalities to follow.

The FCA urged drivers to not use third party firms to claim compensation for the car finance scandal

| PAInstagram Reels and TikTok clips will explain how to apply directly, while FCA-produced videos answer common questions about car finance claims—including how to cancel if a CMC has already been engaged.

Radio ads and online video content will go live in October, running alongside guidance on avoiding scams.

The campaign comes in the wake of an August Supreme Court ruling that failures to disclose dealer commissions on car loans were unlawful. The judgment opened the door to billions of pounds in claims, forcing the FCA to design a formal redress scheme.

Under the model now being consulted on, compensation would cover cases where lenders and dealers failed to reveal commission arrangements—often incentivising dealers to sell loans with higher interest rates.

LATEST DEVELOPMENTS:

- Motorists to receive £50 cashback for following simple rules as thousands urged to act on 'limited-time' offer

- Labour urged to intervene in Jaguar Land Rover cyber attack as workers face 'immediate threat'

- Motability scheme changes demanded to prevent 'billions' being spent on 'drivers with tennis elbow'

The FCA said it aims to publish consultation proposals in early October, with the scheme potentially live by 2026.

Total compensation could run between £9billion and £18billion, though the watchdog said the eventual figure is likely to fall somewhere in the middle.

FCA chief executive Nikhil Rathi pledged the scheme would be "fair and easy to participate in," stressing that customers will not need help from CMCs or solicitors.

The FCA has also been clamping down on misleading claims activity. Between January 2024 and August 2025, it forced 396 non-compliant adverts relating to motor finance commissions to be withdrawn or amended.

The car finance scandal could be worth up to £18billion | GETTY

The car finance scandal could be worth up to £18billion | GETTYAlongside the Solicitors Regulation Authority, it has warned firms over inaccurate marketing and weak client verification.

At the same time, consumers have been increasingly targeted by fraudsters posing as car finance lenders, falsely promising compensation under a non-existent scheme.

The FCA advised hanging up immediately and never sharing personal information.

Motorists who believe they overpaid on car loans because of undisclosed commissions have been urged to complain directly to their lender now.

While the industry-wide scheme is still being finalised, the FCA insisted consumers do not need to pay a third party to secure redress.

"When the scheme launches, applying directly will save consumers hundreds of pounds," the regulator said.