Drivers warned of car insurance price hikes after major changes that could 'negatively impact' Britons

Vehicle Risk Ratings came into effect on August 1, 2024

Don't Miss

Most Read

Latest

Drivers have been warned that new changes to car insurance ratings could lead to higher premium costs as the UK moves away from traditional Insurance Group Rating in favour of Vehicle Risk Ratings.

The VRR, which came into effect for new cars registered after August 1, sees cars assessed under five risk areas and provides individual category scores.

The VRR system rates cars from one to 99 across five categories: performance, damageability, repairability, safety and security with the higher the number, the greater the risk in that area. Insurers use these metrics when setting premium prices for drivers.

It replaces the insurance group system which was introduced in 2009 and previously included 50 different groups.

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

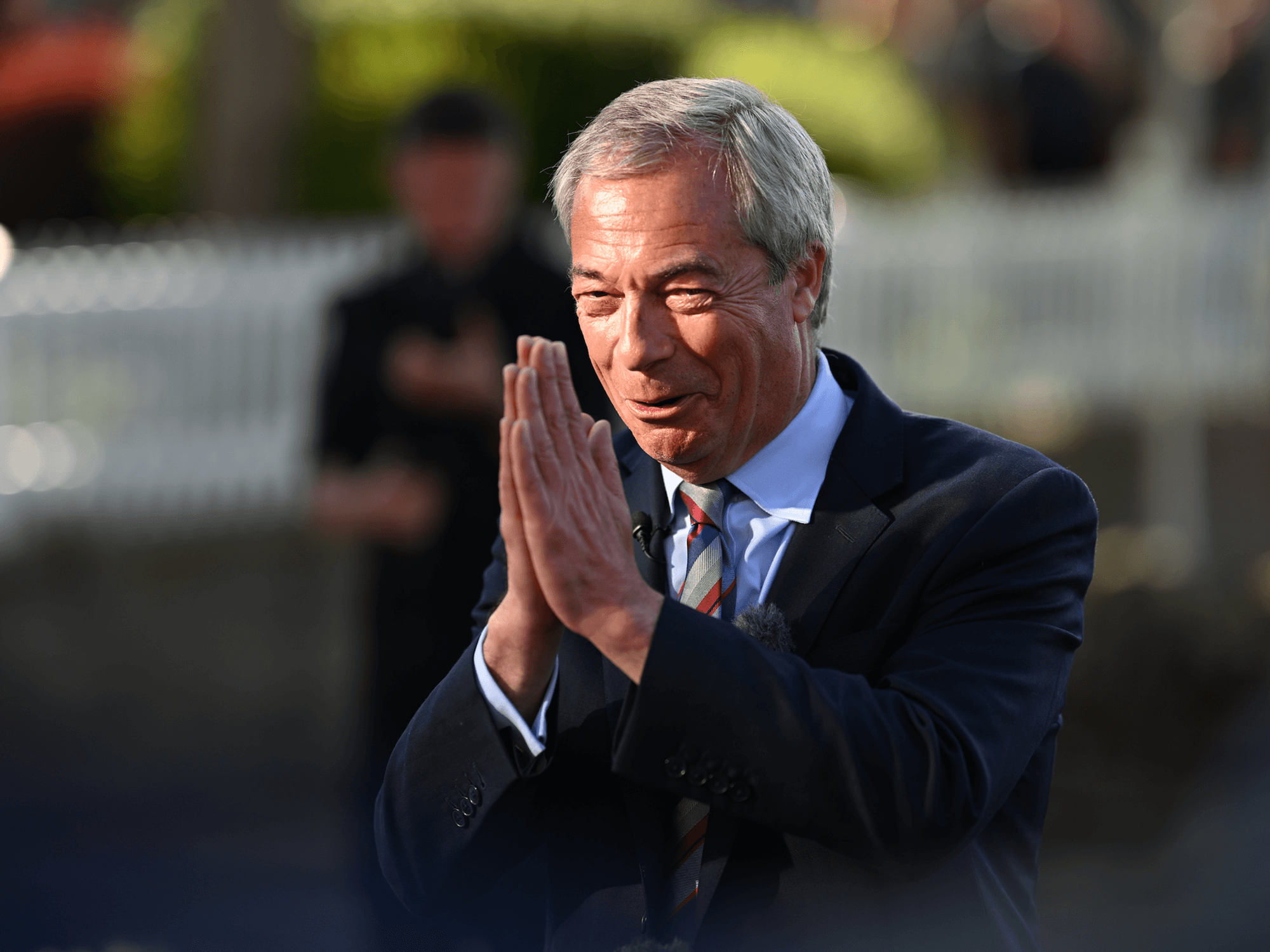

Electric car owners could face higher costs under the new rules

| GETTYHowever, experts have cautioned about the impact this could have on electric car owners who may face higher premiums.

Chris Rosamond, current affairs and features editor at Auto Express, stated that while the VRR is ultimately “much fairer”, EV drivers could see their premiums spike due to the introduction of “repairability” as an insurance rating score.

He said: “Previously, car insurance was based on the more generic 1-50 group rating system, but factors such as an influx of Chinese EVs with insufficient spare parts back-up and a lack of critical repair information, or the introduction of expensive-to-fix tech such as LED headlamps or driver-assistance systems, were making it increasingly hard for insurers to assess risk accurately.

“As a result, premiums have skyrocketed - and we are all paying for this knowledge gap. With more detailed risk assessments across these five categories, insurers will be able to offer premiums that more accurately reflect a car's actual risk.

“Whether that be imports from China or other markets where standards differ so greatly from our own, or complex new tech from already established brands. This is a game changer for the industry, and a much fairer way to assess risk.”

So far, only nine vehicles have been assessed under the VRR system, which will run alongside the traditional Group Rating system for the next 18 months.

Thatcham Research expects that within two years, all insurers and related systems will have adopted the five VRR assessments with Group Ratings being phased out for new models.

However, Rosamond explained that while the new system promises greater transparency, it could lead to relatively higher insurance premiums for vehicles with high damageability or poor repairability scores.

He stated: “VRR could negatively impact EVs if the difficulty of repairing EV batteries pushes scores up, because we will start to see elevated premiums for models affected. VRR is a more comprehensive – and much fairer - assessment of vehicles, which is great news for consumers.”

After the transition period ends, the VRR system will become the sole reference for new cars with change hoping to have a positive impact on the car insurance industry.

The new system's ability to update ratings over time may also lead to more frequent adjustments in insurance premiums.

Mark Shepherd, head of general insurance at the ABI told GB News: “The new rating system is a great step forward to allow more detailed risk assessments of the changing automotive landscape.

LATEST DEVELOPMENTS:

- Pay-per-mile car tax changes are a 'threat to our privacy and freedom' as drivers warn 'we will not pay!'

- UK charging industry insists electric car owners have not been 'ripped off' by high costs and VAT spikes

- Disabled driver hit with £70 fines for parking outside her own house - 'I'm just tired of all this'

The traditional Group Rating system will remain active for the next 18 months

| GETTY"We also hope it will encourage manufacturers to consider things like security and repairability more closely when designing new cars for UK roads.”