Drivers warned as car insurance prices could rise even further amid spike in bogus claims

The number of bogus insurance claims appears to be growing significantly

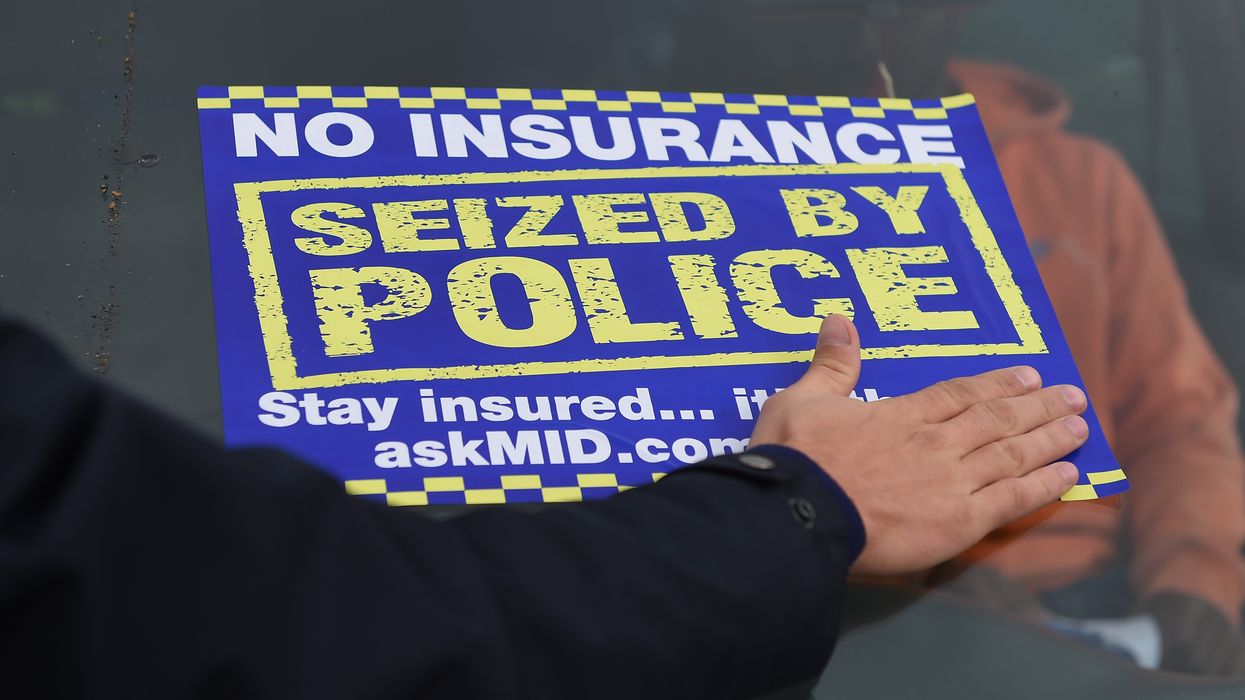

| PA

'Where we detect fraud, we will vigorously defend fraudulent or inflated claims'

Don't Miss

Most Read

Major insurance companies have reported a huge spike in the number of bogus claims made by drivers attempting to cheat the system, which could lead to costs rising for drivers.

Aviva reported that more than 11,000 suspect claims were made in 2023 worth £116million. This equates to 30 claims a day, totalling £318,000.

The insurer also identified fraud on more than 51,000 motor policy applications in 2023 - a significant rise of 64 per cent compared to 2022.

A large percentage of injury claims that Aviva rejected were "opportunistic claims" often brought forward by non-Aviva customers.

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

Aviva said it has invested in technology to detect bogus claims

|PA

One of the most common reasons for the exaggerated injuries came from low-speed accidents, like being shunted in a car park.

Pete Ward, head of claims counter-fraud at Aviva, said: “We’re here to help our customers when something’s gone wrong, settling their claim quickly and fairly.

"But where we detect fraud, we will vigorously defend fraudulent or inflated claims and, where appropriate, prosecute those who target Aviva."

Ward highlighted the lengths that the insurer is going to in order to protect the business and avoid passing costs on to drivers.

Aviva has invested in tools, technology and people in a concerted effort to create a "robust counter-fraud capability".

The insurer said the investment has improved its ability to detect fraud across the business to

Ward added: "[The investment] has contributed to the steep rise in the number of fraudulent claims we detected last year – particularly in motor, where exaggerated claims for damage have rocketed.”

Aviva said that organised crime gangs have "refocused their efforts" on the repair aspects of motor claims, including credit hire and repair.

New research also found that car insurance prices have jumped by 18 per cent on average over the last year.

This has forced the average car insurance price to hit £850 in May 2023, compared to a year ago when prices were as low as £718.

Drivers over the age of 80 have seen the largest percentage increase with a £27 per cent jump to £656 - a hike of £139.

At the opposite end of the spectrum, younger drivers aged between 16 and 24 will be paying £1,901 for their premiums on average, rising more than £300 in a year.

LATEST DEVELOPMENTS:

- 'Electric vehicles are not responsible for potholes!' - Experts slam claims that heavy EVs are damaging roads

- Ulez scrappage scheme failing to support electric vehicles with just two per cent of vans replaced by EVs

- Bentley's new £236,000 Continental GT is the 'fastest underwater vehicle ever' with a top speed of 208mph

'Shunting' cars has made up a lot of bogus claims

| GETTYAnna McEntee, Director at Compare the Market, said: “The substantial cost of car insurance is understandably causing concern for many motorists. Our research shows motor premiums have risen by more than £100 year-on-year.