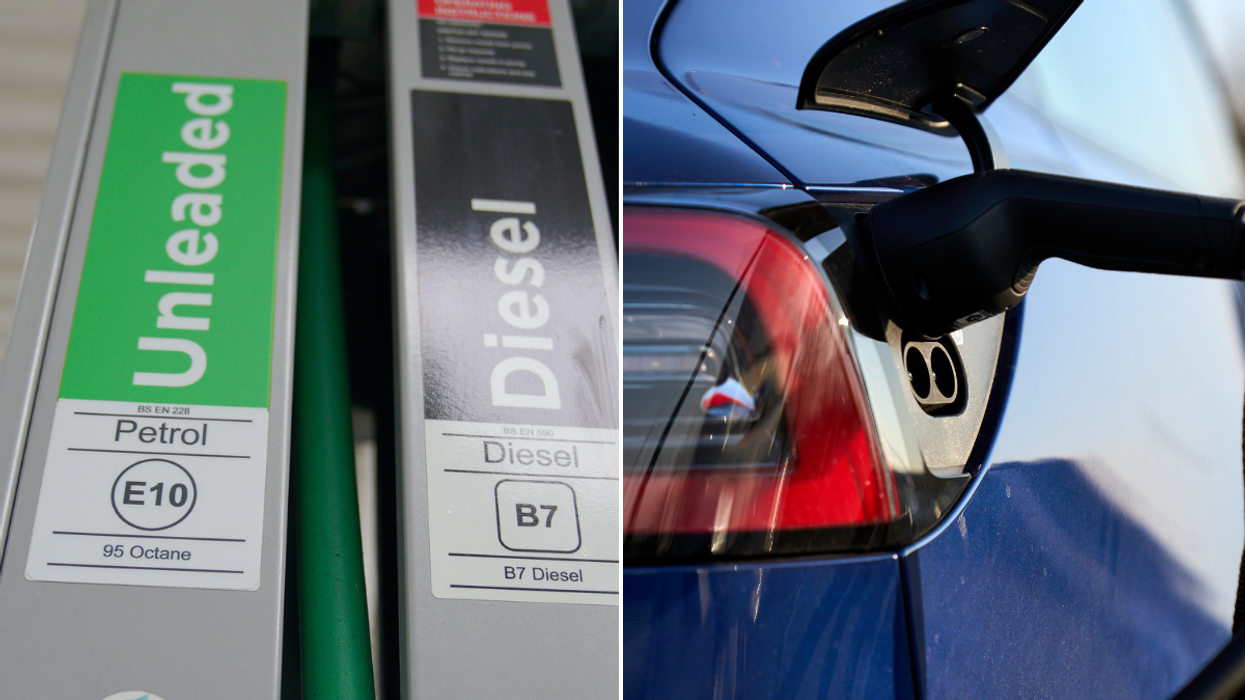

UK to see major motoring changes impacting petrol, diesel and electric cars

New rates are announced four times a year

|GETTY/PA

The changes come into effect on September 1

Don't Miss

Most Read

Major UK driving law changes have been unveiled which affect petrol, diesel and electric cars in less than a week.

The advisory fuel rates have been announced ahead of the September 1 change with drivers urged to check how it impacts them.

The rates are used by businesses which offer company cars and are important as they help set the standard for how much employers should reimburse for travel.

It also determines how much employees need to repay for the cost of fuel used for private travel.

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

EV rates have dropped to 7p

| PAHMRC reviews the rates four times a year, usually in March, June, September and December.

It is calculated by the mean miles per gallon which is taken from manufacturers’ information and looks at annual sales to businesses to come up with fair rates.

The new rates for September however, are marginally less than in June, according to official figures.

Petrol cars with a 1,400cc or a smaller engine will pay 13p, it will be 15p for engines between 1,401cc to 2,000cc and 24p for engines over 2,000cc.

As for diesel cars, engines with a size of 1,600cc or less will pay 12p, engines between 1,601cc and 2,000cc are charged 14p and motorists over this limit will pay 18p.

For electric cars, the rate has dropped to 7p and has consistently been falling to help bring EVs in line with the amount petrol and diesel drivers pay.

Hybrid cars, however, will be treated the same as either petrol or diesel cars for advisory fuel rates.

Commenting on the June rates, Darren Miller, car expert at BigWantsYourCar.com previously explained that the advisory fuel rates play an important role in managing the costs associated with company car use.

He stated that these rates, which are reviewed quarterly by HMRC, provide a “standardised framework” for reimbursing employees for business travel or calculating repayments for private fuel use.

By aligning with these rates, employers can ensure compliance with tax regulations and also manage company car expenses.

Coupled with the introduction of an advisory electric rate for fully electric cars, Miller said the new rates mark a “significant development in fuel reimbursement practices”.

Meanwhile HMRC detailed: “There will be no fuel benefit charge if you correctly record all private travel mileage and use the correct rate (or higher), to work out how much your employees must repay you for fuel used for private travel.

LATEST DEVELOPMENTS:

Advisory fuel rates used to charge for company cars

| GETTY“You will not need to use the advisory rates where you can show that employees cover the full cost of private fuel by repaying at a lower mileage rate.”

HMRC added that the rates only apply to employees using a company car and should use them when reimbursing employees for business travel in their company cars.

They should use the rates when repaying the cost of fuel used for private travel but are warned not to use these rates in any other circumstances.