JK Rowling proves trans activist boycotts have FAILED as fans mock 'purple-haired' mob over rich list spot: 'Good for her!'

The Harry Potter author has contributed a gargantuan sum to the government in the past 12 months

Don't Miss

Most Read

Latest

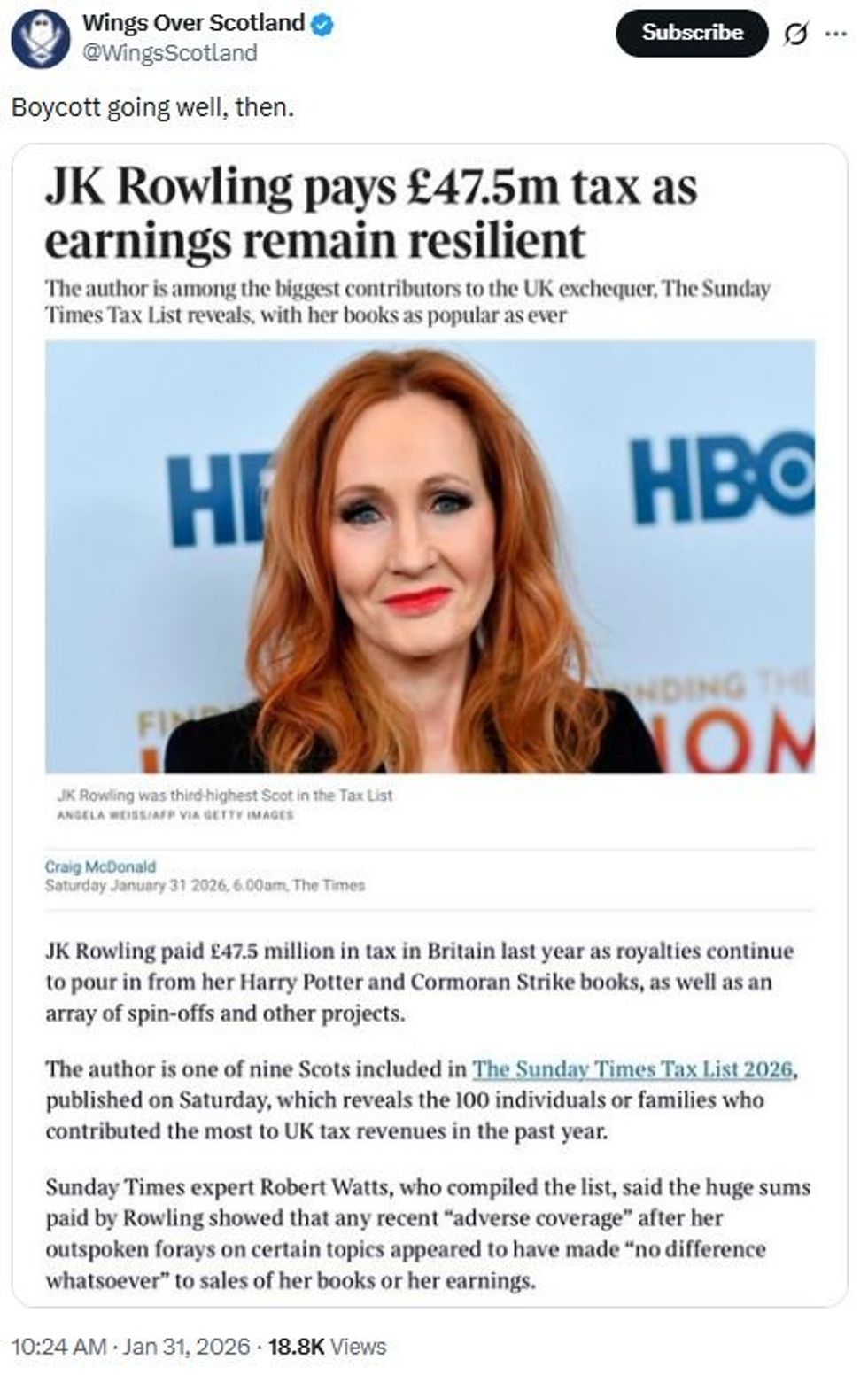

JK Rowling has been revealed as one of Britain's most significant taxpayers, contributing £47.5 million to the Treasury over the past year.

The Harry Potter creator, 60, ranks 36th in The Sunday Times Tax List 2026, which identifies the nation's 100 largest individual tax contributors.

Her annual payment works out at roughly £130,000 every single day.

The Edinburgh-based author continues to generate substantial income from her Wizarding World franchise, encompassing the original seven novels, film adaptations, and numerous spin-off projects.

JK Rowling has been at the centre of the trans debate in recent years | PA

JK Rowling has been at the centre of the trans debate in recent years | PAAnd the author has managed to rake in the considerable sum while facing ongoing backlash and boycotts thanks to her views on gender and single-sex spaces.

Robert Watts, who compiles the annual rankings, observed that recent controversy surrounding Ms Rowling's public statements appeared to have had "no difference whatsoever" to her book sales or overall earnings.

The fact that the boycotts by trans activists and similar-minded groups appear to have had no financial detriment to the author has been seen as a reason to celebrate among her fans.

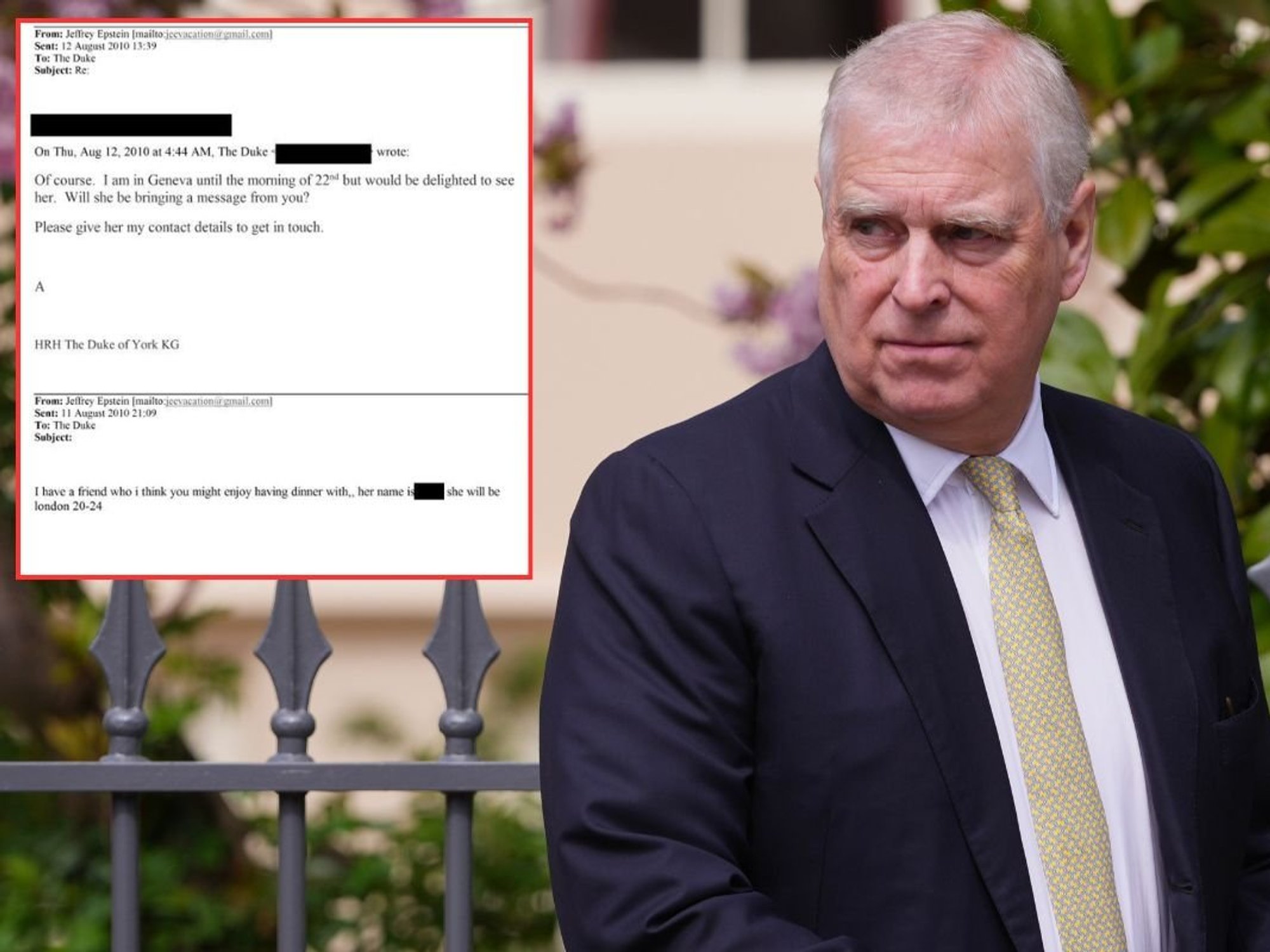

Wings Over Scotland, a group of free speech advocates, shared a screenshot of an article about Ms Rowling's tax payments with the sarcastic caption: "Boycott going well, then."

JK Rowling has faced boycotts over her views on gender

| PAIn response, another fan took aim at Ms Rowling's critics on X: "The pull of Harry Potter is just too much against the unrelenting hysteria of the TQ+ gang..."

Elsewhere, a third X user reached out to Ms Rowling directly: "Dear @jk_rowling, I sincerely hope your wealth continues to grow exponentially and that you are able to continue living like the Queen you are and that you can increase the good deeds you do as much as you wish."

"The purple hairs will be most baffled," a fourth X user teased, while a fifth similarly mocked: "Oh gosh ...some people are going to be really cross."

And another weighed in: "Wow, that's a whack of Tax. Good for her. Robust earnings then. That should put a few gasses at a peep." (sic)

JK Rowling is no stranger to debates about trans issues | GETTY

JK Rowling is no stranger to debates about trans issues | GETTYLATEST DEVELOPMENTS:

Elsewhere, the rankings are topped for the first time by Fred and Peter Done, the billionaire siblings behind betting chain Betfred, who paid an estimated £400.1 million in tax.

This represents a jump of nearly 50 per cent compared with their previous year's contribution of £273.4 million.

The Warrington-based brothers established their gambling empire in 1967, funding their inaugural shop with winnings from a successful bet on England's World Cup triumph the year before.

Their elevated payments, along with those of many others on the list, stem from increases to corporation tax rates and other fiscal measures introduced by the Labour Government to support higher welfare spending.

Harry Styles made the list for the first time

| GETTYCollectively, the 100 individuals and families featured in this year's rankings paid £5.758 billion in tax, a substantial increase from the £4.985 billion recorded 12 months earlier.

Former One Direction singer Harry Styles makes his debut on the list at number 54, having contributed £24.7 million to public coffers.

The singer has found himself in hot water with his own fans of late due to the supposed "extortionate" prices of his upcoming tour tickets.

The 25-year-old is poised to release his fourth studio album in March and earned more than £51.8 million from his touring and merchandise company in 2023-24.

Erling Haaland also made the top 100

|REUTERS

Premier League footballers also feature prominently among the newcomers.

Manchester City striker Erling Haaland, who earns £500,000 weekly plus an additional £10 million in extras, enters at 72nd position with an estimated £16.9 million tax bill.

Liverpool forward Mohamed Salah, on a basic salary of £400,000 per week, contributed approximately £14.5 million.

Other recognisable names featured include stadium-filling musician Ed Sheeran at 64th position with £19.9 million, and heavyweight boxing champion Anthony Joshua, who rounds out the list at number 100 with £11 million.

JK Rowling's fans rejoiced after learning of the author's financial situation

|X

The list also underscores a growing trend of wealthy individuals departing British shores for lower-tax jurisdictions.

One in nine of those featured are no longer resident in the UK, having relocated to destinations including Monaco, Dubai, Switzerland, Cyprus, Portugal, the United States, and the Channel Islands.

Six taxpayers on this year's list left the country within the past 12 months, with speculation that moves were prompted by higher taxes under Labour or the abolition of non-dom status.

Those who have recently departed include Revolut founder Nik Storonsky, Wren Kitchens founder Malcolm Healey, and sports promoter Eddie Hearn.