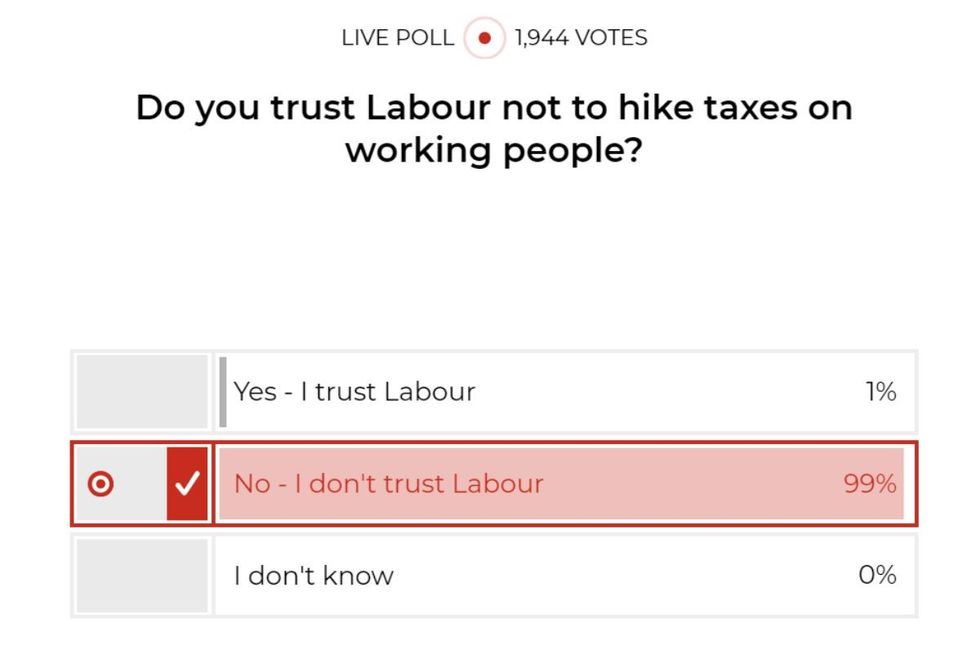

POLL OF THE DAY: Do you trust Labour not to hike taxes on working people? YOUR VERDICT

Do you trust Labour not to hike taxes on working people? Join thousands of GBN members voting in today's poll of the day - results will be announced on TV and online later today

Don't Miss

Most Read

GB News members do not trust Labour not to hike taxes on working people, a damning new poll has revealed.

A staggering 99 per cent of GB News members do not trust Sir Keir Starmer and Rachel Reeves to keep levies at current rates ahead of the Chancellor Budget next week.

Just one per cent of the 1,950 respondents claimed to trust Starmer and Reeves.

Labour has consistently pledged not to hike taxes on working people but ambiguity around the wording of the pledge has “left the door open to other changes” in the form of a stealth tax.

In his manifesto, Sir Keir Starmer vowed there would be no increase in income tax, National Insurance or VAT on working people.

And when pressed on the issue the Prime Minister has said: "We are going to keep our manifesto pledges."

However, with an alleged £40billion shortfall in public finances which Labour claim was left by the last Conservative Government, critics have suggested this election pledge may be broken.

One way in which Rachel Reeves can raise money for the treasury is via a stealth tax.

The so-called fiscal drag could help Reeves summon £7billion annually for the treasury.

Stuart Adam at the Institute for Fiscal Studies (IFS) told The Times: “The promise not to increase the basic, higher and additional rates of income tax was carefully worded and deliberately leaves the door open to other changes to income tax that could raise money.”

Prime Minister Sir Keir Starmer and Chancellor of the Exchequer Rachel Reeves during the International Investment Summit in London

|PA

As the policy would not be a direct increase in taxes, Labour could safely maintain they upheld their manifesto pledge.

Labour sources argue that freezing thresholds does not constitute a tax rise despite themselves calling the policy a “stealth tax” while serving as the opposition.

Streeting told GB News’Political Editor Christopher Hope: “I genuinely don't know what decisions the Chancellor has made or is making about tax because she doesn't share those until much closer to the budget.”

“And I'm not going to speculate because I value my kneecaps. And the Chancellor won't tolerate me going around speculating about her budget.

“We were very clear in our manifesto no increases in income tax, National Insurance or VAT on working people," he stated. "And we will keep those promises.”

MORE FROM MEMBERSHIP:

Rachel Reeves could raise £7billion annually by freezing income tax thresholds

|PA

According to reports, the Chancellor could hike fuel duty by 7p forcing motorists to pay £175 extra per year.

Fuel duty rakes in around £25billion per year for the Government, with Paul Barker, editor of Auto Express, saying a “reported 7p rise in fuel duty” would be a “major blow” to drivers who continue to struggle with the cost of living crisis.

Additionally, plans to end the stamp duty discount could mean thousands of buyers will end up paying the property tax.

Introduced by Liz Truss' short-lived Government in 2022, the house price thresholds at which stamp duty is paid were raised from £300,000 to £425,000 for first-time buyers.

However, Reeves could lower the threshold back to £300,000 from April 2025, meaning thousands of buyers will now have to pay more.

Kirstie Allsopp, the property guru, called the levy “a monster” and said the changes would cause “chaos” while failing to “claw back any money” for the Government

She told Times Radio: “It’s become so complicated that I can no longer tell anyone what they would be paying in stamp duty. I have to go on to the stamp duty calculator and calculate it with the Government calculator per property and I have to put in all the different circumstances. Stamp duty has become a monster.”

She added: “It won’t claw back any money. Stamp duty is a dead tax.”

Implementing the change is expected to generate an annual £1.8billion for the Treasury by 2030.

Do you trust Labour not to hike taxes on working people? Have your say in the comments section below