Labour warned landlords are ALREADY ‘bashed from pillar to post’ as Rachel Reeves mulls tax raid

Labour warned landlords are ALREADY ‘bashed from pillar to post’ as Rachel Reeves mulls tax raid |

GB NEWS

Treasury officials are considering plans to slap an 8 per cent charge on landlords’ rental earnings

Don't Miss

Most Read

Trending on GB News

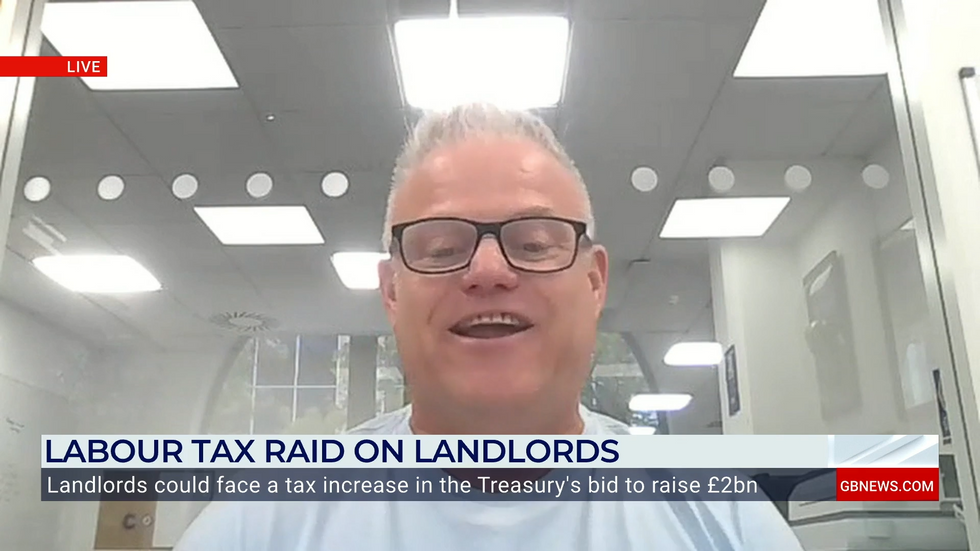

Paul Shamplina, who heads Landlord Action, has claimed that property owners have been "bashed from pillar to post," warning that continued pressure results in increased rents and property sales that displace tenants.

The warning comes as treasury officials are considering plans to slap an 8 per cent charge on landlords’ rental earnings, a move that could rake in more than £2.1billion a year.

The proposal would see national insurance expanded beyond traditional employment income to cover property profits, which insiders describe as “unearned revenue.”

Property income totalled £27billion in 2022/23, and Government sources say it represents a “significant potential extra source of funds” for the Treasury.

Paul Shamplina claimed that property owners have been 'bashed from pillar to post'

|GB NEWS

The plan is likely to prove controversial among landlords already warning that a raft of tax changes and rising interest rates are driving many out of the rental market, pushing rents up for tenants.

Speaking on GB News, Mr Shamplina said: "I am a landlord. I run a company called Landlord Action, where we help landlords with problem tenants.

"Landlords have been bashed from pillar to post, and when that happens the biggest losers are tenants because rents go up or landlords end up selling properties, forcing good tenants to leave.

"And dare I say it, some landlords might not have put rents up otherwise. But the reality is this all really started in 2017 with George Osborne.

"He abolished mortgage interest relief, so any landlord with an interest-only mortgage could no longer offset that as a disbursement.

"What happened then was landlords were being taxed on turnover rather than profit the only business sector that had this.

LATEST DEVELOPMENTS:

"It was phased in alongside fixed-rate tax bands, and that was a big change for the industry.

"On top of that came the additional stamp duty: originally three per cent, now five per cent. So any landlord buying a property, or anyone buying a second property, has to pay five per cent extra stamp duty.

"Then the Government abolished the wear-and-tear allowance, which means you can’t offset costs for wear and tear.

"Of course, when you do sell your property as a landlord, you pay capital gains tax of between 18 and 24 per cent.

Rachel Reeves will deliver the Autumn Budget in October

| GETTY"As of last year, 2024/25, there were 570,000 properties sold a great income for the Government, up from 188,000 in 2010.

"Think about everything else in the environment. Liz Truss came in, interest rates shot right up.

"I do remind landlords, when I’m speaking at events that landlords did have it good for a long time, because we had 0 per cent interest rates.

"But now, on top of all that, landlords are facing Labour’s big housing manifesto pledge: the Renters’ Rights Bill."

More From GB News