Thames Water, the United Kingdom’s largest water supplier, must be allowed to fail, says Jacob Rees-Mogg

Thames Water has used financial engineering to pay dividends to shareholders

Don't Miss

Most Read

Latest

Thames Water, the United Kingdom’s largest water supplier, must be allowed to fail.

Thames Water has used financial engineering to pay dividends to shareholders.

It borrowed heavily on interest rates linked to inflation, and has been wrong.

Dud investments have been made.

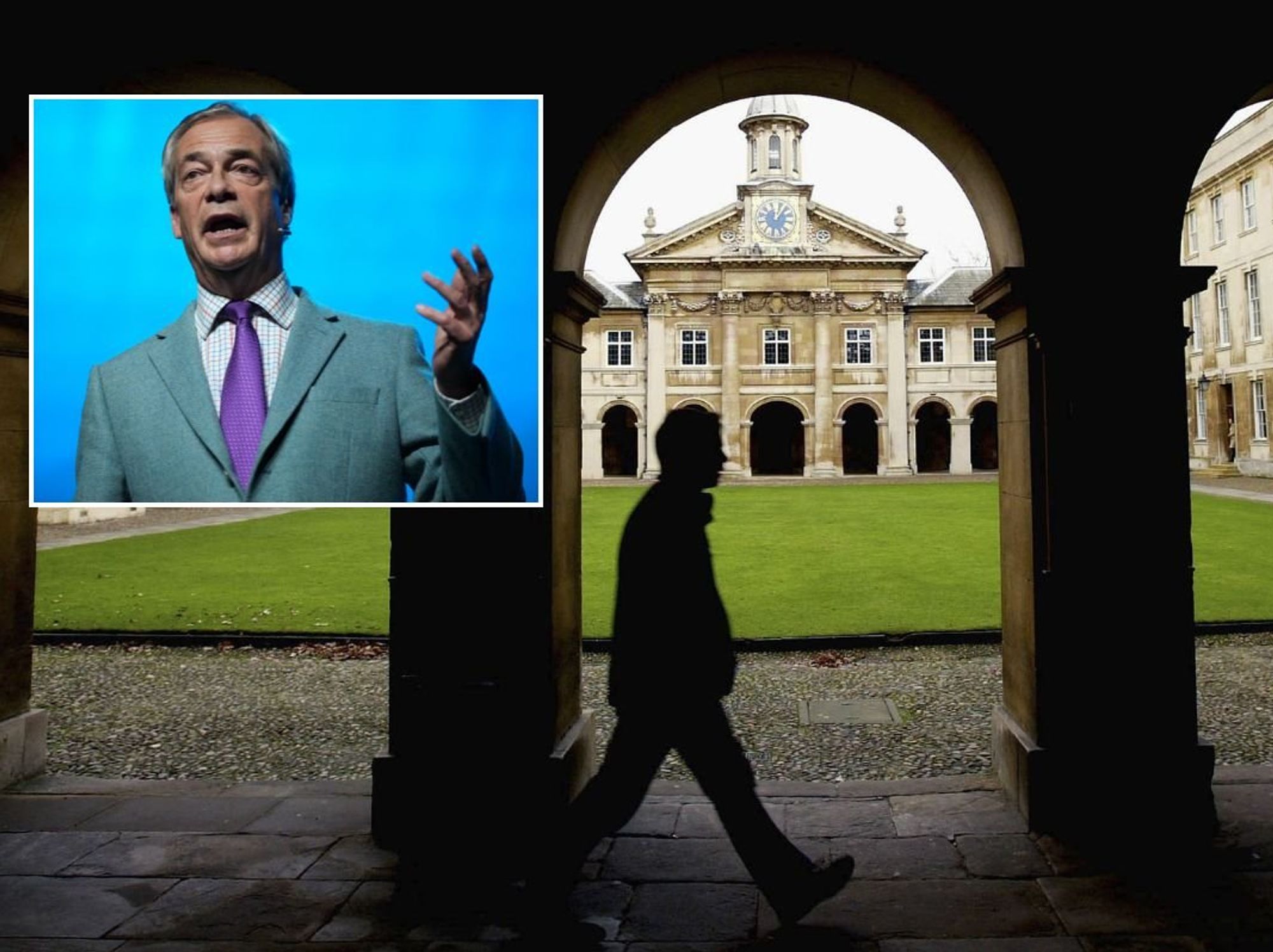

Jacob Rees-Mogg says Thames Water must be allowed to fail

|GB NEWS

This is not inherently immoral but when a scheme of this kind fails, the shareholders and the bondholders should take the hit, not the consumer.

The shares are now probably worthless.

According to the Times, the bonds are trading at 15 per cent of face value, that is to say they have lost 85 per cent of their cost.

Insolvency would allow the normal process of the free market to take place.

The assets which have real value should be sold and the bondholders and other creditors paid off, while the shareholders lose their stake entirely.

This could in fact reduce the price of water in London as the capital invested in the company would probably decline.

Thames Water HQ in Reading | PA

Thames Water HQ in Reading | PAThe new owners could make a reasonable regulated return on a monopoly business on this lower level of capital.

On this new basis future funds could be raised for investment.

There would be no interruption to supply, no risk to consumers, and probably a better, more strongly capitalised company.

There is no need for a bailout, which anyway sounds an odd thing for a water company, and no disincentive to further overseas investment.

Both foreign and domestic investors know some investments go wrong, some are bad, some are mistakes.

Thames Water became a bad investment because of the greed of its shareholders and their own bad decisions.

They deserve no quarter and the consequences of insolvency will be perfectly routine.