‘There is an important point being missed in any debate on inheritance tax,' warns Kevin Foster

In any debate on inheritance tax, people imply it only affects the 'richest' people - but this misses the impact of rising house prices, Kevin Foster warns

|GETTY

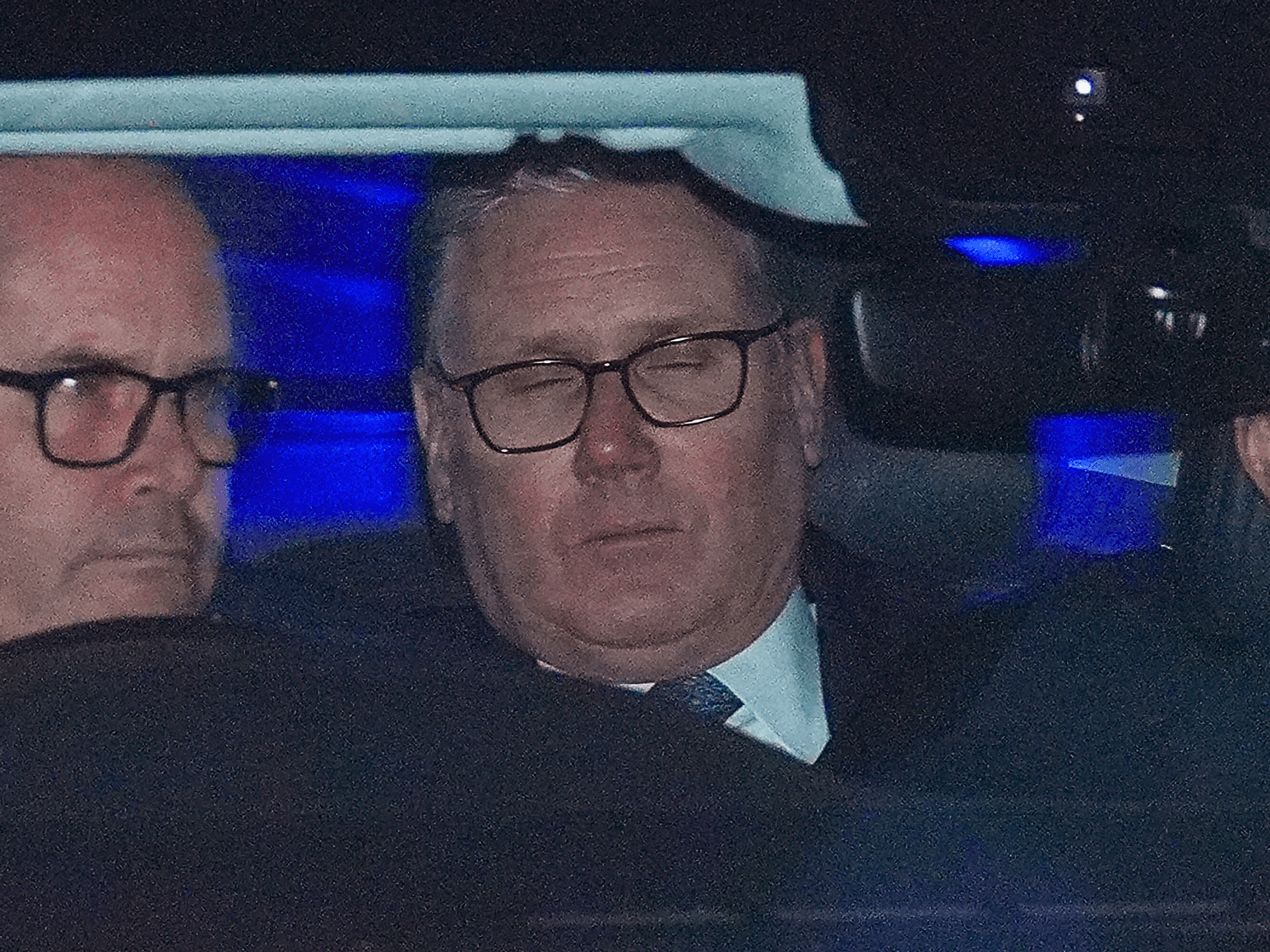

Former Immigration Minister Kevin Foster calls for an uprating of inheritance tax thresholds, which Rishi Sunak and Jeremy Hunt froze until April 2028

Don't Miss

Most Read

Latest

A comfortable retirement, then passing on a lifetime’s achievement to the kids or grandkids is an ambition most conservative-minded people have.

Knowing the next generation will have a secure future after you have passed on is what many parents see as their final act of love and family duty. Yet with house prices inexorably rising, whilst the key inheritance tax bands are frozen, more are finding their home will become the tax man’s source of revenue.

In any debate on inheritance tax, some will quickly point out only five per cent of estates are affected and imply it is a tax for the richest only.

Yet this misses the impact of rising house prices which will steadily expand this number.

Soon it could be a tax many inheriting a home can expect to pay, with what are described as the two unavoidable parts of life - “death and taxes” - coming together for more families.

From January 2013 to January 2023, the average UK house price rose significantly.

According to official figures from the Office for National Statistics (ONS), during that decade the average UK house price increased from £167,716 to £290,000, representing a gain of 73 per cent.

From January 2013 to January 2023, the average UK house price rose significantly, Kevin Foster points out

|PA

Expert analysis now predicts UK home prices could rise by a further 21.5 per cent in the next five years, reaching an average of £370,785 by 2026.

Even the main residence nil-rate band of £175,000 (last raised in 2021) if leaving it to a direct relative will not make up for the full rise in house prices.

When it was set back in 2009/10 the main inheritance tax nil-rate band of £325,000 was roughly double the average house price. If the planned freeze at this rate continues until 2028 as planned, it will be below it.

Some will point to how you can transfer the nil-rate band between couples, making a total of £650,000 available.

Yet with many parts of London and the South-East already seeing prices of homes rising above even this combined rate, plus properties in many coastal areas also having risen sharply, leaving the family home to the next generation will increasingly mean paying a tax bill.

As the Conservative Party reflects on the many reasons for the disastrous General Election result, one aspect which must feature prominently is reconnecting with the aspirations many voters hold, which prompted them to back our party in the past, but which they did not see in our party today.

This includes being able to enjoy the fruits of your labour, create a better future for your family and then hand on an inheritance to keep your family secure.

What offends many about inheritance tax is the way it feels like a tax on responsibility, building up savings, buying your home and doing the right thing by your family means you get hit with it.

Whereas if you spend recklessly and rely on the state your whole life, you never need to worry about paying a penny of it.

Add the prospect of also seeing your life’s work disappear paying care or nursing home fees and it just feels unfair.

READ MORE:

Any changes to inheritance tax will be argued as helping older voters, yet this misses an important point - it affects those inheriting, not the person who has passed on.

Often an inheritance is the chance a hard-pressed family may get to finally own their own home or take ownership of the family home.

Unlike left-wing voters, Conservatives are not about the politics of envy, they just want fairness.

A move to exempt main domestic residences from inheritance tax, at a time of ever-increasing property prices would deliver this.