China takes drastic action to kickstart economy in 'crucial moment' for Beijing

WATCH: Gordon Chang on the Chinese economy

|GB News

China's economy grew at a faster-than-expected pace in the first quarter

Don't Miss

Most Read

Latest

Officials in Beijing have taken drastic steps to stimulate key sectors of its flagging economy by selling off billions of dollars in bonds.

The People’s Bank of China has asked for advice on pricing the sale of the first batch of the sovereign bonds.

The finance ministry confirmed that the 1 trillion yuan ($138.23 billion) of special government bonds would have tenors of 20 to 50 years and issuance will begin on May 17.

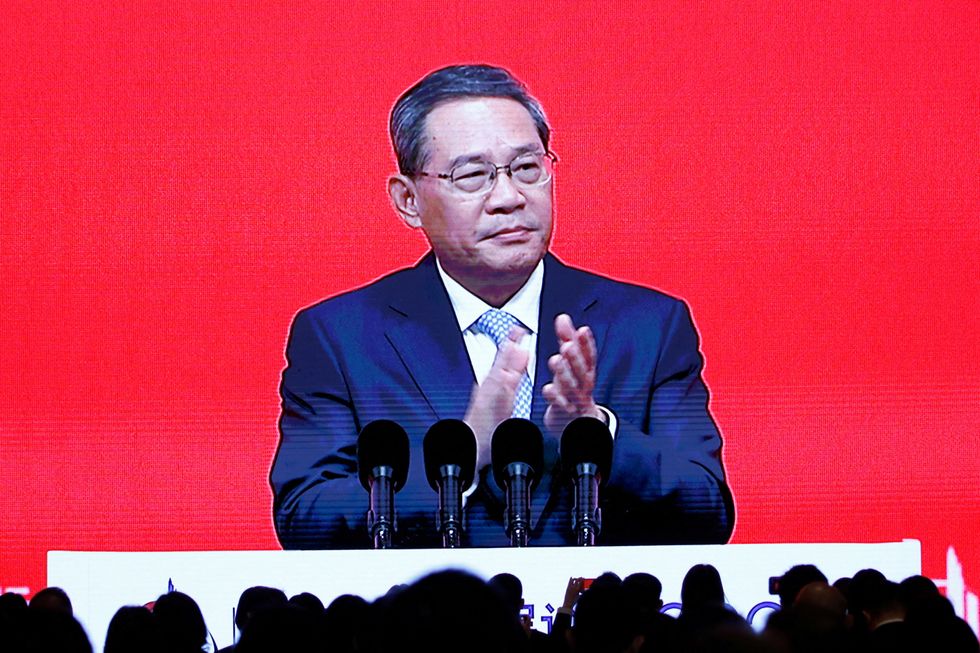

China's Premier Li Qiang on Monday urged officials to make good use of the ultra-long special treasury bonds to support the implementation of major national strategies as well as building security capabilities in key areas.

President Xi's government announced the move earlier today

|Getty

Deputy head of the National Development and Reform Commission Liu Sushe said: "The bond sale is a critical part of the concerted efforts to support significant, urgent and challenging projects that are essential for the modernisation of the economy.

"These are all projects that have long been intended but not materialised, and require a central level drive."

China's economy grew at a faster-than-expected 5.3 per cent pace in the first quarter, offering some relief to officials as they try to work through a property downturn and curtail local government debt.

However, indicators show that demand at home remains frail, weighing on overall momentum.

LATEST DEVELOPMENTS:

Chinese Premier Li Qiang delivering a speech at the opening ceremony of China Development Forum

|Reuters

Jameson Zuo, a Hong Kong-based director at CSPI Credit Rating Co, said the bond sale was "at a crucial time for China to reshape its debt structure".

However, Beijing is still tackling local government debt while using more central government borrowing.

Zuo told the Financial Times: "Compared to a global standard, China still has significant room, potentially trillions of yuan worth of bond issuance over the next five to 10 years, to let the central government take up more leverage and boost investments."

The expansion of outstanding total social financing (TSF), a broad measure of credit and liquidity in the economy, slowed to 8.3 per cent in April, a record low, from 8.7 per cent in March.

The People's Bank of China

|Getty

Zou Wang, an investment director at Shanghai Anfang Private Fund Management, said that while such a supply of bonds is negative for prices, it had been priced in.

"In addition, the market now expects the central bank to provide liquidity support through cuts in interest rates and reserve requirements," he said.