UK councils found to owe almost £100 BILLION in debt in 'staggering' borrowing row

The growing debt totals to around £1,400 per person

Don't Miss

Most Read

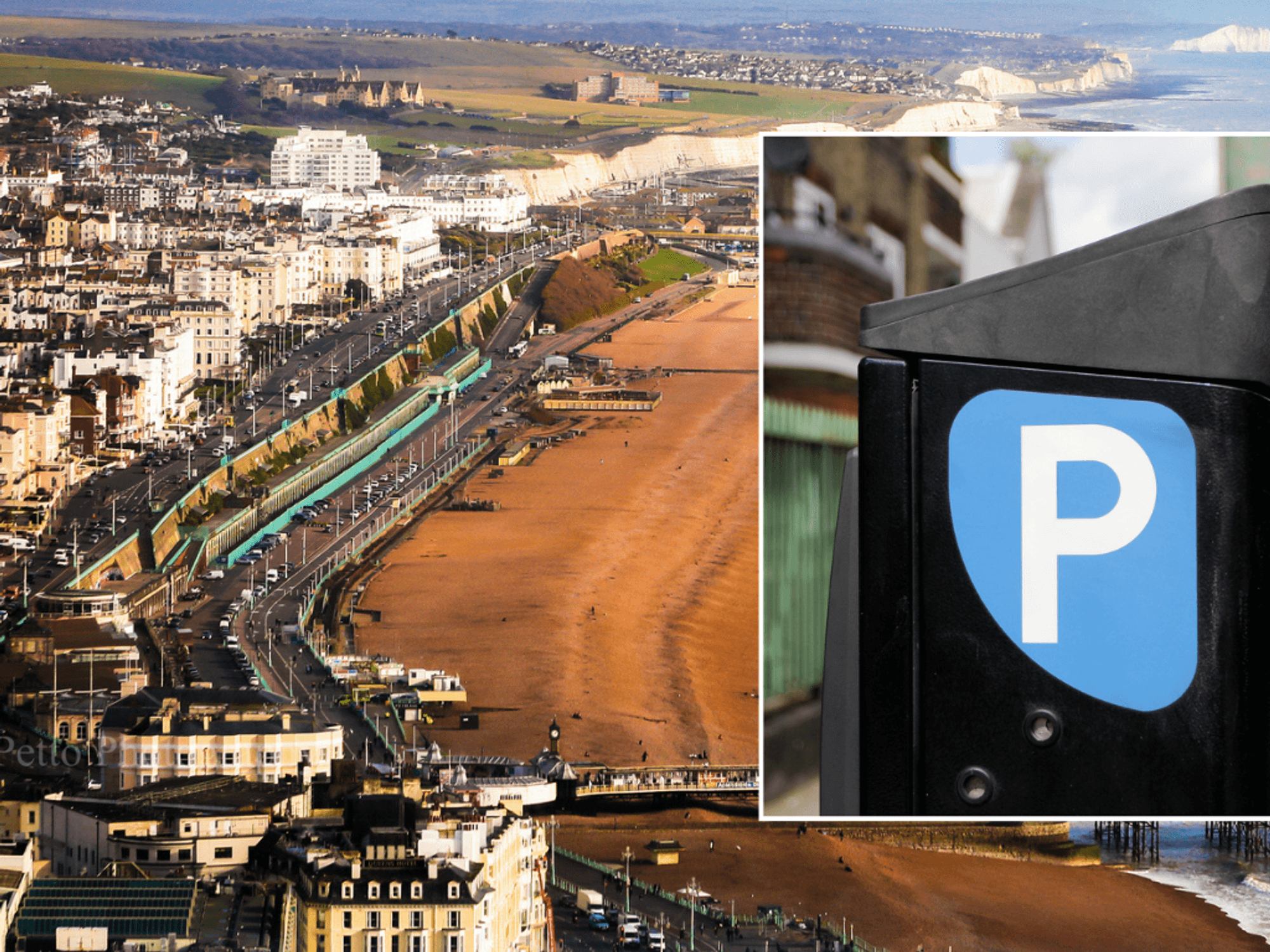

UK councils have run up a staggering amount of debt of almost £100billion, equivalent to around £1,400 per person.

The levels of debt have been described by the chairwoman of the Commons public accounts committee as “staggering”, who warned of a huge risk to local services.

Committee chair Dame Meg Hillier warned of detrimental impacts to residents if more councils go bust.

“Some of the outlier examples of high local authority debt are staggering,” she said. “And the impact on services for residents is liable to be extreme and long-lasting.”

UK councils found to owe almost £100bn in debt in 'staggering' borrowing row | Getty

UK councils found to owe almost £100bn in debt in 'staggering' borrowing row | GettyAccording to the BBC, UK councils owe a combined total of £97.8billion to lenders.

The borrowing amounts of each council varied, with 38 owing no money at all, whilst some owed as much as £3billion.

Woking, Thurrock and Nottingham City Councils are facing major cuts after all three have gone bust in the last two years.

In Woking, which has the highest level of debt in the country at £19,000 per person, special measures have been put in place.

However, the Surrey district council’s debt is expected to sky-rocket, rising to £1.6billion after it has committed millions to develop skyscrapers in the town centre.

To combat the rising levels of debt, the local authority has proposed £12million in tax cuts next year, including the removal of community and arts facilities in the area.

LATEST DEVELOPMENTS:

Birmingham City Council declared itself bankrupt last year

| GettyTreasurer of the Save Our Services in Surrey (SOSiS) campaign group Paul Couchman said the most cuts would impact the most vulnerable people in the town heavily.

“Parts of Surrey will become a wasteland and I don't think that's an exaggeration," he said.

“That's because there are people on the lower ends of the income scale and they are the users of the services being threatened.”

Just two of the top ten councils owing the largest amount of debts have issued Section 114 notice, which prevents all spending apart from on essential services – Birmingham and Nottingham.

Most of the borrowing comes from the Public Works Loan Board (PWLB), a statutory body of the Government which uses public money to hand out long-term loans at a low rate of interest.

Some councils' debt is related to a change in law in 2012 which allowed them to buy out the social housing in their area.

However, other councils have made commercial investments in order to generate an income, which has proved controversial.

Nottingham City Council also issued a Section 114 notice

|PA

Jonathan Carr West, chief executive of the Local Government Information Unit (LGiU), said such investments were not always "reckless" in intent.

“Many people have accused councils of gambling with public money,” he said.

“It's certainly true we've seen some high-profile failures, the most obvious being Woking.

“They had investments that they were unable to service. At the same time, there are dozens and dozens of councils who have made these sorts of investments, who haven't gone bust.

“So you have councils with debts that way exceed their yearly revenue. But what they would say is, that's not the real question. The question is, can we afford to service those debts while delivering all of our services?”

A spokesman for the Department for Levelling Up Housing and Communities said that the government had intensified rules on PWLB lending.

They said: “Councils are ultimately responsible for their own finances, but we are very clear they should not put taxpayers’ money at risk by taking on excessive debt.”