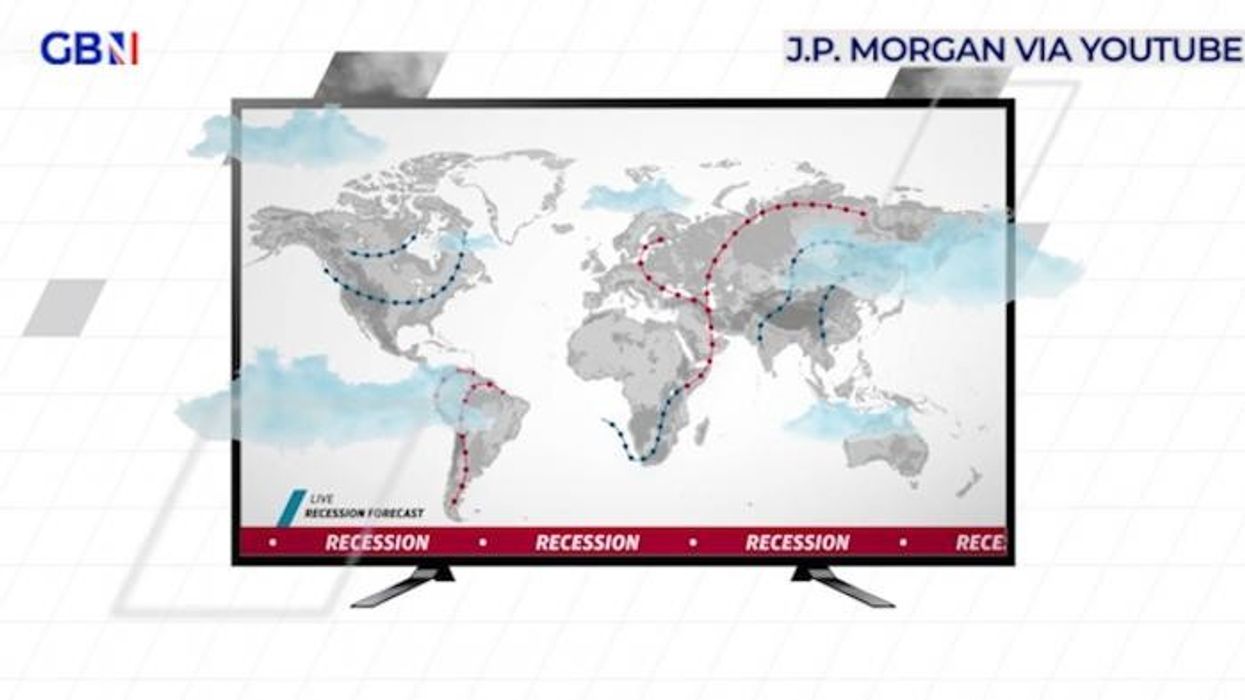

Brexit Britain to soar past Germany as Eurozone faces recession risk

JP Morgan unpacks what a recession really means

|GB NEWS

The German economy has been plunged into turmoil as the housing market slumps

Don't Miss

Most Read

The United Kingdom has been predicted to outpace Germany as the Eurozone faces the risk of a deeper recession due to higher interest rates.

Britain and Germany shrank in the three months to September, with Europe’s two largest economies potentially being plunged into a further fiscal slump.

However, analysts at UBS expect the UK will bounce back within a year.

Germany looks poised to continue to struggle as Berlin grapples with a budget crisis.

Olaf Scholz (left) and Rishi Sunak (right)

|GETTY

Olaf Scholz is facing further pressure after Germany’s top court ruled the Government broke the law by using Covid cash to fund net zero spending.

House prices in Germany recently suffered double-digit declines amid the nation's economic turmoil.

Berlin’s dependence on Moscow-produced gas has also had an impact.

Economists at UBS predict German growth of just 0.5 per cent next year, with 0.8 per cent anticipated in 2025.

In contrast, the UK will grow by 0.6 per cent in 2024 and witness 1.5 per cent growth the year after.

LATEST DEVELOPMENTS:

kyline of the City of London during sunrise

|PA

UBS expects the UK to grow by 1.3 per cent in 2026 and the Eurozone by 1.1 per cent, while Germany is the laggard on 0.9 per cent.

Traders have been backing the UK’s economic revival as many anticipate the Bank of England could cut interest rates from 5.25 per cent to 3.5 per cent by the end of the next year.

A change in economic fortune could assist Rishi Sunak as the Prime Minister is expected to call an election at some point in 2024.

Falling inflation would likely provide the Treasury with more space to cut taxes.

German Chancellor Olaf Scholz

| PAReinhard Cluse, economist at UBS, said: “Manufacturing was especially weak, with new orders dragged down by lower Chinese demand.

“In addition, the energy crisis continued to leave its mark as production in energy-intensive industries was much weaker than in other sectors, even as energy prices declined.”

Sanjay Raja, economist at Deutsche Bank, added: “There are good reasons to be optimistic that we can dodge a recession.

“We will see a sustained period of real positive wage growth in the midst of rapidly falling inflation.

The Bank of England

| PA“That in and of itself will be a boon for households.”

He continued: “Household and corporate balance sheets are still very strong.

“It is not just the excess savings picture that gives us some confidence that households and corporates can weather the shocks and headwinds from tighter monetary and fiscal policy.

“It is the fact that debt ratios are still historically pretty low compared to the past couple of decades.”