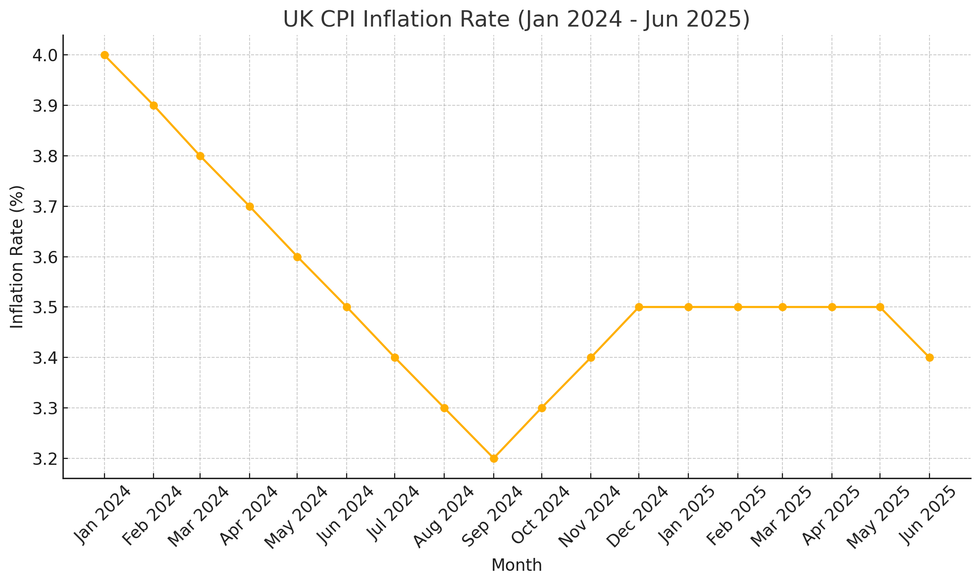

Inflation FALLS to 3.4 per cent - but remains significantly higher than Rachel Reeves's target

Inflation falls to 3.4% in May from 3.5% in April |

GBNEWS

The inflation data is being closely watched by the Bank of England ahead of its meeting Thursday

Don't Miss

Most Read

Consumer Prices Index inflation dipped slightly to 3.4 per cent in May, down from 3.5 per cent in April, according to the latest figures from the Office for National Statistics.

The small drop offers modest relief to households still grappling with higher living costs, but inflation remains well above the Bank of England’s two per cent target.

Core inflation, which strips out volatile items such as energy and food, stayed stubbornly high, raising questions over how soon interest rates might be cut.

Despite the fall, many families continue to feel the squeeze, with prices for essentials such as food, transport and services still significantly higher than they were just a few years ago.

The Bank of England is due to announce its latest interest rate decision this week, and today’s figures could influence whether policymakers choose to hold or lower borrowing costs.

However policymakers are still almost certain to hold interest rates at 4.25 per cent at their meeting despite May’s decline in the consumer prices index (CPI), but it could raise hopes for cuts for the summer and autumn.

The decline in inflation means prices were still rising in May, but at a slower rate than in April when a raft of bills increased for households up and down the country.

Since releasing the data, the ONS said that an error in vehicle tax data collected meant April’s CPI rate should have been 3.4 per cent – but that it was not revising the official figure.

The energy price cap, set by regulator Ofgem, rose by 6.4 per cent in April, resulting in bills for a typical household rising by £9.25 a month.

Inflation falls to 3.4% in May from 3.5% in April

|GBNEWS

Sanjay Raja, senior economist for Deutsche Bank, said he was expecting inflation across transport services to have eased last month following a jump during the Easter holidays in April.

He forecast a fall in the price of airfares in May, compared with April, as well as some train and coach travel costs, while package holiday prices are also set to retreat following a monthly rise.

On the other hand, Sanjay said food inflation is set to "pick up steam" in May, particularly due to rising fresh food prices, while he is also anticipating increases to clothing and furniture prices following Easter sales.

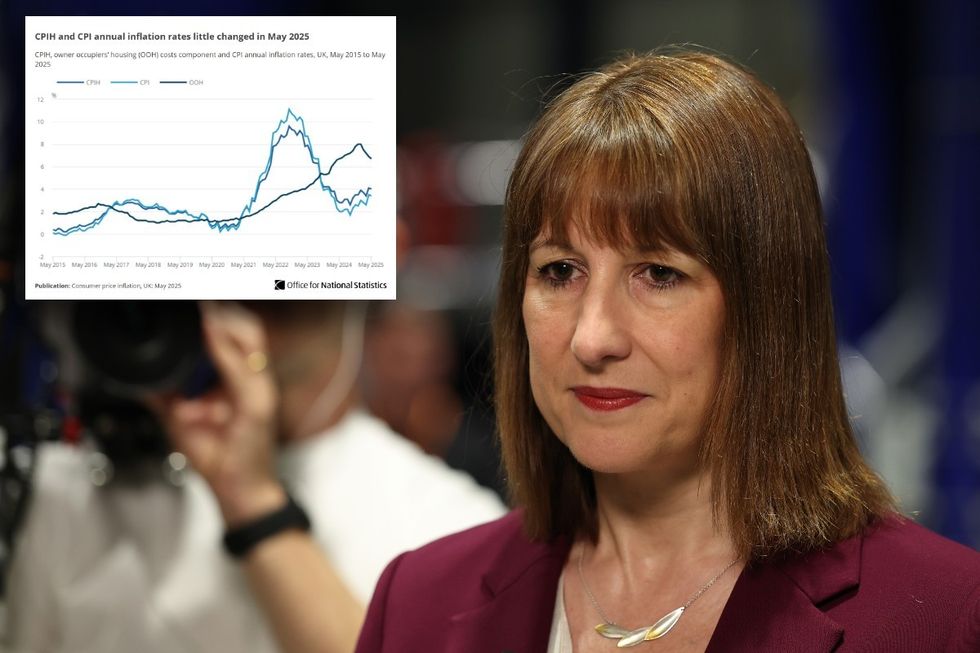

Chancellor Rachel Reeves said there was “more to do” to bring down inflation and help with the cost of livin

| GB NewsChancellor Rachel Reeves said there was "more to do" to bring down inflation and help with the cost of living.

She said the Government’s "number one mission is to put more money in the pockets of working people".

She said: "We took the necessary choices to stabilise the public finances and get inflation under control after the double digit increases we saw under the previous government, but we know there’s more to do.

"Last week we extended the £3 bus fare cap, funded free school meals for over half a million more children and are delivering our plans for free breakfast clubs for every child in the country. This Government is investing in Britain’s renewal to make working people better off."

Shadow chancellor Sir Mel Stride said: "This morning’s news that inflation remains well above the two per cent target is deeply worrying for families.

"Labour’s choices to tax jobs and ramp up borrowing are killing growth and stoking inflation – making everyday essentials more expensive."

Most economists were expecting the CPI rate to come in at 3.3 per cent for May as price rises cooled following a raft of bill increases the previous month, that pushed inflation to the highest level in more than a year.

ONS acting chief economist Richard Heys said: "A variety of counteracting price movements meant inflation was little changed in May.

The Bank of England said earlier this year that it expects the inflation rate to rise to 3.7 per cent in the third quarter, before starting to cool into next year.

|ONS/GETTY

"Air fares fell this month, compared with a large rise at the same time last year, as the timing of Easter and school holidays affected pricing. Meanwhile, motor fuel costs also saw a drop.

"These were partially offset by rising food prices, particularly items such as chocolates and meat products. The cost of furniture and household goods, including fridge freezers and vacuum cleaners, also increased."

The Bank of England said earlier this year that it expects the inflation rate to rise to 3.7 per cent in the third quarter, before starting to cool into next year.

More From GB News