Rachel Reeves to be 'forced' to raise taxes as UK borrowing costs soar

GBNEWS

UK borrowing was £1bn higher than in April last year and well above analysts’ expectations of £17.6bn

Don't Miss

Most Read

UK Government borrowing rose to £20.2 billion in April, the fourth-highest April figure on record.

The jump exceeded forecasts and adds pressure on Chancellor Rachel Reeves ahead of her June 11 spending review — Labour’s first in over a decade.The rise was driven by a £4.2 bn year-on-year increase in central Government spending, largely due to higher public sector wages and inflation-linked costs. But it is not just the spending that is raising concern, it's also the rising cost of financing it.

Yields on the UK’s 30-year gilts climbed to 5.554 percent today, reaching their highest level since 1998. Higher yields reflect market concerns over inflation, debt levels, and the overall credibility of fiscal policy. Crucially, they also increase the interest the Government must pay on its borrowing, tightening fiscal space and leaving less room for investment in services.

This puts Reeves in a difficult position as she to stick to her fiscal rules, she will need to choose between raising taxes, cutting public spending, or changing the rules altogether. The longer borrowing costs remain elevated, the harder those decisions become.

Experts are warning that the current strategy may not be sustainable. Professor Joe Nellis, economic adviser to MHA, said, "Low growth results in lower tax revenues and lower Government income, making it almost impossible for the Chancellor to balance public spending and revenue without growth-inhibiting tax raids.

"Of the Government’s two goals, cutting the deficit and growing the economy, growth must come first. To achieve that, the Chancellor should scrap her fiscal rules and focus on investment."

Ruth Gregory, deputy chief UK economist at Capital Economics, echoed that sentiment, warning that "further tax rises are starting to feel inevitable" as markets grow uneasy about continued public borrowing.

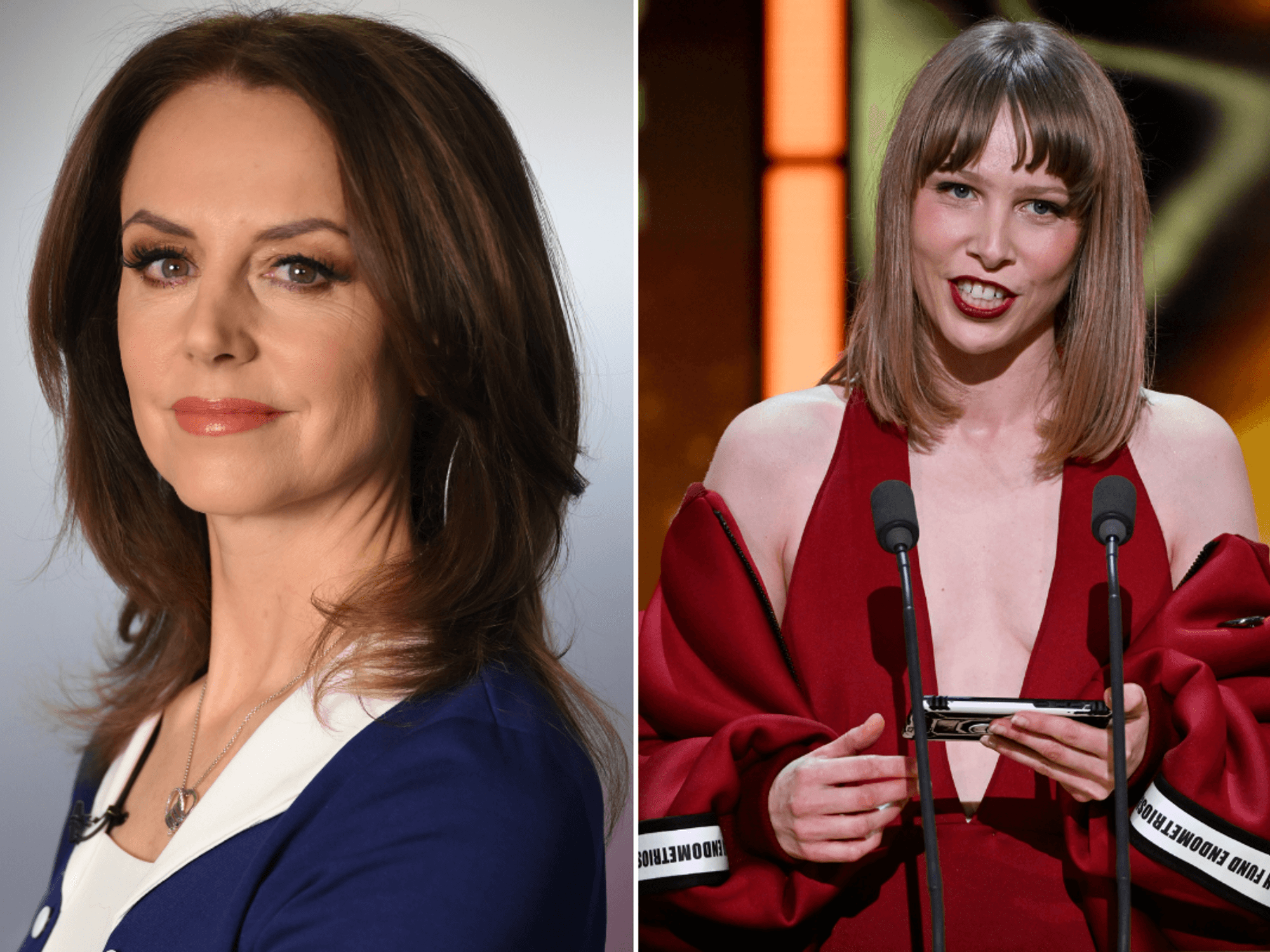

Chancellor Rachel Reeves is attempting to grow the economy and balance the books | GB News

Chancellor Rachel Reeves is attempting to grow the economy and balance the books | GB News The Office for Budget Responsibility has also raised the alarm, forecasting that annual interest payments on the national debt could exceed £100 billion for the rest of this Parliament. That would be a serious and growing strain on the public purse.

The bond market turbulence last month further illustrates the problem. Yields on 30-year gilts briefly hit 5.63 percent during a global bond sell-off, fuelled by fears over Donald Trump’s proposed trade war. UK bonds mirrored US market movements, with 10-year gilt yields jumping to 4.78 percent and the pound slipping against the euro.

Simon French, chief economist at Panmure Liberum, said this reflected market fears that the United States had "lost control of its senses" economically, and the UK was caught in the fallout.

Meanwhile, the Government’s recent £4bn sale of 30-year gilts drew £75 bn in orders, seemingly suggesting strong investor appetite.

Bitcoin has taken a hit as investors navigate an uncertain market | GETTY / GOOGLE

Bitcoin has taken a hit as investors navigate an uncertain market | GETTY / GOOGLE However, analysts caution that this interest came mainly from short-term buyers, not traditional long-term holders like pension funds and insurers.

Many of those institutions already hold large volumes of long-dated debt and are reluctant to buy more. This lack of structural demand could lead to higher long-term borrowing costs or future difficulties in issuing debt at scale.

Craig Inches, head of rates and cash at Royal London Asset Management, warned: "There is a fear that the only option Governments have left is to turn on the fiscal taps."

Although recent hopes of an economic boost followed the UK-EU deal, growth forecasts remain weak. The Chancellor’s task of balancing the books, meeting fiscal targets, and investing in services is becoming increasingly difficult.

Donald Trump has made tariffs the focus of his economic agenda | REUTERS

Donald Trump has made tariffs the focus of his economic agenda | REUTERSGregory noted that the poor start to the financial year raises the chances of more tax rises in the Autumn Budget, especially with growth expected to remain subdued in the coming month.

Responding to the figures, Chief Secretary to the Treasury Darren Jones said: "After years of economic instability crippling the public purse, we have taken the decisions to stabilise our public finances, which has helped deliver four interest rate cuts since August, cutting the cost of borrowing for businesses and working people."

But for now, with rising borrowing costs, stagnant revenues, and subdued growth, the pressure is mounting.

Unless the Government changes course or growth significantly improves, further tax hikes appear increasingly unavoidable.