TSB name could disappear after 200 years as Santander takeover approved - full list of branch closures confirmed

DIGI Payment Choice Alliance Chair Ron Delnevo on bank branch closures

|GBNEWS

Sabadell shareholders approve £2.65billion cash sale of TSB to Santander

Don't Miss

Most Read

Latest

TSB's future on Britain's high streets is in doubt after investors at Spanish banking group Sabadell approved its sale to Banco Santander.

At the meeting on Wednesday, 99.6 per cent voted in favour of the deal.

The takeover could bring an end to the TSB name after more than 200 years of trading. Santander has confirmed it plans to fully integrate TSB into its UK business, raising questions over whether the historic brand will survive.

Once complete, the deal will create the UK's third-largest bank by number of personal current accounts.

Sabadell's board approved the transaction last month as part of a strategy to concentrate on its Spanish operations, where it identifies stronger growth prospects. The acquisition is expected to close in the first quarter of 2026.

TSB has already announced that it will close a minimum of 12 of its 184 locations during 2025 and 2026, with one site set to relocate rather than shut permanently.

These shutdowns add to the wider pattern of high street banking decline across Britain, as financial institutions increasingly shift towards digital services.

TSB currently operates around 175 branches across the UK and employs more than 5,000 people. Santander runs 349 branches with approximately 18,000 staff.

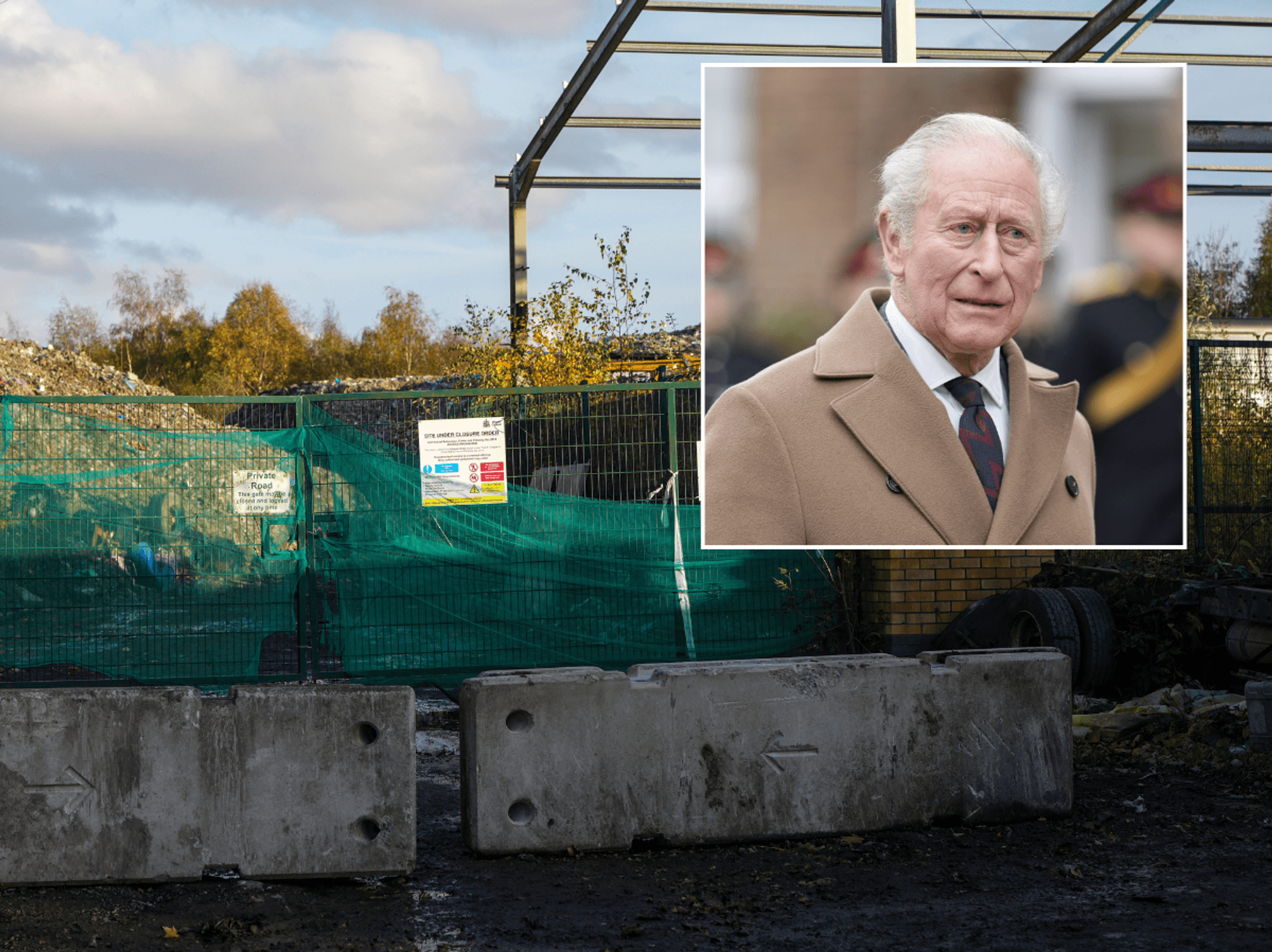

Shareholders of Spanish banking group Sabadell have voted to approve the sale of TSB to Santander

| PABoth lenders have reduced their branch networks in recent years as customers increasingly shift to digital banking. The combined group would face significant overlap in locations.

TSB had confirmed branch closures ahead of the Santander takeover announcement, suggesting they form part of TSB's existing operational plans rather than post-merger restructuring.

With around 175 branches currently operating, TSB's network has already contracted significantly from its peak, and these additional closures will further reduce its physical presence across England, Scotland and Wales.

TSB bank branch closures 2025/26 – full list

- Amble – 75 Queen Street, NE65 0DA – June 5, 2025

- Aylsham – Market Place, NR11 6EH – June 4, 2025

- Banff – 12 Castle Street, AB45 1DL – May 27, 2025

- Bedlington – 42/44 Front Street West, NE22 5UB – May 28, 2025

- Bude – 1 Belle Vue, EX23 8JJ – Date to be confirmed

- Crook – 9 North Terrace, DL15 9ES – June 3, 2025

- Flint – 8a Trelawny Square, CH6 5NN – May 29, 2025

- Frome – 25 Cheap Street, BA11 1BW – Date to be confirmed

- London (South East) – 76 Rye Lane, SE15 5DQ – June 25, 2025

(A new branch will open on the same street on June 27, 2025) - Sheerness – 104–106 High Street, ME12 1UB – March 27, 2025

- Tenbury Wells – 71 Teme Street, WR15 8AQ – May 20, 2025

- Whitchurch – 2 Watergate Street, SY13 1DR – May 21, 2025

The TSB name could disappear after 200 years

| PATSB traces its origins to 1810 when Reverend Henry Duncan founded the Trustee Savings Bank in Dumfriesshire, Scotland.

The institution operated independently for 185 years before merging with Lloyds Bank in 1995, though the TSB brand was preserved during this period.

Spanish bank Sabadell purchased TSB from Lloyds for £1.7 billion in 2015, paying book value for the assets.

The current £2.65billion sale price represents 1.5 times book value, marking a significant premium over Sabadell's original investment a decade ago.

Sabadell will distribute the sale proceeds through a special cash dividend of €0.50 per share, totalling €2.5 billion for shareholders.

Santander is set to takeover TSB in a major deal | PA

Santander is set to takeover TSB in a major deal | PA The disposal marks the potential conclusion of TSB's 215-year presence as a distinct entity in British banking.

The transaction appears designed to strengthen Sabadell's defence against a hostile takeover attempt by rival Spanish bank BBVA, which launched a bid valuing the group at approximately €12billion last year.

Sabadell's chairman Josep Oliu stated the TSB disposal would have proceeded "regardless" due to "clear benefits to the bank and its shareholders", though the bank acknowledged it could "impede the success" of BBVA's approach.

RBC Capital Markets analyst Pablo de la Torre Cuevas described the sale as potentially the "last major effort to convince Sabadell's shareholders to not accept BBVA's offer during the upcoming take-up period".

A Santander spokeswoman welcomed the shareholder approval, calling TSB "an outstanding franchise" and expressing confidence the combined entity would "become the best bank for customers in the UK".

More From GB News