Rishi Sunak launches biggest tax raid in 44 years as one-in-five Britons to be dragged into higher band

Prime Minister Rishi Sunak during a Business Connect event in North London

|PA

The Prime Minister has said he will only cut taxes once inflation and borrowing is brought under control

Don't Miss

Most Read

Latest

Rishi Sunak has launched the biggest tax raid in 44-years as one-in-five taxpayers look set to find themselves in the higher-rate income tax bracket by 2027.

The Prime Minister and his Chancellor Jeremy Hunt recently announced they would freeze income tax thresholds, despite the levy usually going up in line with inflation.

The Institute for Fiscal Studies (IFS) revealed the threshold freeze is the Treasury’s single biggest revenue raiser since Geoffrey Howe increased VAT from eight per cent to 15 per cent after Margaret Thatcher came to power in 1979.

The decision will ensure 7.8 million people will pay a tax rate of 40p or more on earnings by 2027-28, official estimates have suggested.

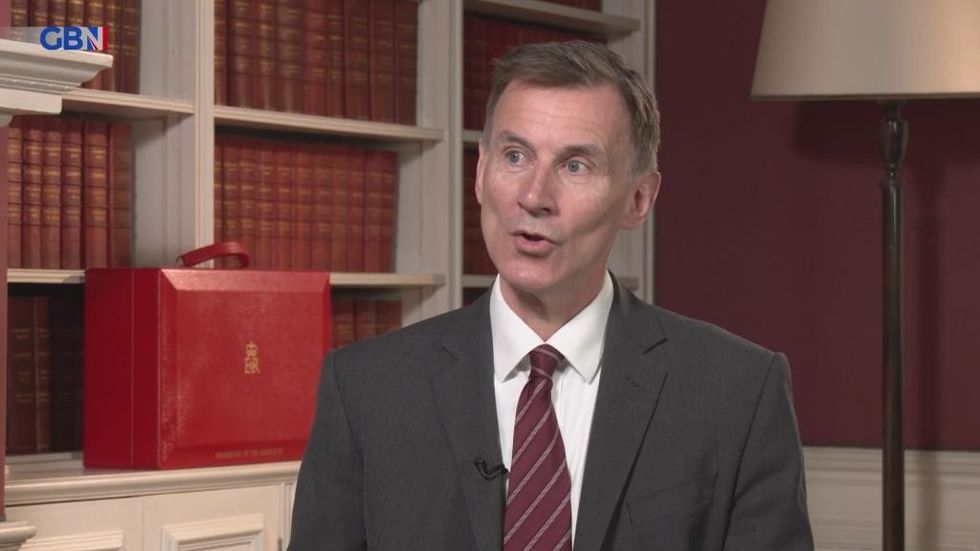

Jeremy Hunt extended the freeze on income tax thresholds

| GB NewsThis will ensure the overall share of adults paying the higher rate has quadrupled since the early 1990s.

Teachers, nurses and electricians have been earmarked as workers who look likely to be negatively impacted by the change.

The IFS also warned the freeze will “disincentive work” at a time when the Government is hoping to encourage Brits to return to work post-Covid.

The think tank said: “More adults than ever are paying higher-rate tax.”

General view of the entrance to the HM Treasury building,

|PA

Isaac Delestre, research economist at the IFS, added: “For income tax, the story of the last 30 years has been one of higher-rate tax going from being something reserved for only the very richest, to something that a much larger proportion of adults can expect to encounter.”

He added: “Alongside the fact that 1.7m people will be paying marginal rates of 60 per cent and 45 per cent in the next few years, this represents a fundamental and profound change to the nature and structure of our income tax system.”

The highest-rate tax threshold is currently frozen at £50,270 but experts warn it would have to increase to nearly £100,000 by 2027 to hit the same fraction of people as it did in 1991.

The Prime Minister has remained steadfast in his commitment to only cut taxes once inflation and borrowing is brought under control.

A UK five pound, ten pound, twenty pound and fifty pound notes with one pound coins

|PA

But Sunak and Hunt have reportedly been considering whether to cut the burden facing Britons ahead of the next general election.

The Prime Minister came under mounting pressure to introduce immediate tax cuts after the Conservative Party was dealt a mauling at the local elections earlier this month.

The Tory Party lost more than 1,000 seats, including in crunch battleground councils in both the Red and Blue Walls.

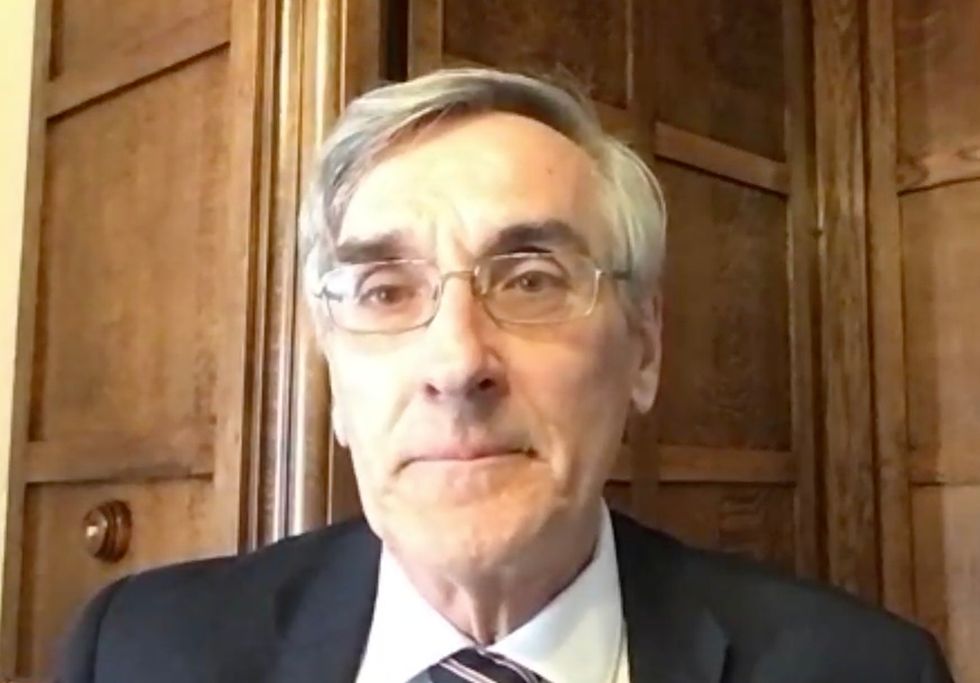

Ex-Welsh Secretary Sir John Redwood was at the forefront of the internal campaign to force Number 10 to cut tax.

Ex-Welsh Secretary Sir John Redwood was at the forefront of the internal campaign to force Number 10 to cut tax

| gbnewsHe told The Sun on Sunday: “The Prime Minister should announce tax cuts on Tuesday — straight after the Coronation bank holiday.

“He has got to get on with it. He has got to cut taxes and promote growth.”

Number 10 also refused to endorse Mel Stride's suggestion that getting people back to work post-Covid could result in a pre-election tax cut for voters.