'Unique window of opportunity' to boost state pension won't last much longer - 'could be one of best retirement decisions'

Many people are falling short of getting the full state pension due to missing National Insurance contributions

Don't Miss

Most Read

Britons are being urged to check their state pension entitlement as it “could be one of the best retirement decisions” they can make.

To get the full new state pension, workers typically need to have 35 years of National Insurance contributions under their belt.

However, many future retirees are unaware they have missing years on their National Insurance record which could stop them getting their full entitlement.

Alice Haine, a personal finance analyst at BestInvest, urged people to look back at their state pension record to check for gaps and fill them, such as by claiming National Insurance credits.

She explained: “Check your state pension record for any gaps – filling them could be one of the best retirement decisions you make.

“Your state pension entitlement is determined by the number of qualifying National Insurance years you have.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Britons are being urged to check their state pension record

|GETTY

“People typically need at least 10 qualifying years of NI contributions to receive any state pension at all and at least 35 years to receive the full new state pension.

“Checking your tax account for any gaps in your National Insurance record quickly identifies whether you have enough qualifying years to receive a full state pension – a valuable source of income considering the full new state pension rose by 8.5 per cent earlier this month and is now worth £11,502 a year.”

This month, those claiming the state pension were awarded this boost thanks to the triple lock, which determines the annual rate hike based on either inflation, average earnings or 2.5 per cent; whichever is higher.

Haine noted that the state pension forecast calculator can be found in each taxpayer’s Personal Tax Account on the Government website.

This states what year someone will begin to receive the state pension, how much they will get and their projected amount of what someone will receive.

The calculator also lists the number of years someone has of full National Insurance contributions and the years they may have not contributed enough to get the full amount.

On the statement, these are highlighted as “Year is not Full” with suggestions on how someone can fill them.

One of the options available to people is making voluntary National Insurance contributions which could be useful for those who have left the workforce for period of time. However, it’s important checking if National Insurance credits can be claimed beforehand.

Haine added: “People that might need to top up include those that took a career break as well as low earners or expatriates living and working abroad.

“Plugging any gaps will ensure you receive your full state pension entitlement, a vital income source in the later stages of life when you may not be fit enough to continue working or have inadequate private pension savings.”

The decision on whether someone needs to top up may depend on how many more years they need to work as there may not be enough time to fill the gap.

Furthermore, it also depends on whether they are entitled to National Insurance credits which assist those who have unemployed or sick in making up the difference.

LATEST DEVELOPMENTS:

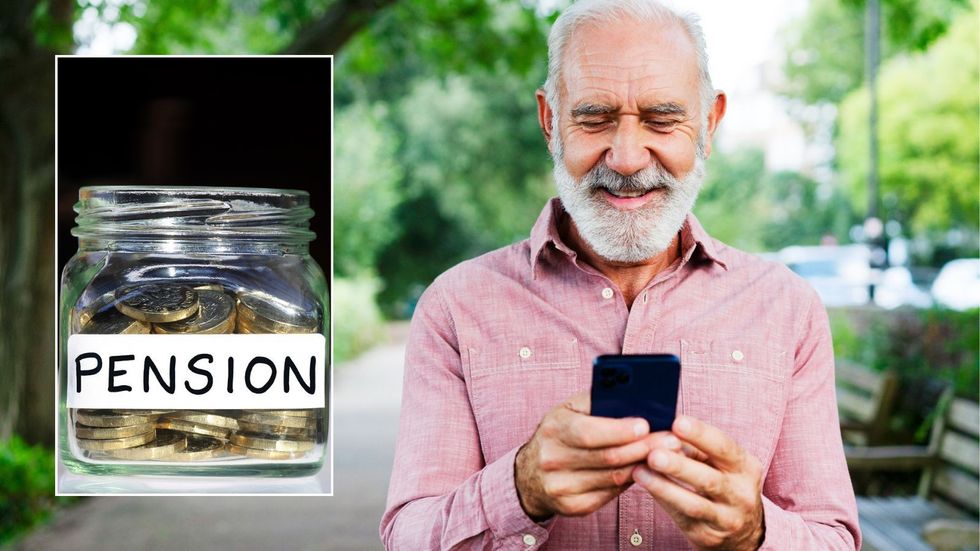

Pensioners need to have 35 years of National Insurance entitlements to get their full entitlement

| GETTYHowever, Haine is reminding taxpayer that they usually can only backdate National Insurance contributions by six years.

There is a way for people to pay for gaps dating back to April 2006 but only for a limited amount of time.

The finance expert added: “The Government is currently allowing people to pay for gaps on their NI record all the way back to April 2006. While the deadline for this one-off concession was initially April 2023, this was extended twice last year due to high demand.

“This unique window of opportunity to plug up to 17 years of missed contributions in one go closes on April 5, 2025, so it is imperative taxpayers take advantage while they can.”