State pension age could rise to 80 under proposal as triple lock 'poses real risk' to economy

Analysts are urging the Government to consider hiking the state pension age to ease pressure on the public finances

Don't Miss

Most Read

The state pension age could increase to 80 years old to balance the books amid concerns over the rising cost of the triple lock, analysts warn. Analysis by Barnett Waddingham challenges the Office for Budget Responsibility's (OBR) projections into the retirement benefit's overall cost.

Earlier this month, the OBR warned that state pension represents a "large financial risk" for the UK and would cost around £15billion to maintain in its current form, nearly triple than initially projected.

According to Barnett Waddingham, the economic and fiscal forecaster's calculations significantly underestimate the financial burden of increasing life expectancy on public finances.

The consultancy's research indicates that under more realistic longevity assumptions, annual state pension costs could surge by approximately £8billion, quadrupling the OBR's estimates.

The state pension age could rise to 80 to pay for the retirement benefit's uptake

|GETTY/ ONS

Jack Carmichael, an associate and senior consulting actuary at Barnett Waddingham, warned that the OBR's modelling employs overly conservative assumptions about future life expectancy improvements.

He explained: "There is a very real risk that the OBR's analysis of the future cost of the state pension actually doesn't go far enough to illustrate how much longevity risk the current system poses to the UK's public finances.

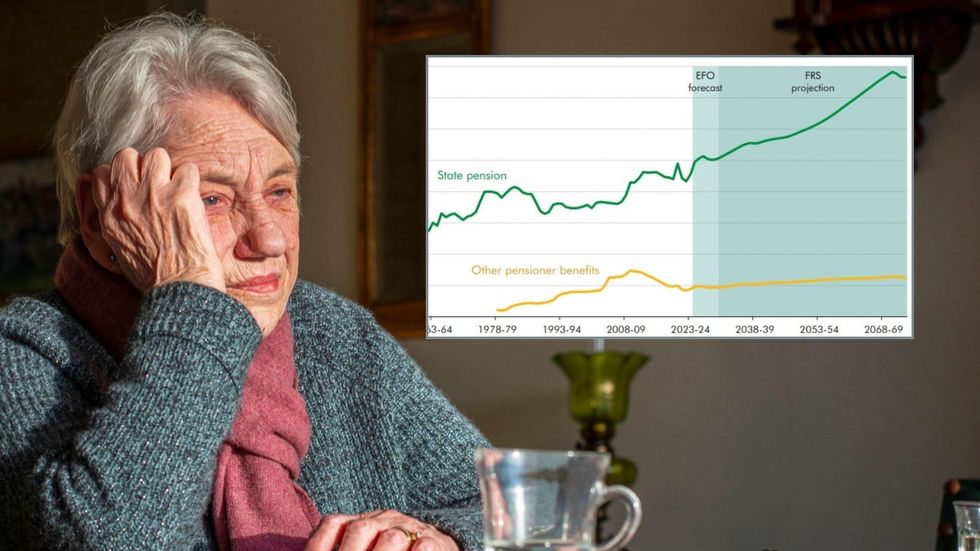

"The OBR's 'Fiscal risks and sustainability' report shows the cost of state pension as a proportion of gross domestic product (GDP) doubling over the next 50 years, driven by a growing retirement population relative to the working age population.

"[It's] modelling uses a high life expectancy scenario, based on the Office for National Statistics (ONS's) definition in their population projections, that results in an additional annual state pension cost of c. £2billion in today's terms. It assumes a long-term rate of 1.9 per cent, rather than 1.2 per cent.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

How much will the state pension triple lock cost the British taxpayer? | OBR

How much will the state pension triple lock cost the British taxpayer? | OBR "In reality, that sensitivity is too cautious and broad-brush, which underplays the degree of longevity risk in the state pension system. A more cautious approach would be to assume a closing of the life expectancy gap between the individuals with the lowest and highest life expectancy.

"Not only does this more accurately capture the financial impact of longevity risk in the UK state pension system, it is also more likely to reflect healthcare spending priorities over the next 50 years if those living the longest at the moment are assumed to have almost reached the life expectancy cap.

"Under this alternative life expectancy sensitivity, the annual cost of the state pension would increase by £8billion - four times higher than the current model predicts. To keep the cost at a similar proportion of GDP would then require a massive increase in the state pension Age, potentially up to the dizzying heights of age 80."

Ministers have launched a comprehensive assessment of the state pension system amid growing concerns about its financial sustainability, with experts warning that maintaining current benefit promises could necessitate delaying retirement for millions.

The review will examine how the starting age for state pension payments affects long-term public spending, though officials have confirmed the triple lock guarantee will remain untouched during this Parliament.

Financial specialists have cautioned that preserving the triple lock mechanism, which ensures pensions increase annually by the highest of inflation, wage growth or 2.5 percent, creates immense budgetary pressures.

LATEST DEVELOPMENTS:

DWP minister Liz Kendall has launched a new Pensions Commission | PA

DWP minister Liz Kendall has launched a new Pensions Commission | PARetirement advisers suggest this commitment could paradoxically harm future pensioners by compelling the government to accelerate planned increases to the qualifying age, currently set to rise from 66 to 67 between 2026 and 2028.

Steven Cameron, pensions director at wealth management firm Aegon, explained that continuing the triple lock indefinitely would necessitate more rapid and extensive increases to the state pension age than would otherwise be required.

He characterised this as a difficult national choice between preserving current pensioners' income protection and forcing younger generations to delay their retirement by several additional years.

Advisory group My Pension Expert's policy director Lily Megson-Harvey acknowledged the triple lock's substantial expense whilst cautioning that significant modifications could severely impact retirees' financial security.