Savings warning: 'Wake-up call' as Britons losing up to £219 a year to low-interest accounts

Experts are urging savers to "wake up" as savings rates plummet

|GETTY

Savings rates are beginning to fall in a blow to Britons

Don't Miss

Most Read

Money experts are issuing a "wake-up call" savings warning as Britons are leaving their cash languishing in low-interest accounts.

New research conducted by finder.com found that savers are keeping their money in accounts with interest rates that fall well below the base rate.

Earlier this month, the Bank of England's Monetary Policy Committee (MPC) narrowly voted for rates to be slashed from 5.25 per cent to five per cent.

High street banks have already begun to cut savings rates in response to the central bank's actions which means savers have little time left to snatch record high interest.

According to finder, the average interest rate bank customers have attached to their easy-access savings accounts comes to 2.39 per cent.

The best rate available on this type of account is 5.2 per cent which is double what the average saver is earning now.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Savers can earn up to 5.2 per cent in easy access savings accounts right now | GETTY

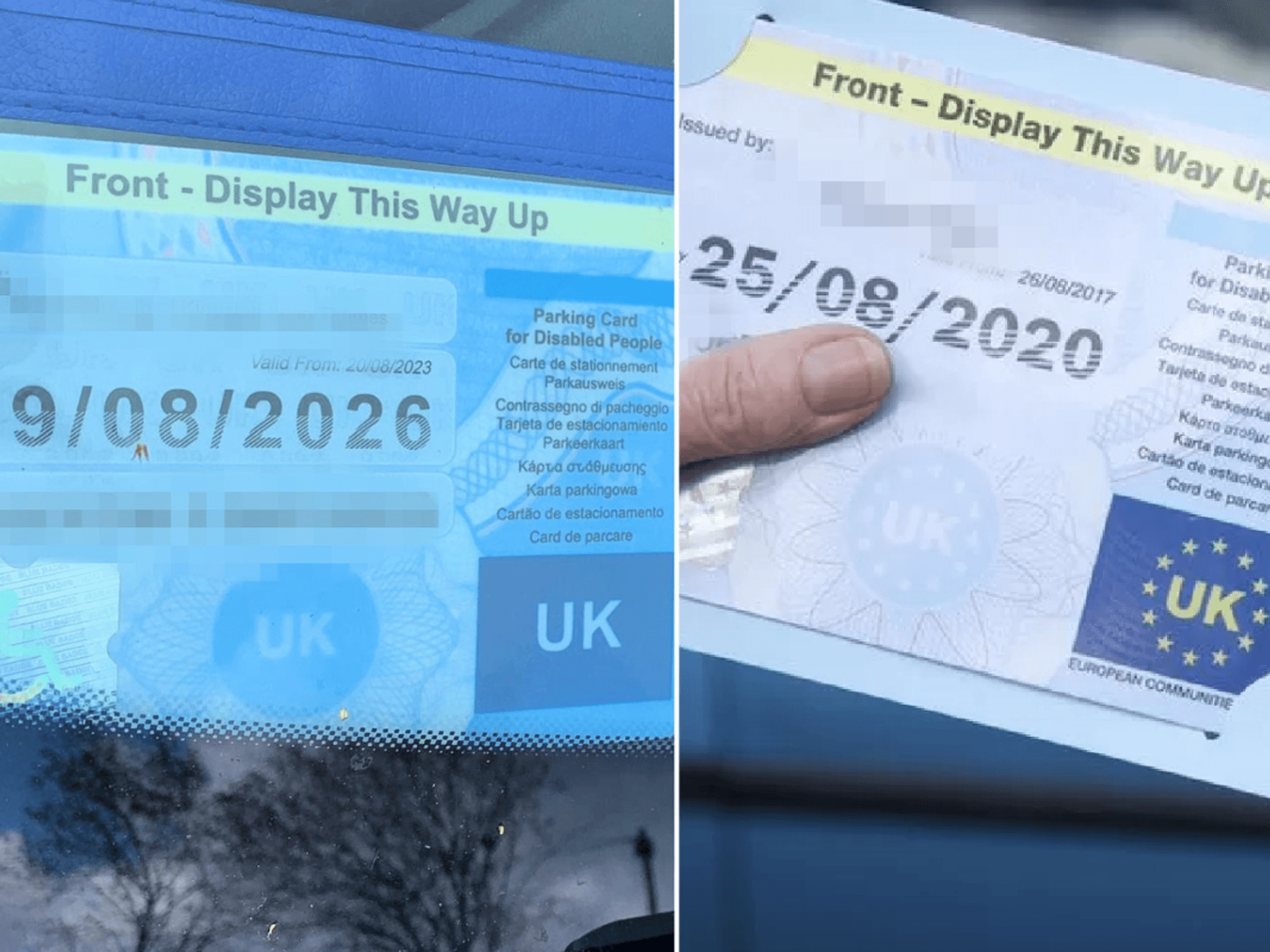

Savers can earn up to 5.2 per cent in easy access savings accounts right now | GETTYBased on finder's analysis, the average savings amount Britons have in a dedicated easy-access savings account is £7,784.

Over the space of one year, if someone kept this amount in a best easy access savings account, they would earn £405 in interest.

This is £219 more than what they would get from an account paying 2.39 per cent, or £186 over a year.

Around one in four savers are estimated to missing out on a significant savings boost due to low-interest accounts worth 1.5 per cent.

In terms of age, baby boomers and the silent generation were found to have an average of £11,875 in savings, according to finder.

This is £7,610 more than Generation Z’s average savings pot of £4,265.

Despite this, older Britons were found to be the age group most likely to not know what their savings rate was despite having the largest pot coming in at 31 per cent.

In comparison, 15 per cent of Gen Z savers were unaware of the interest rate attached to their account.

When it comes to gender, women were found to be twice as likely to not be aware of their interest rate (32 per cent) compared to men (18.5 per cent).

Liz Edwards, a money expert at finder.com, urged bank customers to "get a better deal" if they can.

LATEST DEVELOPMENTS:

Earlier this month, the Bank of England voted to cut interest rates | GETTY

Earlier this month, the Bank of England voted to cut interest rates | GETTY She explained: "These findings are a wake-up call for UK savers as they show many are not making the most of their savings.

"In today’s economic climate, it’s crucial to be proactive about securing the best returns on your money. It’s also worth seeing if you can get a better deal by opting for a fixed-rate account, if you don’t need easy access to your money.

"With some banks already cutting rates following the recent base rate adjustment, now is the time to compare your options and switch to better deals.

"In addition to ensuring you’re getting the best interest rate on your savings, taking advantage of current account switching deals is an easy way to earn some extra cash."