Santander division increases interest rate on easy access savings account to 5.12 per cent

Santander division cahoot has increased the interest rate offered on its easy access Simple Saver account

|GETTY

Santander division cahoot is a UK-based online bank serving more than 60,000 active customers

Don't Miss

Most Read

Latest

Santander division cahoot has today increased the interest rate offered on its easy access Simple Saver account.

The cahoot Simple Saver (issue 2) now pays 5.12 per cent AER/gross variable rate interest for 12 months.

This rate applies on balances up to £500,000.

Customers who choose to have their interest paid monthly, rather than annually, will earn five per cent gross (variable).

Savers can put up to £2million in this account but only £500,000 will benefit from the 5.12 per cent interest rate

|PA

Savers can put up to £2million in this account, which previously paid 4.90 per cent, but the 5.12 per cent rate only applies on savings up to half a million pounds.

The rate rise means a customer with £10,000 saved in the account can earn £512 a year in interest, cahoot said.

The account can be opened online with a minimum operating balance of £1

Savers can open this account either as a single or a joint account.

To be eligible, customers must be aged 16 or over, a UK resident, and be registered or will register for online banking with a valid email address.

Withdrawals can be made at any time from this account, which can be done by transferring another account in online banking.

The term of the account is 12 months and on maturity, cahoot will transfer the money into a cahoot Savings Account.

The interest rate is variable which means the bank can increase or reduce the interest rate.

LATEST DEVELOPMENTS:

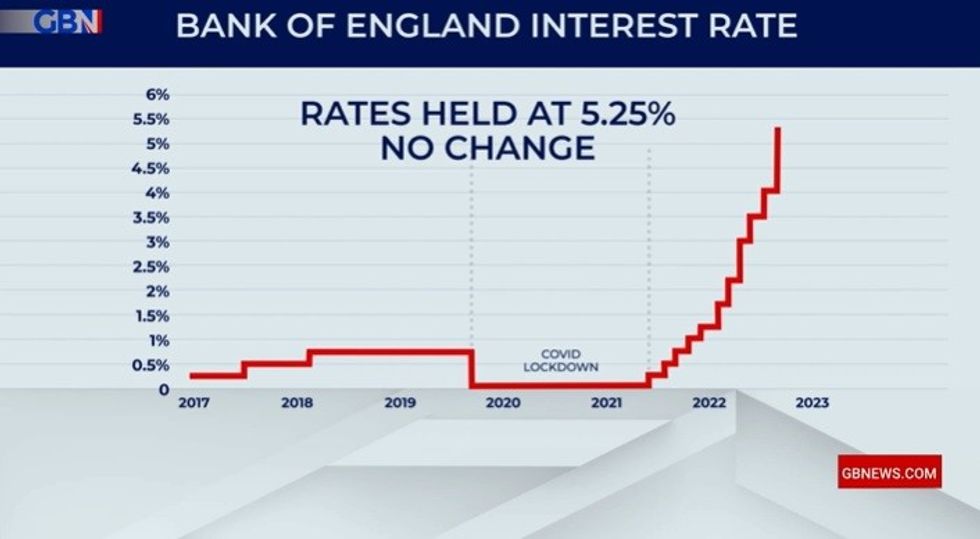

The Bank of England base rate was held at 5.25 per cent last month

|GB NEWS

If the rate goes down, cahoot will let people know around 60 days before the rate changes.

Interest rates on savings accounts have been increasing of late, following 14 increases to the Bank of England base rate.

The base rate now stands at 5.25 per cent, and it was held at this level for the first time in nearly two years last month.

The hikes came as the Bank of England attempted to ease high levels of inflation in the UK.