POLL OF THE DAY: After 6,000 high street branches disappear, should banks be allowed to shut even more sites? YOUR VERDICT

DIGI Payment Choice Alliance chair Ron Delnevo on bank branch closures

|GB NEWS

Branch closures are continuing at a rapid pace but should banks be allowed to shut down more locations?

Don't Miss

Most Read

The number of bank branch closures in the UK over the last nine years has hit 6,000, according to new research from Which?.

Britain’s high streets have been hit by an “avalanche” of closures with million of people being in need for replacement banking services, the consumer watchdog found.

Which? noted that today’s eight branch closures from Barclays took the number of banks shutting down to 6,005.

This figure is the equivalent of 60 per cent of the bank branch network since the consumer champion began keeping track of closures in 2015.

So far, Barclays has closed 1,216 branches in the last nine years in a blow to the financial institution’s customers.

However, NatWest Group, which comprises NatWest, Royal Bank of Scotland and Ulster Bank, has shut down the most sites at 1,360.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

After 6,000 high street branches disappear, should banks be allowed to shut even more sites?

|GB News

Lloyds Banking Group, which includes Lloyds Bank, Halifax and Bank of Scotland, has closed 1,146 sites, Which? found.

The organisation noted that around 200 closures by various banks and building societies are already scheduled for the rest of 2024.

Some 24 branches are earmarked for closure next year, although more are expected to be confirmed in the months ahead.

Despite the wave of closures, Nationwide Building Society has been among the high-street financial institutions which has pledged to remain in every community it has a branch.

Some 6,000 bank branches have closed in the UK since 2015, according to Which?

|PA

Despite millions switching to digital banking, consumer experts are warning that many people are being left behind by the end of the high street branch.

Sam Richardson, the deputy editor of Which? Money, warned of the “seismic shift” taking place on Britain's high streets with the ongoing trend of branch closures.

He explained: “While some may hardly notice the closure of their local branch as they seamlessly switch to online banking, for others reliant on face-to-face services, the impact can be disastrous.

“It’s not about halting closures altogether, but ensuring that essential banking services remain accessible to those who still rely on them.”

A Barclays spokesperson said: “As visits to branches continue to fall, we need to adapt to provide the best service for all our customers.

“Where levels of demand don’t support a branch, we maintain an in-person presence though our Barclays Local network, live in over 350 locations, based in libraries, town halls, mobile vans and our banking pods.

LATEST DEVELOPMENTS:

Bank branch closures are continuing at an 'alarming rate', according to Which? | GETTY

Bank branch closures are continuing at an 'alarming rate', according to Which? | GETTY “We also support access to cash with our cashback-without-purchase service, 24-hour deposit-taking ATMs and by working alongside the Post Office and Cash Access UK.”

A spokesperson for the Trade Association UK Finance said: “An ever-increasing number of people are using telephone, mobile and internet banking and fewer people are visiting bank branches on a regular basis. Balancing this change in the way we bank means firms have to make difficult decisions about maintaining their branches.

“The industry has invested heavily in alternative services, including thousands of post offices where people can do a lot of their day-to-day banking. Alongside this, the industry is working to roll out shared banking hubs to bring together different firms to support their customers.

“There is also significant ongoing investment to ensure access to cash, including free ATMs and cashback without purchase. If you are concerned about your local bank branch closing, please contact them and they will help you find the best alternative for your needs.”

Stephen Noakes, retail director at Nationwide said: “Branches are valued for everyday banking but also for important moments like scam worries and transferring a large amount of money.

“That’s why we have promised that everywhere we have a branch today we will remain until at least 2028.”

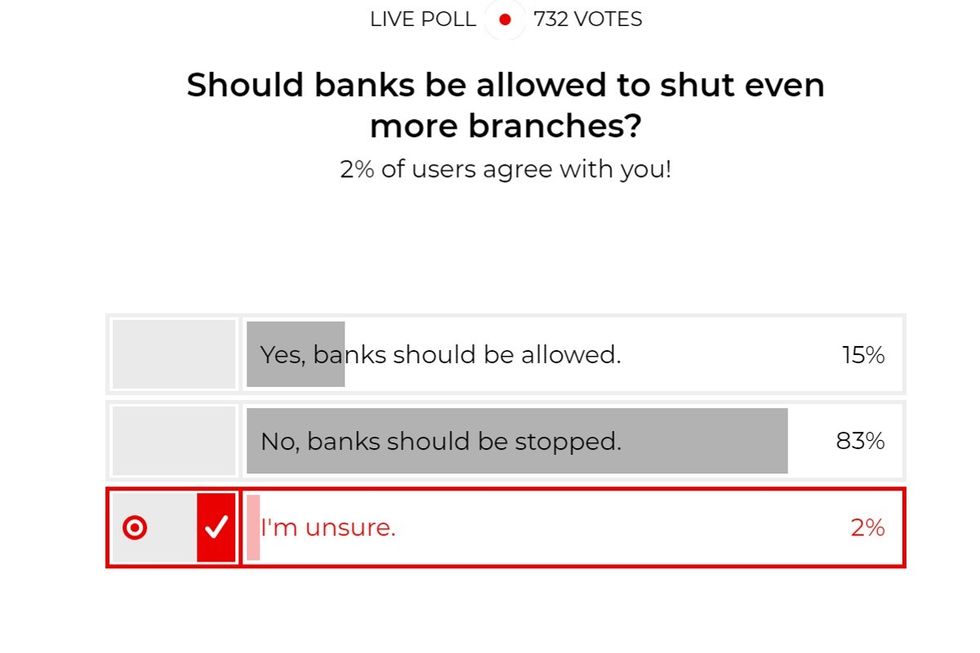

In an exclusive poll for GB News membership readers, an overwhelming majority (83 per cent) of the 732 voters thought banks should not be allowed to shut even more sites, while just 15 per cent thought they should. Two per cent said they did not know.