Lloyds snubs Rachel Reeves's £50bn bid to boost British companies

Lloyds announces 1600 job losses across bank branches |

GBNEWS

The firm says investment decisions must be based on returns, not geography, as it turns down a key part of the Chancellor's strategy

Don't Miss

Most Read

Latest

Lloyds Bank has delivered a blow to Rachel Reeves’s investment plans by snubbing an invitation to join a £50billion pact.

The lender’s pension arm has walked away from a major Government-backed deal aimed at boosting growth through British investment.

Scottish Widows, which manages over £100billion in pension savings, has refused to sign the updated Mansion House Accord.

The pact would see 17 of the UK’s biggest pension providers invest £50billion in private assets such as infrastructure and property by 2030. Half of that money would go into British projects.

The Chancellor had hoped the deal would spark new economic growth and help meet net zero goals. But Scottish Widows said the focus on UK-only assets was a step too far.

Chief executive Chirantan Barua said the firm would not let geography guide its investment choices.

He said: "We will continue this investment approach to support our communities where it generates strong returns for pensioners."

Some firms were prepared to commit up to 15 per cent of their funds into private markets,

|GETTY

The original Mansion House agreement was launched last year by Jeremy Hunt. It asked pension firms to put at least five per cent of workplace pension savings into private companies. Reeves had wanted to build on that with a larger, more UK-focused deal.

Sources say Scottish Widows was "almost a flat-out no from the start". While the firm signed the original pact, it has drawn the line at the updated version. One City source said: "Above that, we wouldn’t sign."

Other major players, including Aegon, Aviva, Nest and Phoenix also raised concerns about targeting UK-only assets.

Some firms were prepared to commit up to 15 per cent of their funds into private markets, but did not want a strict requirement for how much of that must be invested in the UK.

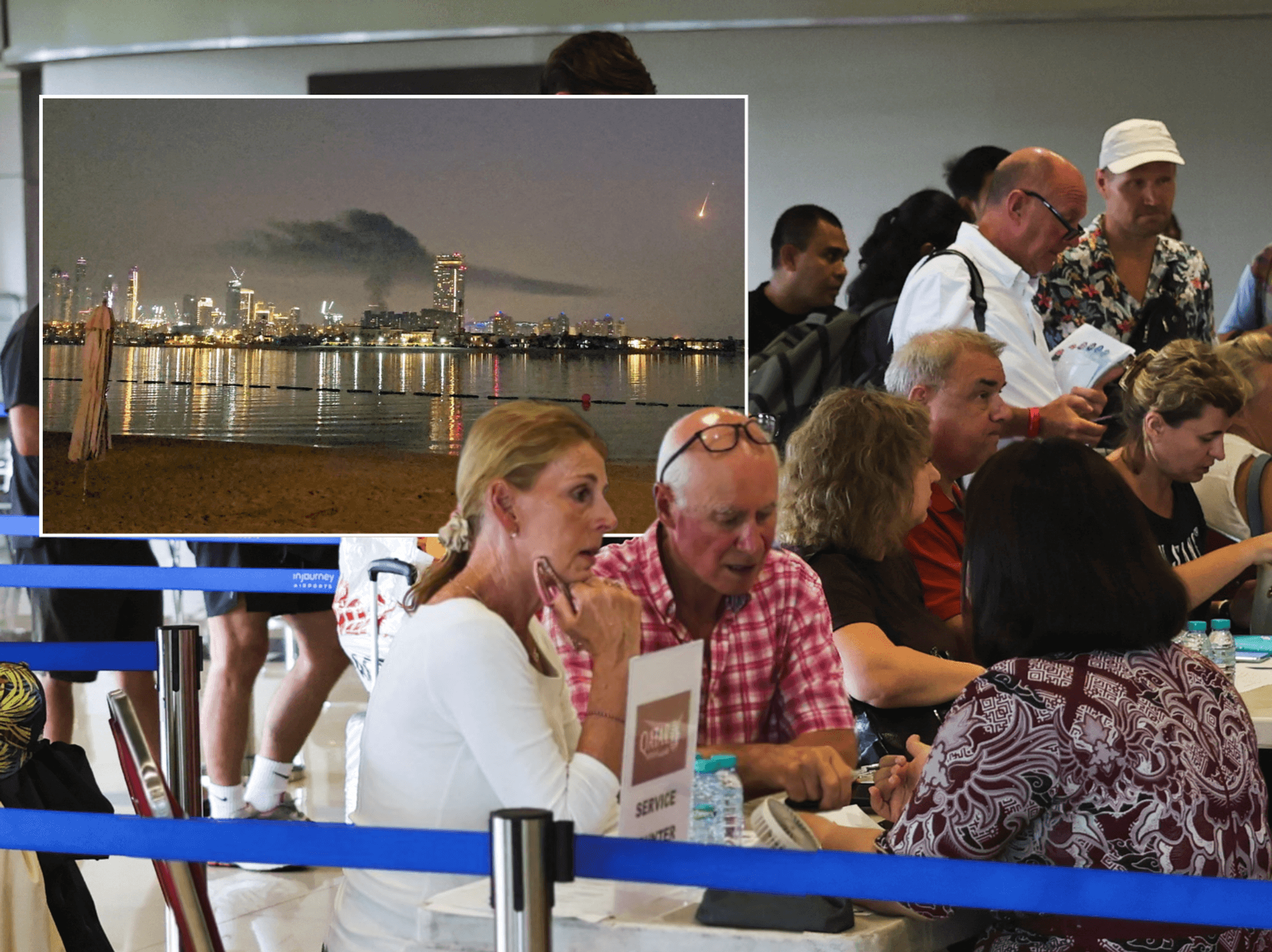

Rachel Reeves's decisions have drawn scorn from businesses | Parliament TV

Rachel Reeves's decisions have drawn scorn from businesses | Parliament TVScottish Widows already invests 7.6 per cent of its £72billion default pension pot into London-listed shares. However, it has not disclosed how much of that is in private assets.

A spokesman said: "We remain committed to the original Mansion House Compact target of investing 5 per cent of our default funds in unlisted equities by 2030."

The Treasury is now under pressure to make the deal work. Officials are understood to be considering powers to force pension firms to invest more in the UK if they do not meet the targets voluntarily. This process is known as mandation.

In a statement, the Treasury said: "Progress against the commitment will be monitored and the initiative will be reinforced by measures to be announced in the upcoming final report of the Pensions Investment Review."

Some industry leaders are warning that pushing UK-focused investment too hard could backfire

| GETTYBut some industry leaders are warning that pushing UK-focused investment too hard could backfire.

Benoit Hudon, chief executive of Mercer UK, said: "The ultimate result of a mandate may be lower returns for pensioners and poorer pensioners in the country – which goes completely against the fundamental objective of this proposal."

Reeves has defended the scheme and said it would help grow the economy. She said: "I welcome this bold step by some of our biggest pension funds, which will unlock billions for major infrastructure, clean energy and exciting startups – delivering growth, boosting pension pots and giving working people greater security in retirement."

Scottish Widows has 10 million customers and is part of Lloyds Banking Group. It was founded in 1815 and is well known for its iconic advertising campaigns.