Inflation sparks blow for mortgage holders and buyers waiting for Bank of England interest rate cuts

Inflation increased to four per cent in December, up from 3.9 per cent

|GB NEWS

Mortgage rates have surged following 14 consecutive Bank of England base rate hikes

Don't Miss

Most Read

Latest

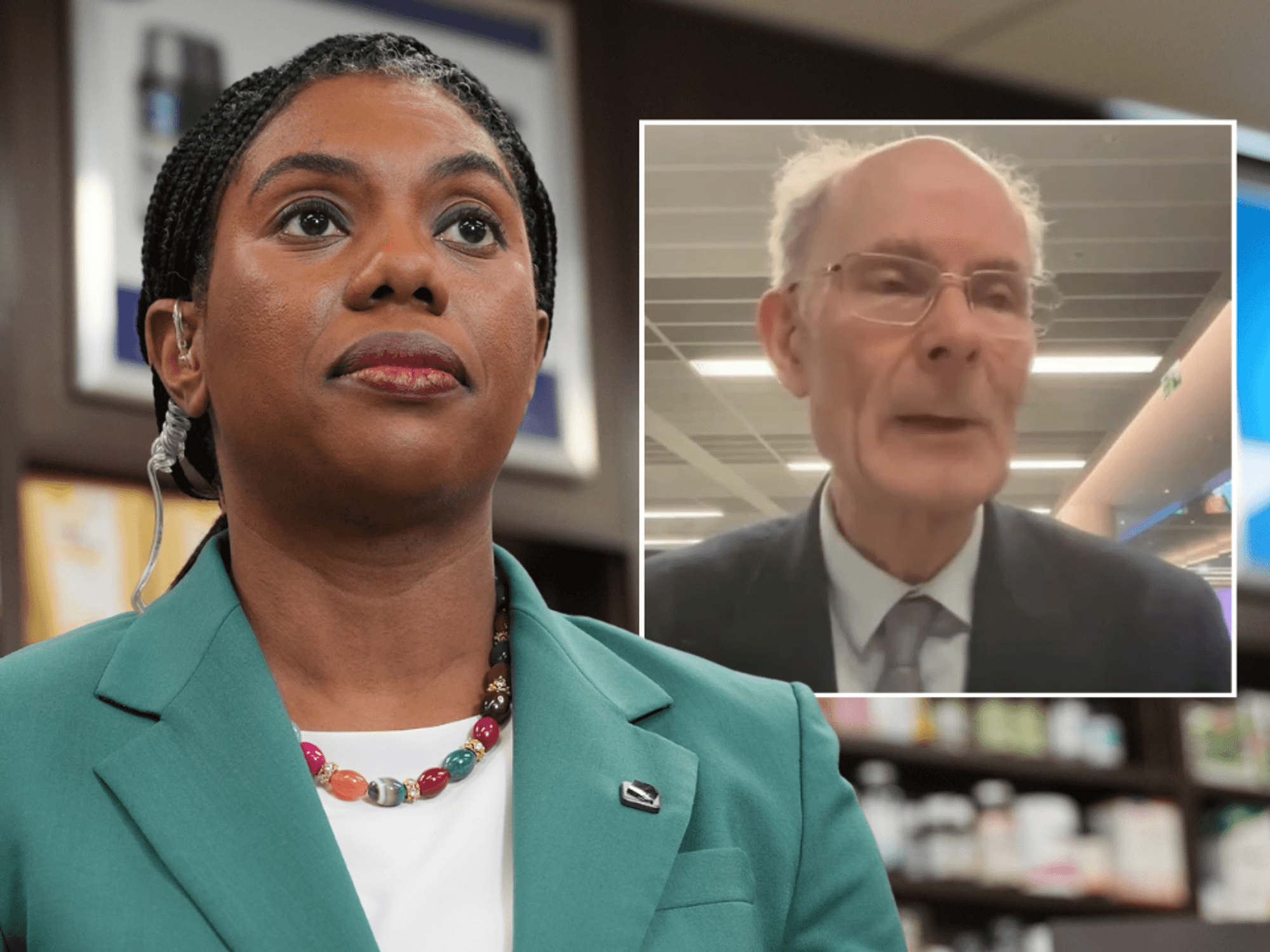

Mortgage holders and prospective buyers have been hit with bad news today as the UK inflation rate increased in the year to December 2023, bucking the recent trend of falling inflation.

It was the first time the rate has increased since February 2023, the Office for National Statistics said, sparking fears the Bank of England could hike the base rate again, beyond its 15-year high of 5.25 per cent.

Alice Haine, Personal Finance Analyst at Bestinvest, said the rise in inflation would come as a blow to borrowers and hopeful homebuyers, who are “waiting on tenterhooks” for interest rate cuts “to soften the blow from high mortgage rates”.

She said: “Improving interest rate expectations in recent weeks has led to some forecasters predicting the first cut in the first half of 2024, with lenders slashing mortgage rates as they battle it out to retain their existing clients and attract new business.”

The inflation figure would be a "blow" to borrowers and hopeful homebuyers, who are “waiting on tenterhooks” for interest rate cuts, and expert said

|GETTY

However, Ms Haine said it’s “not all bad news”, pointing out the number of mortgage products available is continuing to creep up.

Deal availability is now at the highest level in more than 15 years and there are more options for those with lower deposits.

Tobias Gruber, founder and CEO of My Community Finance, said he thought the Bank of England seemed to be “losing the battle against inflation”, warning interest rate hikes could lie ahead.

He added: “These shocking figures mean Andrew Bailey may need to contemplate yet another base rate hike, spelling further misery for borrowers.

“The strategy of increasing interest rates, aimed at curbing spending, paradoxically translates to added hardship for millions grappling with the prospect of shelling out hundreds of pounds extra each month on their mortgages.

"It's a perplexing scenario for borrowers who struggle to comprehend why diligent homeowners are forced to shoulder the burden of getting inflation under control, while the banks continue to reap the benefits.

“This raises fundamental questions about the fairness of the current economic approach and whether it genuinely serves the interests of hardworking people."

Amanda Aumonier, director of mortgage operations at Better.co.uk said the surprise uptick in inflation could, in theory, spark the Bank of England to raise interest rates.

She added: “This possibility will raise concerns for anxious homeowners facing the unenviable challenge of securing a new mortgage deal this year, as there's a fear that mortgage rates could increase.

LATEST DEVELOPMENTS:

CPI inflation is now twice the Bank of England’s target of two per cent

|PA

“1.5 million homeowners have fixed-rate deals concluding this year. If you’re one of them, reach out to a mortgage broker ASAP to help you navigate the best way forward.

“Being proactive can make managing challenges associated with the shift in your finances more straightforward.”

The Consumer Prices Index (CPI) rose by four per cent in the 12 months to December 2023, up from 3.9 per cent in November.

It means inflation is now twice the Bank of England’s target of two per cent.

The Bank of England hiked the base rate 14 consecutive times from December 2021 to August 2023, before voting to hold rates at 5.25 per cent in recent months.