Inflation warning: CPI rate RISES for the first time in 2024

The latest inflation figures have been published

|GETTY

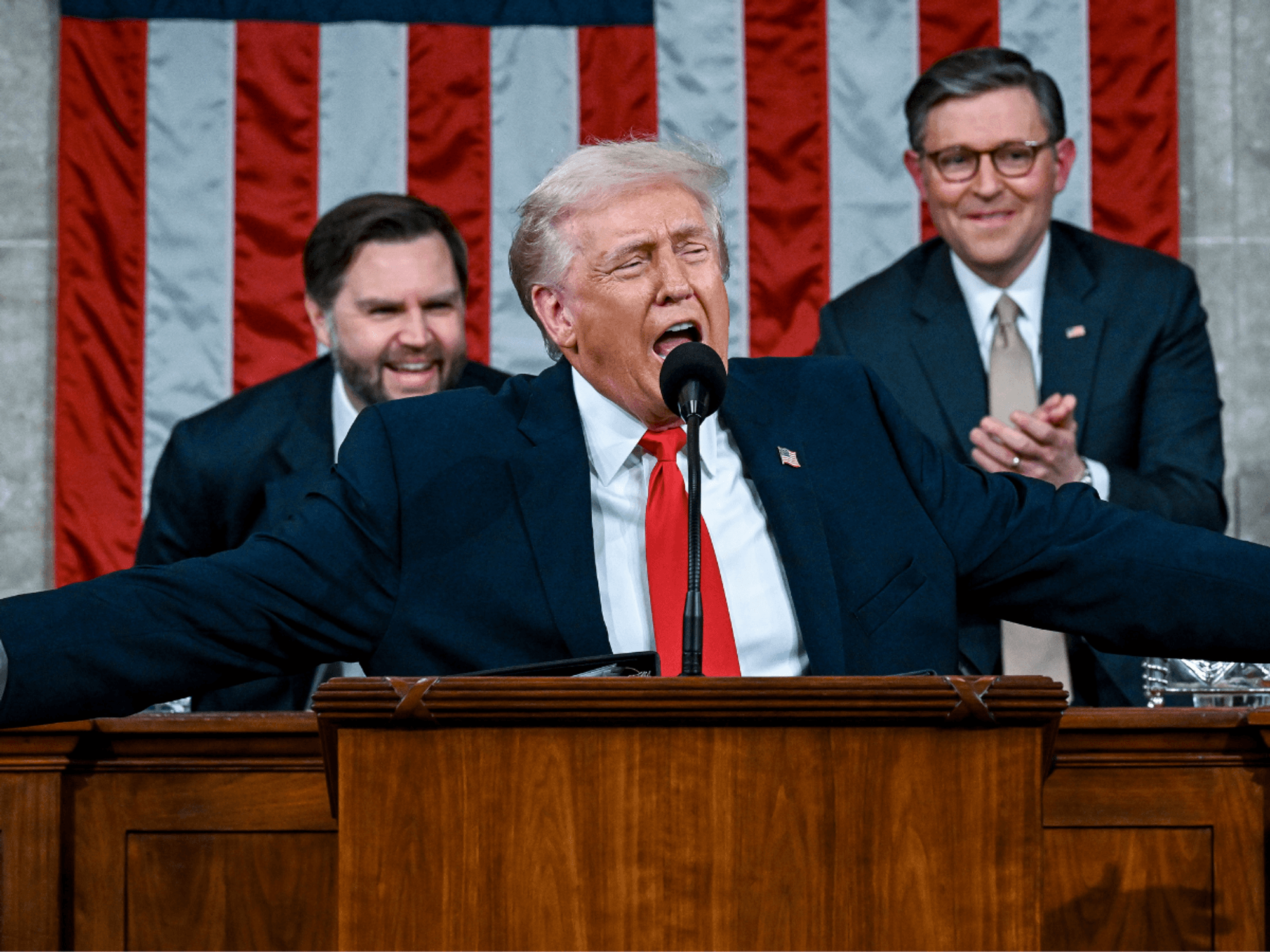

The ONS has published the latest inflation figures for July 2024

Don't Miss

Most Read

Inflation in the UK has risen for the first time this year in a blow to the UK economy but has come under previous estimates.

The latest figures from the Office for National Statistics (ONS) have revealed the consumer price index (CPI) rate jumped to 2.2 per cent for the 12 months to July 2024.

Analysts had previously forecast inflation coming in at around 2.3 per cent for last month.

This comes shortly after the Bank of England's Monetary Policy Committee voted to slash the base rate from its 16-year high after its two per cent inflation target was reached.

Interest rates were raised by the central bank as part of its efforts to ease inflation which have been partially successful.

Since May 2024, the CPI rate has fallen to the Bank's two per cent but this latest jump signals further "volatility" for the economy.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Earlier this month, the Bank of England voted to cut interest rates

| GETTYRussell Gous, the editor-in-chief for TopMoneyCompare, noted that UK inflation is currently in a similar trajectory to the Eurozone rate.

He explained: "Traditionally, inflation results in a weakening of the pound. However, with interest rates being such a focal point of attention right now, these results could reduce the likelihood of another rate cut in September.

"BoE Governor Andrew Bailey has stressed the importance of keeping inflation low and not cutting interest rates too quickly or by too much.

"Markets are predicting another one or two rate cuts in the UK this year, but news of rising inflation may push this decision to the November and December MPC meetings. In this regard, the UK's August inflation figure could prove more interesting."

According to the ONS figures, the CPI rate coming in lower than expected was primarily due "core rate" plummeting by more than expected.

Core CPI, not including energy, food, alcohol and tobacco, jumped by 3.3 per cent in the 12 months to July 2024, down from 3.5 per cent in June.

The services rate also fell from 5.7 per cent to 5.2 per cent over the period.

On today's figures, Chief Secretary to the Treasury Darren Jones said: "The new Government is under no illusion as to the scale of the challenge we have inherited, with many families still struggling with the cost of living.

"That is why we are taking the tough decisions now to fix the foundations of our economy so we can rebuild Britain and make every part of the country better off."

Despite today's rate hike, economists are cautioning people not to panic over this "modest increase" in inflation.

LATEST DEVELOPMENTS:

Inflation has risen for the first time this, per ONS figures

| GETTYProfessor Joe Nellis, an economic adviser to MHA, explained: "We anticipate that headline number will continue to edge up for the rest of the year as we head into the winter months and an inevitable rise in energy prices.

"The drop in core inflation is more significant and welcome news to the new Labour Government as it prepares for its first Budget since March 2010 and the most significant for a decade in October.

“The decision by the Bank of England to cut interest rates on 1 August, is likely to be followed by at least one more cut before the end of the year particularly if the FED and ECB reduce rates in the Autumn.

"This reflects more concrete optimism globally that inflation is now under control and back to historically ‘normal’ levels."