HSBC UK urges savers to 'review' accounts as bank increases interest rates on five savings accounts

HSBC UK interest rate rises have come into effect today

|PA

HSBC UK said it’s important customers “regularly review their accounts” to see if they can get better savings accounts or interest rates.

Don't Miss

Most Read

HSBC UK is increasing the interest rate paid across five of its savings accounts today.

The changes include a 0.25 percentage point boost on two instant access accounts – Premier Savings and Flexible Saver.

The rates now stand at 2.25 per cent and two per cent, respectively.

Pella Frost, HSBC UK’s head of everyday banking, said: “The challenges brought about by the increased cost of living mean that people want to make sure their money is working harder for them.

HSBC UK is urging customers to review their accounts

|PA

“We are supporting our customers to make the most of their money in a number of ways, such as increasing the interest rate across our range of savings accounts, including on instant access accounts, but also by encouraging our customers to review their savings arrangements.”

The Online Bonus Saver rate when a withdrawal is made in a month has increased from 1.75 per cent to two per cent.

The standard rate for the Loyalty Cash ISA has increased from 2.30 per cent to 2.50 per cent.

The Other Loyalty rate has also increased by 0.15 percentage points to 2.85 per cent.

HSBC has added 0.25 percentage points to the MySavings account for balances over £3,000. It now pays 2.25 per cent.

Balances under £3,000 continue to have a rate of five per cent.

HSBC urged customers to check their bank accounts in case they could get a more competitive option.

Ms Frost said: “It’s important that customers regularly review their accounts as their finances or financial goals may have changed significantly in recent years, and there may be better accounts or better rates now available to them.

The Bank of England base rate has been increased to 5.25 per cent

|PA

“Our aim is to improve our customers’ awareness of what our different products offer, provide support and education to ensure customers are accessing the right savings products for their needs, and encouraging greater financial resilience through building new or improved savings habits.”

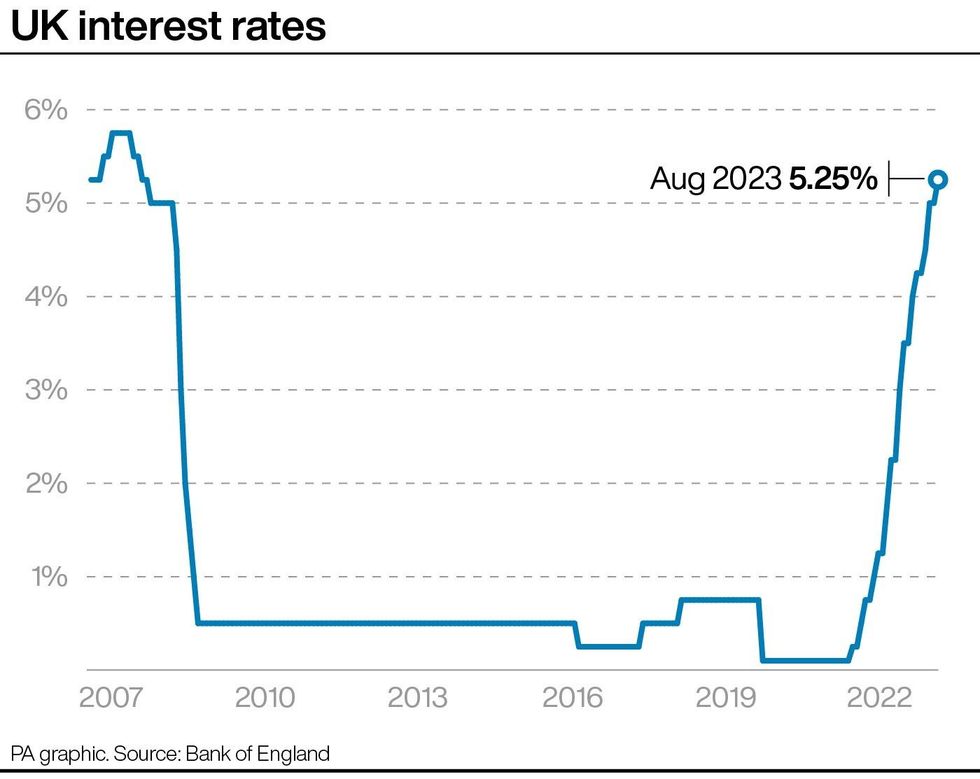

HSBC announced the increases last Thursday, the same day the Bank of England base rate increased for a 14th consecutive time.

The central bank increased the Bank Rate by 0.25 percentage points to 5.25 per cent.

The base rate is at a fresh 15-year high, having been cut from this level in April 2008.