British high street in crisis as nearly 50,000 firms on the brink of collapse after Rachel Reeves tax raid

Hospitality and retail firms are among the hardest hit, with financial distress rising by over 40 per cent

Don't Miss

Most Read

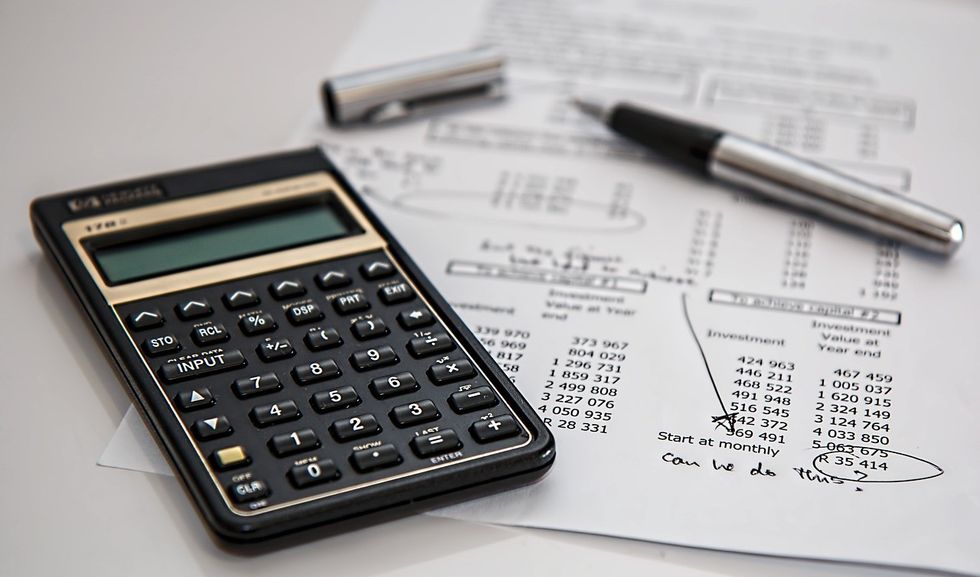

Nearly 50,000 businesses in the UK are on the brink of collapse, as rising taxes and wage costs put huge pressure on firms.

Experts say the situation is now critical, with tax increases and wage pressures creating an "immense strain" on businesses.

New figures from Begbies Traynor, a firm that helps struggling companies, show that 49,309 businesses are in "critical financial distress", up more than 21 per cent compared to this time last year.

Pubs and restaurants are some of the hardest-hit, with a 41.7 per cent rise in severe financial trouble. Travel firms saw distress rise by 39 per cent, while retail businesses faced a 17.8 per cent increase.

A big part of the problem is the Chancellor's decision to raise National Insurance by £25 billion, along with minimum wage increases.

High Street sales have now fallen for 10 months in a row. The latest retail figures from the Confederation of British Industry (CBI) show a sales reading of -34, which is slightly better than June’s -46, but still deeply negative.

Shoppers are cutting back as businesses raise prices to cover their own rising costs. Inflation is now at 3.6 per cent, well above the Bank of England's two per cent target, while the UK economy has shrunk for two months straight.

Experts are warning of "stagflation", where the economy slows but prices keep rising. This squeezes consumers, damages businesses, and makes it harder for the Bank of England to decide when or if it should cut interest rates.

Research shows around 10,500 UK shops permanently closed in 2023 | PA

Research shows around 10,500 UK shops permanently closed in 2023 | PAThe crisis has already claimed well-known names. Fashion chains Seraphine and Quiz have folded, and River Island is fighting to survive.

Begbies Traynor warns that many small pubs won’t last another year without help.

Business rates, the tax firms pay on their properties, are adding to the pressure, and Labour's decision not to reform them has left retailers disappointed.

The Chancellor's decision to raise National Insurance by £25 billion, along with minimum wage increases has created pressure for businesses

| GETTYMartin Sartorius, principal economist at the CBI, noted that "firms reported that elevated price pressures, driven by rising labour costs - and economic uncertainty continue to weigh on household demand."

The combination of National Insurance increases, minimum wage rises and unchanged business rates has created what industry observers describe as an unsustainable operating environment for thousands of British businesses.

Concerns are mounting that the Chancellor may impose further tax increases in the autumn Budget to fund public sector spending commitments, potentially deepening the crisis for struggling businesses.

The CBI has urged ministers to acknowledge the severe pressures facing companies and build confidence in the Government's economic strategy.

The lobby group specifically cautioned about the potential impact of proposed workers' rights legislation, warning it could compound existing challenges for employers.

Industry leaders are calling for immediate government recognition of the crisis, with particular emphasis on supporting smaller enterprises that lack the resources to weather prolonged financial stress.

The spectre of widespread business failures threatens not only employment levels but also the vibrancy of Britain's town centres and High Streets

| PAThe spectre of widespread business failures threatens not only employment levels but also the vibrancy of Britain's town centres and High Streets.

Without swift action, experts warn that the current wave of corporate distress could escalate into a broader economic crisis affecting communities nationwide.

More From GB News