Gold price soars to record high as traders bet on interest rate cuts

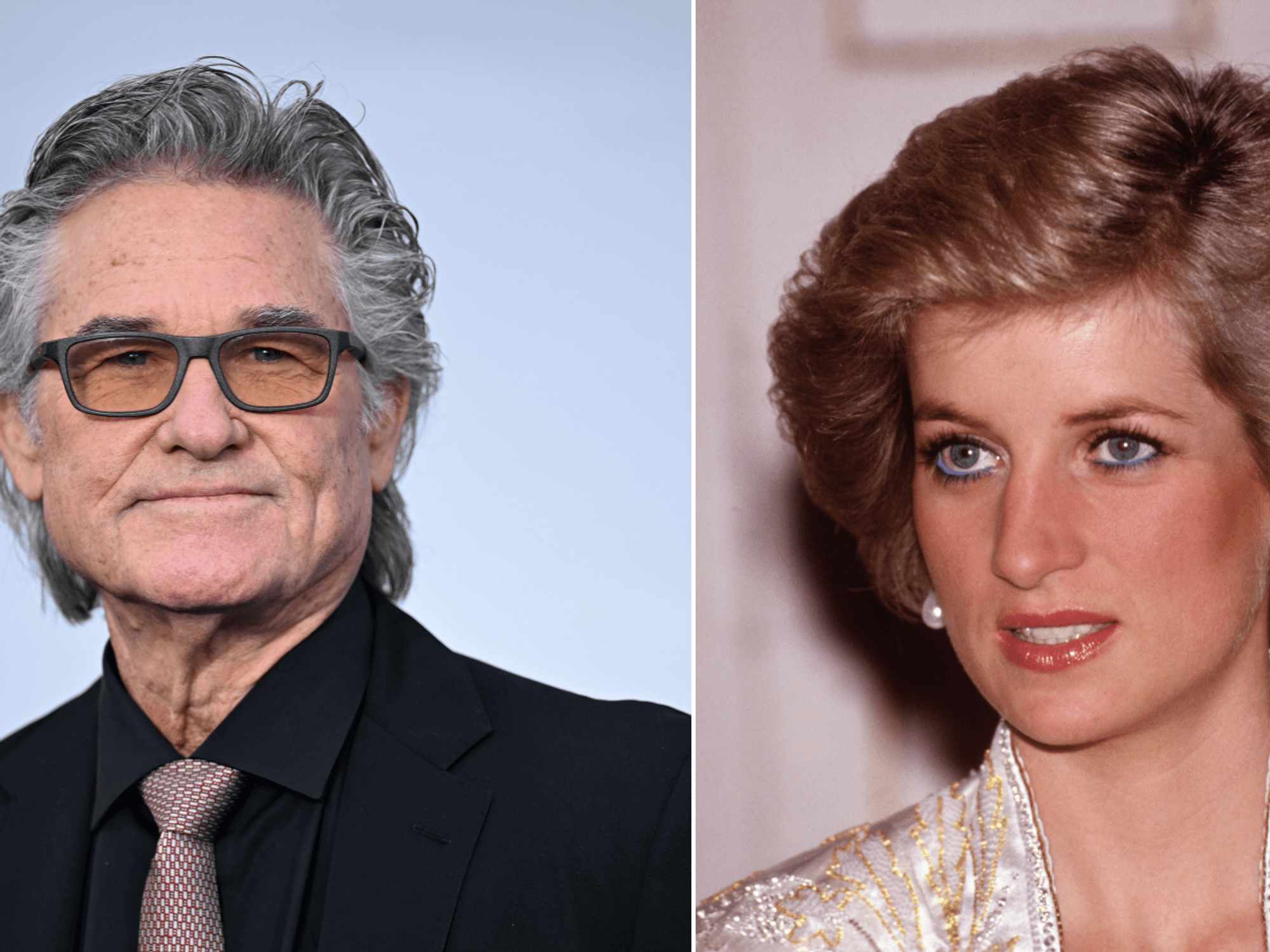

The price of gold hit a record high on Monday

|GETTY

The gold price rally came after the head of the Federal Reserve seemed to suggest interest rates would not be hiked further for now

Don't Miss

Most Read

The price of gold surged to a new all-time high this week as investors bet on interest rates being cut.

The price of gold jumped to more than $2,100 as Asian markets opened on Monday, peaking at around 2,134 dollars per ounce, before retreating.

However, gold slipped on Tuesday as the dollar regained footing and investors refrained from making big bets ahead of key US jobs data, which could offer more clarity on the US interest rate path.

Spot gold was down 0.4 per cent at $2,018.29 per ounce by 2.45pm GMT (9.45am ET).

Gold prices surged to a new all-time high on Monday

|GETTY

Bullion climbed to a record high of $2,135.40 on Monday, before dropping more than $100 in a single day to close two per cent lower.

Monday's rally came after the head of the US central bank indicated further interest rate hikes were not around the corner.

On Friday, the Chair of the Federal Reserve Jerome Powell signalled the central bank did not need to hike interest rates further at this time.

In his speech, Mr Powell said the Fed’s policy was now “well into restrictive territory”.

However, the head of the US central bank dampened expectations the Fed would cut interest rates as soon as March 2024.

He said: “It would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease.

“We are prepared to tighten policy further if it becomes appropriate to do so.”

Victoria Scholar, head of investment at Interactive Investor, said: “Gold hit an all-time high for the second day in a row today, surpassing 2,100 dollars per ounce.

LATEST DEVELOPMENTS:

“So far this year, the precious metal is up around 13.5 per cent and has gained around five per cent in the past month.

“Concerns about the shaky global economic backdrop and the Israel-Hamas conflict have fuelled investor demand for safe-haven assets like gold.

“Plus, expectations for Fed rate cuts next year have put downward pressure on the US dollar which is trading around three-month lows, adding to gold’s attractiveness.”