Bank branch closures slammed 'a national disgrace' as town's last two banks set to shut its doors for good

As banks continue to close down, some Britons are left to travel miles to find their closest branch

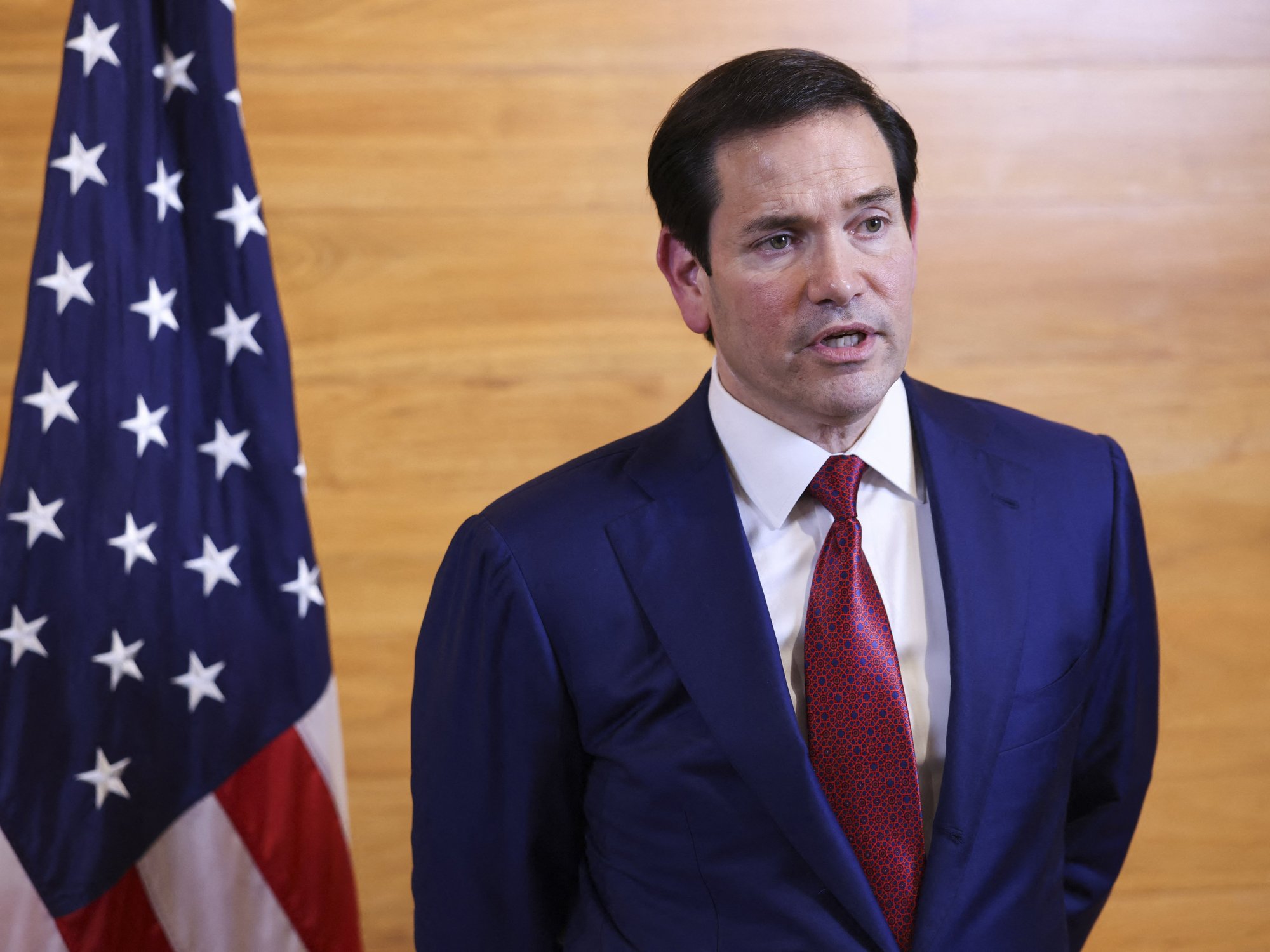

| GETTY

As banks continue to close down, some Britons are left to travel miles to find their closest branch

Don't Miss

Most Read

Latest

Certain towns being left without a bank branch is a "disgrace," an expert has warned.

Many vulnerable people are being left without a local bank branch which is impacting their abilities to perform simple banking tasks.

The Halifax and Lloyds Bank branches will close in Witham, Essex this winter.

These are the town's last two banks and they are to close for good in October.

Witham council have said they hope banking services will remain accessible after the closure of the last two banks in the Essex town was announced.

The closure of the banks followed an investigation of the two branches and reviews of how their customers were choosing to bank.

The banks, both owned by Lloyds Banking Group, will close their Witham branches in October

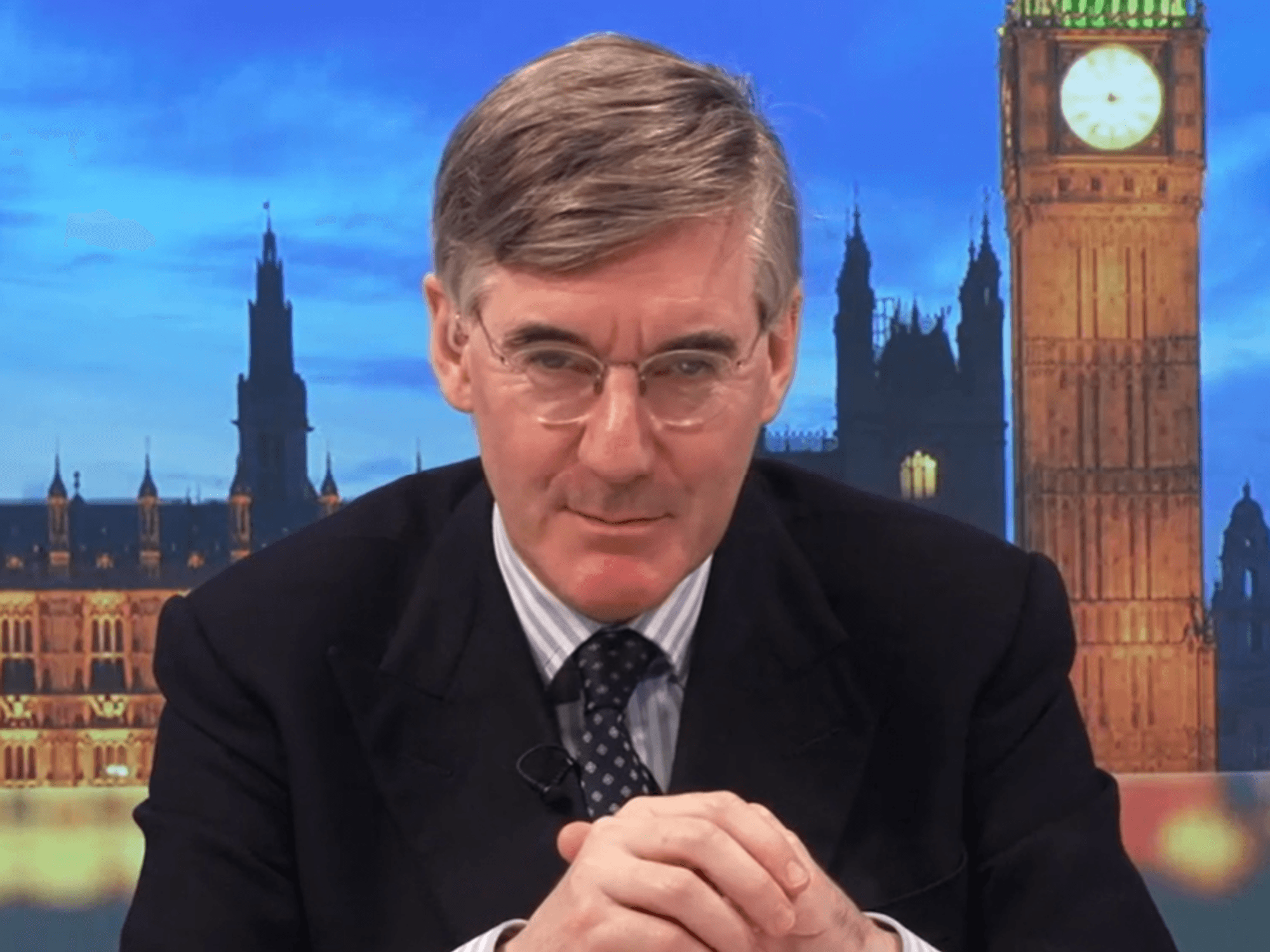

| PAExperts have stated the closure of all banks in certain towns is "a national disgrace".

Martin Quinn, director at Campaign for Cash told GB News: “Parts of the UK being left without bank branches is a national disgrace.

"A few 100 banking hubs is not the answer, what is needed is for the Government to immediately stop the Big 5 banks from closing further branches.

"Communities and high streets are being hollowed out and abandoned by the banks, and it’s cash users and business owners bearing the brunt."

The nearest branches of Lloyds and Halifax are in Braintree, which is about eight miles away from Witham.

NatWest closed its Witham branch in 2018 and HSBC has also left the town.

A total of 6,094 bank branches have closed since January 2015, a rate of 53 a month, according to Which?, the consumer group.

Link, the ATM network, is to launch 14 new banking hubs in a bid to tackle increasing branch closures on the high street and improve access to cash.

Towns that are big enough and have lost all their bank branches can have a hub recommended by Link.

The banking hub is a place where customers can pay in and withdraw cash, deposit cheques and pay utility bills.

Different high street banks take turns to send their own staff to a private room in the hub, usually a different bank each weekday, to help to answer customer queries.

Over 1,500 banks have now closed their doors, leaving those needing face-to-face service looking to travel further to another branch or use an alternative service.

LATEST DEVELOPMENTS:

The Labour party pledged to open atleast 350 banking hubs over the next parliament, recognising the need for banking to be widely available on the high street again.

There are now 70 banking hubs in the UK, run as a partnership between the Post Office and the banks to try to fill the gap left by the closure of thousands of bank branches.

John Howells, chief executive Officer at Link said: "The banking hubs we’ve announced will protect access to cash on 14 high streets which are losing their last bank branch.”

The Treasury said: “Banking services are vital for local people and businesses, which is why we are committed to work closely with industry to roll out at least 350 banking hubs across the country.

"The banks are looking at improvements that can be made to services and we are working with them on this.”