Bank branch closure crisis: UK loses 1/3 of locations in 5 years as Britons become 'cashless pioneers'

Rafe Heydel-Mankoo reacts to the Bank of England's plan to remove historical figures from banknotes |

GB NEWS

UK banks closed more than 6,000 branches between 2015 and 2024, research conducted by consumer champion Which? found

Don't Miss

Most Read

Britain's bank branch closures crisis continues as more than one-third of banking locations have shut down for good in the last five years, according to shocking new figures.

Major financial institutions, including Santander, Lloyds Bank and NatWest, have reduced their branch network as customers move to online banking services.

However, the latest data from the Office for National Statistics (ONS) suggests Britons are surpassing the rest of Europe when it comes to being "cashless pioneers".

ONS figures found that the number of bank, building society and credit union branches in the UK plummeted to 6,870 in 2024, representing a 34 per cent drop on the 10,410 in 2019.

**ARE YOU READING THIS ON OUR APP? DOWNLOAD NOW FOR THE BEST GB NEWS EXPERIENCE**

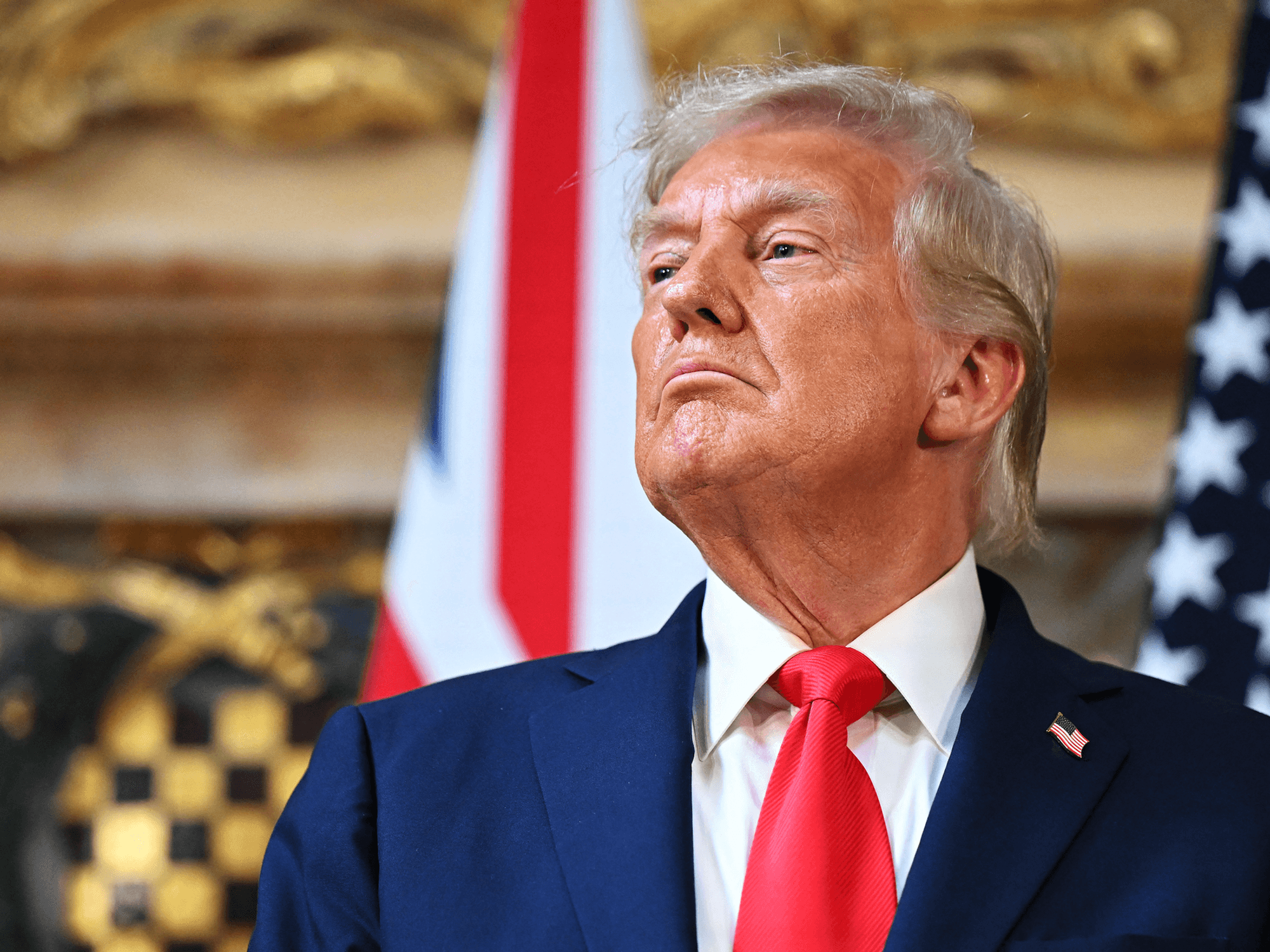

More than one-third of the UK's bank branch network has been axed

|GETTY

For 2024 alone, the number of in-person banking locations operating in Britain slipped by a staggering 10.4 per cent amid changing consumer habits.

Later this year, Lloyds Bank, NatWest, Halifax and Bank of Scotland are preparing to close 113 branches before the end of November, with Santander announcing plans to shut down 99 of its 444 UK sites back in March.

Research compiled by consultancy firm Kearney determined that Britain ranks highly among other European countries for closing the most bank branches.

Spain and the Netherlands have axed the most locations as a proportion compared to the UK, slashing their respective branch networks by 37 per cent 48 per cent over the last half-decade.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Britons are concerned about cash access amid recent bank branch closures | GETTY

Britons are concerned about cash access amid recent bank branch closures | GETTY As it stands, Kearney's data shows there is one bank branch per 10,000 people in the UK while Spain and Portugal has 2.5 branches, and France has 4.9 branches.

Sameer Pethe, a partner at Kearney, explained: "Compared with the rest of Europe, the UK really stands out, largely due to the scale of this shift [away from branch banking].

"We now have the second-lowest branch density in Europe . . . only the Netherlands is lower." Notably, Mr Pethe cited that Britain has a lower branch density than the Nordic countries, which are widely considered "cashless pioneers".

He added: "That suggests a very lean branch network isn’t always necessary for digital adoption, and UK banks may have simply taken a more aggressive approach."

MEMBERSHIP:

- MAPPED: Full list of local authorities housing hotel migrants - how many are in YOUR area?

- REVEALED: The 32 seats that could parachute Nigel Farage into No10 as General Election petition hits 800k

- Think Reform has gone soft? Farage's migration blueprint will leave you eating your words - Ann Widdecombe

- REVEALED: Panic stations for Keir Starmer as migrant hotel fury sparks ballot box revenge in 20 seats

- Lucy Connolly's release is a step in the right direction, but the screws are turning – Matthew Goodwin

On why banks are reducing their branch portfolio, Mr Pethe said: "This isn’t simply about doors closing or cost-cutting . . it’s a clear signal that high street banks are reshaping their operating models, doubling down on digital as online banking becomes second nature for most customers."

Between 2020 and 2024, the number of consumers using digital services to access banking products went up by 33 per to 59 per cent. Furthermore, this period saw the rise in prominence of digital challenger banks, including Revolut and Monzo.

LATEST DEVELOPMENTS:

Banking Hubs are being rolled out to offset the recent wave of bank branch closures | PA/GETTY

Banking Hubs are being rolled out to offset the recent wave of bank branch closures | PA/GETTY Speaking to the Financial Times, UK Finance personal banking director Peter Tyler shared: "The way that we bank has been changing for some time, with a shift to digital services which is driven by customer demand.

"The variety of ways that customers can access banking services has grown in recent years,” he said. “That has led to a reduction in footfall in branches."

Last year, the Financial Conduct Authority (FCA) told banks and building societies that they must ensure customers have access to physical cash services in any areas where branches have closed down.

Currently, the Government is in process of rollout out 350 banking hubs across high street streets to plug the gap left by branch closures, with 179 having been opened.

More From GB News