Pay-per-mile car taxes could be introduced in rule change - 'The less you drive, the less you pay!'

WATCH: Conservative AM Neil Garratt grills Sadiq Khan on a pay-per-mile scheme in London

|CITY HALL

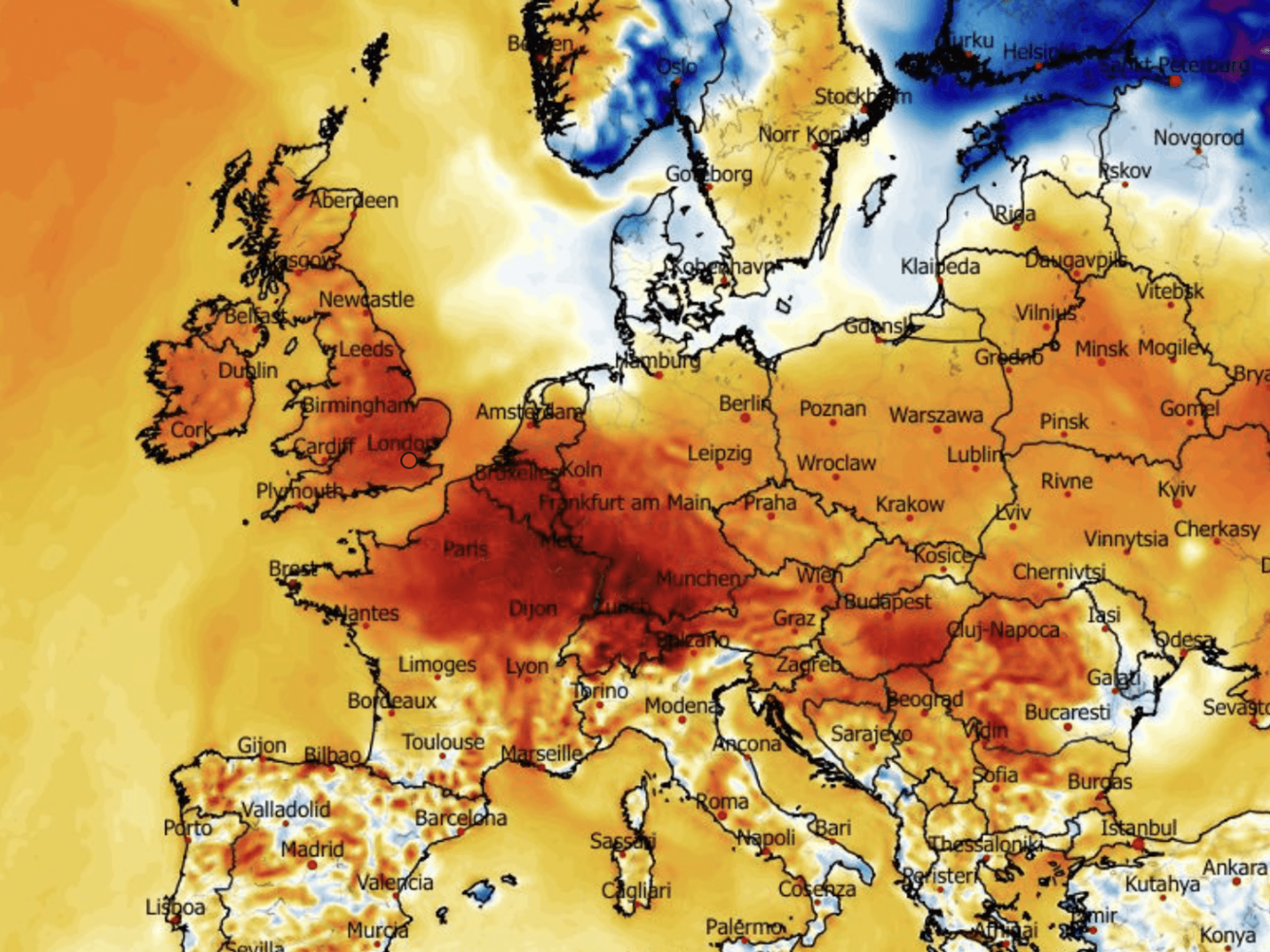

The plan in Oregon would see electric vehicle owners start to sign up in the coming years

Don't Miss

Most Read

Motorists in the United States could soon end up paying for their time on the road based on how often they drive, as a new pay-per-mile scheme is suggested.

Lawmakers in Oregon are looking to fill a $300million (£224million) transportation funding black hole that could threaten funding for road repairs.

Governor of Oregon, Tina Kotek, proposed that electric vehicles in the state could pay a road usage charge, which is equivalent to five per cent of the state's tax on fuel.

The proposal would also raise the "gas tax" by six cents (four pence) to 46 cents (34p) per gallon, hiking fees for petrol and diesel drivers.

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

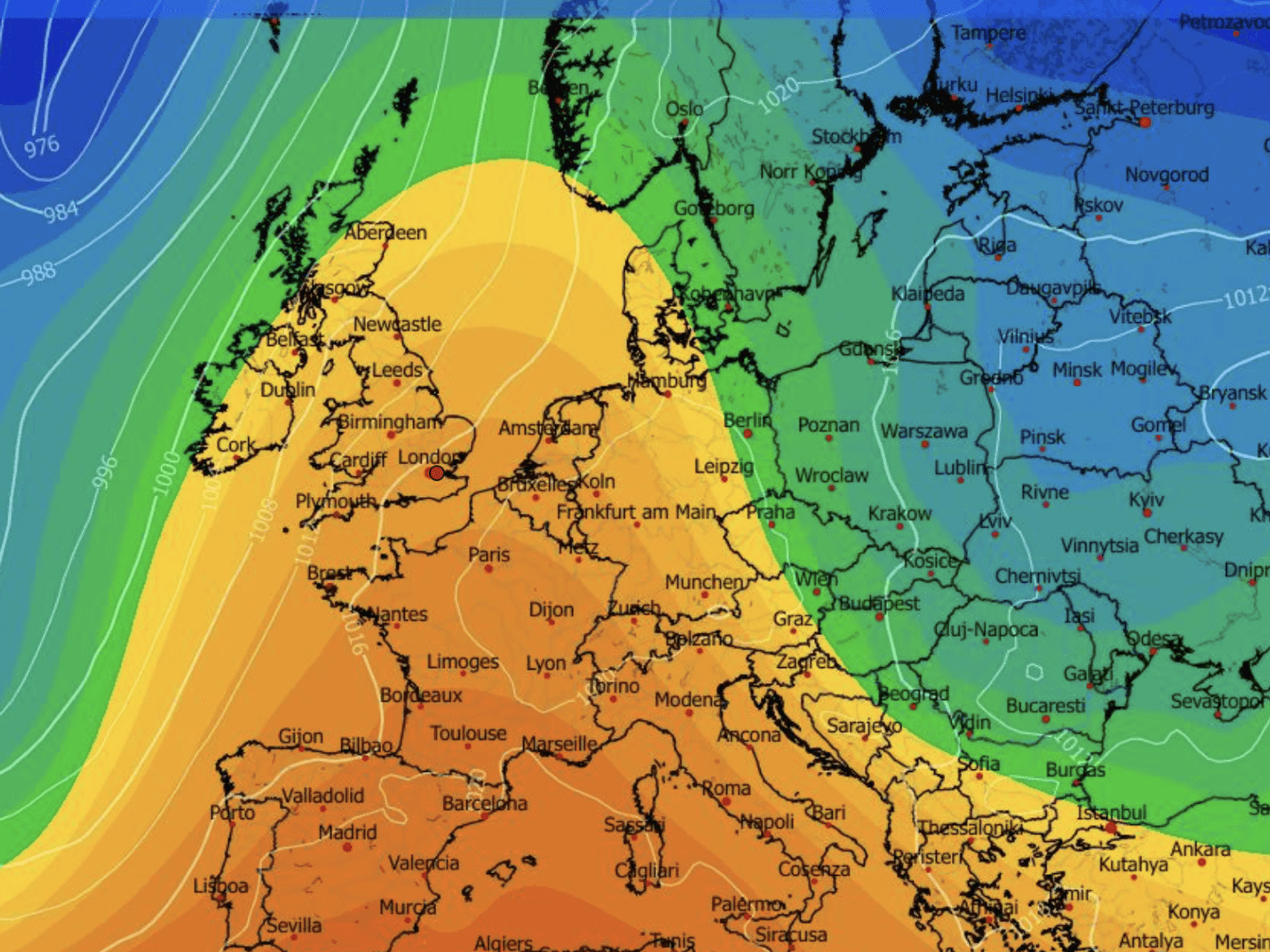

Experts have long called for road pricing solutions to mitigate the impact of fuel duty revenue losses

|GETTY

It is estimated that the hike to the gas tax could raise around $90million per year (£67.2million).

The OReGo programme for electric vehicles and hybrids requires owners to sign up, with Governor Kotek calling it "necessary" to fund future road projects.

A voluntary scheme has been in place since 2015, in which participants paid two cents (1.5p) for each mile they drive, with money generated going to the State Highway Fund.

Oregon Public Broadcasting reported that the rate was calculated to match what gas-powered vehicles were paying to get 20 miles per gallon when the programme was launched.

Scott Boardman, innovative programmes policy advisor at the Oregon Department of Transportation (ODOT), commented on the potential introduction of such rules and the impact it would have on motorists.

He said: "If we switch to a road usage charge, in which people would be paying by the mile, it kind of decouples the amount that you're paying in transportation taxes and fees from the efficiency of the vehicle to the actual usage of the transportation system itself.

"The less you drive, the less you pay, versus the more you drive and the more wear and tear that you impose on the system, the more you contribute to the operations and maintenance of the roads and the bridges."

If passed, current electric vehicle owners would need to sign up for the programme when they renew their registration after July 2027.

LATEST DEVELOPMENTS:

New EV owners will be required to sign up from January 2028, while hybrid and plug-in hybrids will be phased in, starting from July 2028.

Oregon could follow in the footsteps of Hawaii, which introduced its road usage charge in 2023 to replace the drop in fuel tax revenues as more drivers switch to zero emission vehicles.

The Hill outlined that Hawaiians pay an annual fee of $50 (£37.38), or $8 (£5.98) per 1,000 miles, capped at $50.

From 2028, all electric vehicle drivers in Hawaii will be required to sign up for the programme and have their odometers read annually at inspections.

Oregon Governor Tina Kotek proposed the pay-per-mile scheme for electric car owners

|X

Pay-per-mile road pricing schemes have gained favour in recent years as experts look to fill the impending £35billion gap in funding once drivers stop using petrol and diesel vehicles.

Organisations, including the Tony Blair Institute for Global Change, have emphasised the need for a replacement to ensure Government coffers are not wiped out once fuel duty revenue is lost.

Potential proposals have included giving rural drivers a certain allocation of "free miles" or having a higher threshold for electric car owners.

Speaking to GB News, an HM Treasury spokesperson said: "We have no plans to introduce road pricing. We are committed to supporting our automotive sector as we transition to electric vehicles in order to meet our legally binding climate targets."